India’s Simpl Successfully raises $40 Million for its New Buy Now, Pay Later Service

Bangalore-based fintech startup Simpl has raised $40 million as it looks to expand its online buy now, pay later service’s offerings in the world’s second largest market.

Valar Ventures and IA Ventures led the six-year-old startup’s Series B round. LFH Ventures and some existing investors also participated in the round, said the startup, which has raised $83 million to date.

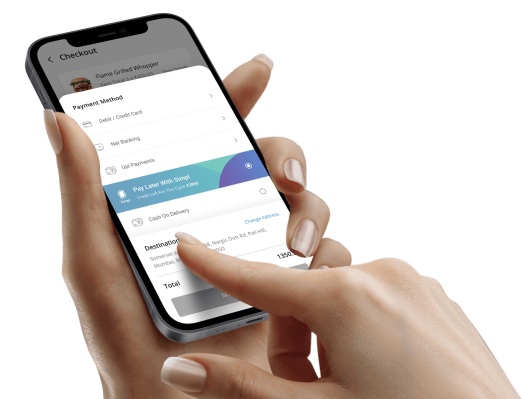

Simpl partners with popular online brands and offers their customers the ability to make purchases without paying for them at that very moment.

Over the years, additionally, it has also developed a range of offerings including a one-time checkout feature; Bill Box, which allows customers to automate their recurring expense payouts, and splitting a bill in three parts, to build a “full-stack solution,” said Nitya Sharma, co-founder and chief executive of Simpl, in an interview with TechCrunch.

Some of Simpl’s partners include telecom network JioPlatforms, food delivery Zomato, pharmacy 1MG, grocer BigBasket, and ticketing platform Makemytrip.

Buy now and pay later services have existed in India for several years, but have started to gain fast traction only in recent quarters as e-commerce and digital payments increase their reach in the country.

One of the factors that is making these services popular among consumers is the trust deficit that exists between them and the services with which they are engaging, said Sharma, pointing to continued popularity of cash as the payment method for e-commerce firms. (Fun fact: Uber introduced the ability to let users pay driver partners with cash for the first time in its existence months after launching in India.)

With a service like Simpl, customers know that they don’t have to pay right away and have the ability to dispute transactions and quickly request a refund, he said. The startup uses its own underwriting technology to determine the customers to whom it can offer its services, he said. For brands, too, an easier checkout process means the conversion increases significantly, he added.

“We built a fullstack checkout platform that gives merchants ultimate control of user experience and helps them build trust with consumers at checkout. Simpl is like a Khata or a Tab for online commerce. This intuitive user experience, built on the bedrock of trust, will enable a larger ecommerce market and will lead to greater adoption of mobile payments in India and the rest of the world,” he said.

The startup said it has grown its monthly active merchants and active user base by ten times in the past 18 months. Over 7,000 brands now use Simpl, the startup said. It now plans to work on further improving the consumer and merchants experience on its platform and also expand to new areas including bringing Simpl to offline neighborhood stores and building a loyalty program, said Sharma.

“India’s e-commerce market is at an inflection point and we believe Simpl’s solution is a key enabler in accelerating adoption of digital payments in e-commerce” said James Fitzgerald, Partner at Valar Ventures, in a statement. “It significantly improves consumer experience which is why it is quickly becoming a preferred partner for merchants.The team has shown great execution and we are excited to join their mission of democratizing e-commerce for all merchants big and small.”

Pay-later fintech players today finance loans worth $500 million each year, analysts at Bernstein wrote in a recent note to clients. They expect the figure to balloon to $26 billion by 2025.

Source: TechCrunch