Banking metaverse: what new changes will it bring to banking activities?

Banking metaverse: what new changes will it bring to banking activities?

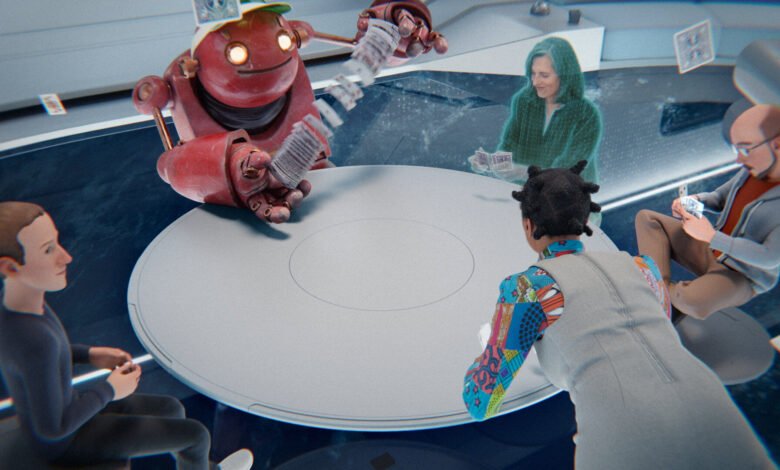

A virtual reality setting called the banking Metaverse allows users to communicate with both other users and a computer-generated world. These virtual worlds are made possible by VR and AR headsets. 25% of individuals will log into the Metaverse at least once a day by 2026, according to Gartner’s prediction. By 2024, $800 billion in transactions will be conducted on platforms powered by metaverse technology, predicts Bloomberg.

Gaming platforms, where the immersive quality of the game boosts young players’ involvement, have been the most effective metaverse implementations. When they want to communicate with others, young people are willing to spend a lot of time online. Several companies are trying to draw younger users to the Metaverse because of this prominent trend. The two biggest entities in the Metaverse are Decentraland and The Sandbox. On these sites, you may find JP Morgan and HSBC among other significant banks.

A virtual lounge where visitors from the Metaverse might learn more about bank services and products would be the first step for banks in the Metaverse. Banks should be careful to design interesting lounges because offering virtual reality product brochures does not facilitate customer journeys in an action-oriented platform (most young customers would arrive at your location after a thrilling game), so half-baked forays into the Metaverse with digital information lounges are unnecessary. Bankers need to go back to the last time a millennial requested or read a brochure before designing a simple lounge. What goods and services can the bank offer walk-in clients now that they’ve attracted them to its lounge?

Examples of use cases for metaverse walk-ins include: Initially, a crypto-to-dollar conversion is needed if a gamer has earned prize money in Mana (a cryptocurrency from Decentraland) and wishes to convert it to dollars. They could also be searching for money to promote investment banking services for cryptocurrency NFOs or to buy non-fungible tokens in the metaverse.

The difficulties that banks would have in fulfilling these expectations are highlighted after that.

Understand your clientele: Before delivering any client service, banks have a fiduciary legal duty to know who their customers are. This crucial element guarantees that banks follow the law. India has made significant progress in developing its payment infrastructure by integrating OTP and KYC for UPI payments, which serve as a means of digitally verifying consumer information.

The payment infrastructure of India is a model that emerging nations can adopt. Customer verification, however, is a difficult task in immersive and virtual worlds. Both iris scanning and thumbprint capture are not possible with VR equipment or gloves. Customers could be reluctant to remove their VR headgear when verifying OTPs on their mobile devices. As a result, alternative solutions, including voice prints or the use of unique cyber tokens, might be considered to confirm that the customer is indeed in the bank’s lounge.

Crypto: Being blockchain-first settings that host their coins is the most interesting aspect of metaverse platforms. Mana is the problem in Decentraland, whereas Sand is the problem in the Sandbox. Therefore, hosting cryptocurrencies as a product is a need for any banking or financial institution wishing to grow on these platforms. Otherwise, it is pointless for you to be here; if consumers enter the metaverse branch and you tell them that only cash is accepted, they will not be given much of a benefit. It is important to set a hold before entering the cryptocurrency market because Indian regulators are currently developing roadmaps for it.

Crypto-Asset funding: One of the draws of the Metaverse is the purchase of virtual land and NFT-related assets. Non-fungible tokens are in high demand among online shoppers. Customers have bought digital movie posters, music, blockchain gaming assets, and even digital art. In certain circumstances, assets have been bought for millions of dollars. Can these assets be funded by banks? Certainly. The ownership or lien rights of these assets may be quickly transferred to the bank’s wallet since they are supported by a blockchain.

Blockchain technology makes the asset more secure than border-jumping billionaire borrowers. Whether banks are interested in NFTs is the more crucial question. Although it is certain that NFTs will expand and that new lenders may emerge to support NFTs, it is irrelevant to ask if banks are prepared under the current legal environment.

Advertising difficulties: The new web3 paradigm, which draws on elements of the blockchain, aims to shift the emphasis away from algorithmic search and advertising on the web and toward genuine user access to information. JP Morgan identified the decentralization of consumer data as a key trend. If users stored their personal information in a cyber-wallet instead of on servers run by Twitter or Facebook, their ability to advertise would be significantly diminished.

Since the data is stored in the customer’s wallet rather than Facebook’s computers, the algorithm would lose its predictive ability. Every company must establish a presence across all conceivable cyber fronts, including Metaverse, in the competitive world of digital advertising of the future.

Engagement of the client: The younger age groups are becoming increasingly interested in using the Metaverse for virtual interactions, notably on gaming platforms. By building immersive environments, banks might imitate Metaverse games to engage customers in the Metaverse. For instance, financial literacy and financial planning lessons that are immersive games might help young clients visualize their future and be motivated to plan.

Even though the Metaverse is drawing in millennials, Indian banks are now unable to serve as effective financial intermediaries in the Metaverse due to current restrictions, such as those governing the adoption of cryptocurrencies.

edited and proofread by nikita sharma