Godrej Group Headed For a Harmonious Family Split Of India’s Legacy Conglomerate Valued At ₹1.76-lakh-crore

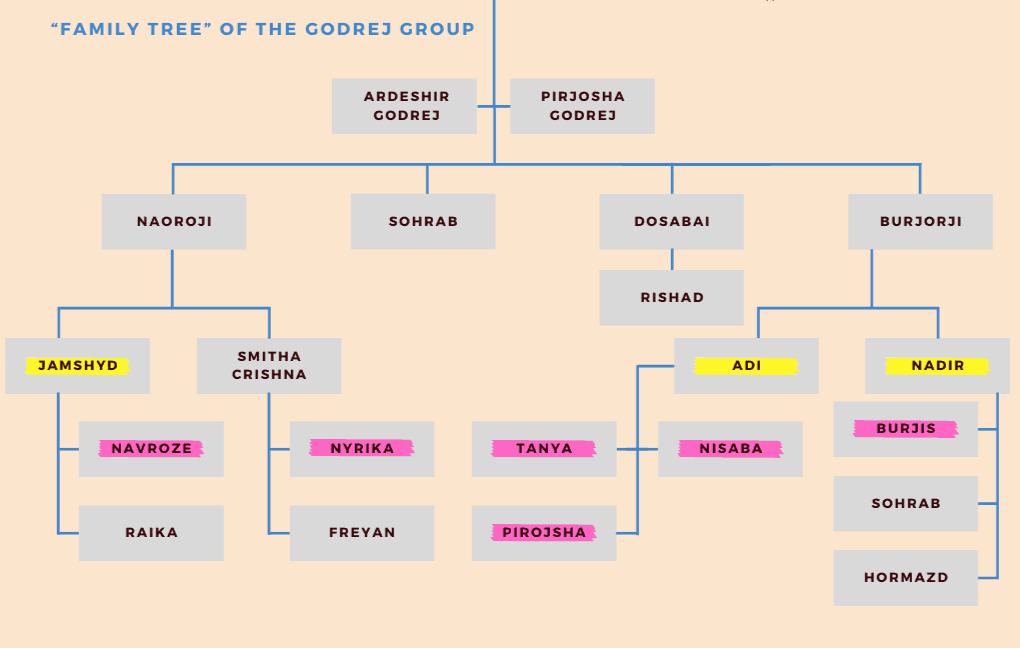

The Godrej Group, a stalwart in the Indian business landscape with a history dating back over a century, is on the brink of a significant transformation. Valued at a staggering ₹1.76-lakh-crore conglomerate, the group is poised to undergo a well-calibrated division among its various branches, marking a pivotal chapter in its legacy. While the same has been in talks for a while, the first news of the same came back in FY20; the endeavour is led by the two factions of the Godrej family: Godrej Industries & Associates, spearheaded by Adi Godrej and Nadir Godrej, and Godrej & Boyce Manufacturing Company (G&B), led by cousins Jamshyd Godrej and Smitha Godrej Crishna.

The Godrej Group is reportedly in advanced stages of crucial negotiations to conclude the formal division of its diverse businesses.

The Godrej Group’s interests span a wide array of sectors, including engineering, appliances, security solutions, agricultural products, real estate, and consumer products.

The ₹1.76-lakh-crore conglomerate that began its industrial journey five decades before Independence selling locks headed for a split, the two factions of the Godrej family – Godrej Industries & Associates led by Adi Godrej and his brother Nadir and Godrej & Boyce Manufacturing Company (G&B) involving cousins Jamshyd Godrej and Smitha Godrej Crishna.

The impending division aims to create clarity and uncomplicate the shareholding and business structure, thereby ensuring better shareholder value in the future. However, this intricate process is not without its challenges, with crucial aspects needing careful consideration.

1. Brand Name Usage and Land Valuations: One of the key points of contention revolves around the usage of the Godrej brand name after the split, potentially involving royalty payments. Additionally, the valuation of approximately 3,400 acres of prime land held by G&B is another significant challenge, given its tax implications.

2. Equity Cross Holdings: The process also entails untangling equity cross holdings, which require meticulous legal handling to ensure a fair division of assets.

Family Harmony Prevails

Despite the complexities involved, the Godrej family is handling these challenges with remarkable poise; unlike most Indian business feuds that end up in court, the smooth transfer of assets of the Godrej Group — if it happens — may become the template for other wealthy families to follow.

The family council has been conducting closed-door discussions, prioritizing the best interests of all stakeholders, including consumers; the amicable approach reflects the family’s long-standing tradition of harmonious cooperation despite differing shareholder views.

Expert Advisors in the Fold

To facilitate this monumental transition, the Godrej family has enlisted the counsel of renowned professionals.

Top investment banker Nimesh Kampani and esteemed corporate lawyer Zia Mody are reportedly advising Jamshyd Godrej, while Uday Kotak, Asia’s richest banker, and Cyril Shroff’s legal firm, Cyril Amarchand Mangaldas, are representing the Adi Godrej faction.

Pirojsha Godrej, Adi Godrej’s son and chairman of Godrej Properties, has also been actively involved in these deliberations.

Cross-Holdings and Trusts

One distinctive aspect of the Godrej Group’s structure is the existence of five family branches under Adi Godrej, Nadir Godrej, Jamshyd Godrej, Smita Crishna-Godrej, and Rishad Godrej.

Each branch holds an equal 15.3% stake in G&B, with the Pirojsha Godrej Foundation owning approximately 23%. The foundation’s role extends to investments in environmental, health, and education sectors, funded by dividends from various group companies.

G&B’s Diverse Ventures

G&B, a privately held company, boasts diverse business interests, including appliances, construction, precision engineering, furniture retailing, and aerospace.

In FY22, G&B reported revenues of ₹12,345 crore with a net profit of ₹472 crore; moreover, the company holds notable stakes in Godrej Consumer and Godrej Properties, contributing to its combined valuation of ₹9,089 crore.

The Godrej Group in Numbers

The Godrej Group includes five listed firms: Godrej Industries, Godrej Consumer Products, Godrej Properties, Godrej Agrovet, and Astec LifeSciences.

These entities collectively boasted a market capitalization of ₹1.76 lakh crore as of September 2023; in the same fiscal year, these firms reported revenues of nearly ₹42,172 crore and profits of ₹4,065 crore.

Godrej Industries, a holding company, maintains interests in consumer goods, agriculture, real estate, chemicals, and financial services; it holds significant stakes in Godrej Agrovet, Godrej Consumer, and Godrej Properties.

Notably, the promoter-holding in Godrej Industries is distributed among 28 family members.

Challenges of Division

The complexities surrounding the division of such a vast empire cannot be overstated as the Godrej family is not just dealing with business assets but also grappling with the delicate issue of succession planning.

In this regard, Rishad Godrej, who is childless, poses an interesting question; his shares are expected to be distributed equally among the other family members upon his death, as reported by local media.

The Most Contentious Asset: Prime Land in Mumbai

The most contentious asset in this division is the vast land parcel in India’s business capital, Mumbai, covering nearly 1,400 hectares in the Mumbai suburb of Vikhroli, this land holds immense potential for the family, potentially exceeding billions of dollars in value when developed.

Remarkably, this land has been in the Godrej family’s possession since it was auctioned by the government in 1943′ after acquiring the land, the Godrej family set up industrial units and staff quarters in the area.

In 1990, they formed a company to develop part of the property into condominiums; however, the family also took measures to preserve significant portions of the land, which comprise mostly mangrove forests.

Over time, slums have encroached on parts of the property, adding complexity to the division process.

In September this year, The Bombay High Court directed the Maharashtra government to decide within a month an application by the Godrej & Boyce Manufacturing Company for enhanced compensation for its land acquired for the Ahmedabad-Mumbai bullet train project.

According to the application, the government granted a final award of Rs 264 crore in compensation on September 15, 2022, for acquiring 9.69 acres of the company’s land; however, it was far less than the initial amount of Rs 572 crore that the government had offered.

This issue is currently before the courts as the Godrej family seeks a higher price than what the government is offering; the outcome of this dispute could significantly impact the division process and the overall value realized from this valuable land asset.

Navigating the Road Ahead

As the Godrej family treads the path toward division, they face both business and emotional challenges; the legacy they carry, built over generations, is not just about wealth but also about values, ethics, and the responsibility of preserving their heritage.

While public feuds and court battles have marred most Indian business families, the Godrej Group’s approach is distinct their commitment to an amicable division sets an example, often characterized by acrimony and the family’s unity and their dedication to upholding their reputation are admirable qualities that set them apart.

The Last Bit, With family seniors signaling no public fights, observers are betting the next generation will maintain that decorum.

One thing that stands out about the Godrejs is upholding the family’s reputation ahead of themselves.

In a country where business family feuds often lead to protracted legal battles, the Godrej Group’s quiet and methodical approach to division sets an inspiring precedent.

With the transition underway, the Godrej Group is writing a new chapter in its illustrious history.