‘We Made India The 5th Largest Economy In 10 Yrs’, Says Modi; Has India Truly Arrived And Does Indian Economy Under Modi Offer A Real Alternative To China In the Global Scheme Of Things?

In 2014, when Narendra Modi took charge in Delhi, he solemnly pledged to the nation - to end the era of plunder and corruption that had plagued India's governance. Fast forward a decade, and the fruits of that promise are unmistakable. India stands tall as the world's fifth-largest economy, adorned with grand infrastructure projects and modernized landmarks. Modi's vision has steered a new dawn for India in global economics as the search for viable alternatives to China's dominance has become a pressing concern for investors and policymakers alike. Against this backdrop, India is emerging as a compelling candidate, offering a blend of economic potential, strategic advantages, opportunity and growth - herein, we do a bit of analysis on the hits and the misses and if India has indeed emerged as an alternative to China and if the country is truly on a positive trajectory under Modi's leadership.

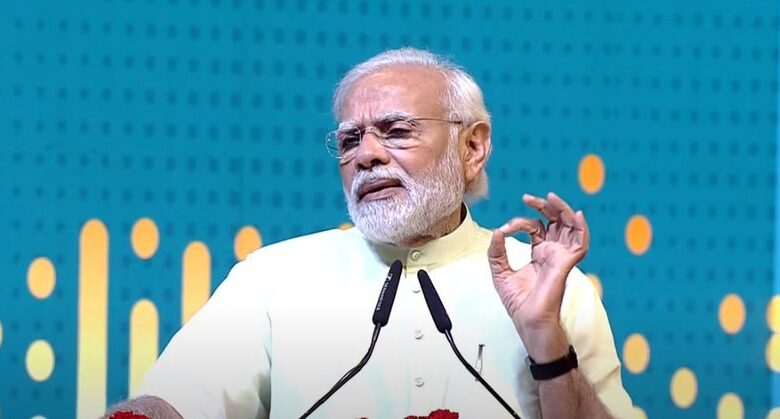

“When you sent me to Delhi in 2014, I made a promise that I will not let the country be looted anymore. The scams worth thousands of crores during the Congress tenure have now stopped. In last 10 years, we made India the 5th largest economy in the world. As a result, new grand constructions world are visible all over the country. Our pilgrim places are emerging in a modern form… A new image of India is emerging because of the mega projects…”

In a public address in Dwarka, Modi targeted the opposition Congress, accusing it of lacking the intention and sincerity to serve the people. He criticized the party for prioritizing the betterment of a single family over the welfare of the nation.

Speaking at the inauguration of projects worth Rs 4,100 crore, including the Sudarshan Setu, India’s longest cable-stayed bridge between Okha and Beyt Dwarka, built at a cost of Rs 978 crore.

Modi reminisced laying its foundation stone six years prior, now celebrating its completion as an engineering marvel benefiting devotees visiting Dwarka – Modi said, “I (as the then Gujarat Chief Minister) used to repeatedly write to the then Congress government (about the necessity of the bridge).

Reflecting on his tenure, Modi asserted his government’s success in halting all scams inherited from the Congress regime over the past decade.

We know India is in the election year, and it is evident that every party/leader would want to highlight the positives regarding good governance, economic growth, global feats, etc, yet it is undeniable that under his leadership, India has witnessed some transformative growth and development, with the quality of infrastructure being just one aspect drawing global attention.

)

The Modi Affect

Financial professionals worldwide have taken note of India’s progress since 2014 under Modi’s two-term premiership, driven by his ambition to elevate India to a $5 trillion economy by 2025.

On Tuesday, the International Monetary Fund edged its forecast for growth in India, which is projected to remain strong at 6.5% in both 2024 and 2025, with an upgrade from October by 0.2 percentage points for both years on resilient domestic demand.

China’s stock markets have experienced a prolonged slump since their peak in 2021, resulting in the erosion of over $5 trillion in market value across Shanghai, Shenzhen, and Hong Kong bourses. In contrast, India’s stock market has been surging, surpassing $4 trillion in company valuations last year.

The outlook for India’s economic future is promising, with projections indicating a market value doubling to $10 trillion by 2030. The growth trajectory makes India an irresistible prospect for large global investors, signalling a new era of economic dominance under Modi’s leadership.

Filling The Void

Which is the other country that can replace China?

India is emerging as a potential substitute for China’s economic prowess; while no country mirrors China entirely, India presents itself as a formidable contender capable of driving global growth.

However, India is one of many destinations that has emerged as an alternative to China and has benefited from the slowdown in the Chinese economy – Japan, too, has witnessed benefits from investors seeking alternatives to China.

Tokyo’s main stock index recently achieved a 34-year high, buoyed by improved corporate earnings and a depreciating yen. However, Japan grapples with recessionary pressures and recently ceded its spot as the world’s third-largest economy to Germany.

The India Optimism

The latest adjustment by global stock index compiler MSCI accentuates the growing optimism surrounding India.

MSCI announced an increase in India’s weighting in its emerging markets index to 18.06% while reducing China’s to 24.77%, signalling a shift in investor sentiment towards India.

Aditya Suresh, head of India equity research at Macquarie Capital, noted the significant rise in India’s weight in the MSCI index from about 7% a few years ago, indicating a natural gravitation towards potentially reaching 25%.

As India approaches national elections, market observers anticipate favourable outcomes for Modi’s Bharatiya Janata Party, hoping for continued political stability and consistent economic policies over the next term.

So what are the factors that are driving the Indian economy?

Analysts highlight India’s potential as the next global growth engine and point to several factors driving the optimism – a growing young population and thriving industrial sector, India is setting the stage for robust economic expansion.

The International Monetary Fund forecasts India’s growth to outpace China’s next fiscal year, with Jefferies analysts predicting India to become the world’s third-largest economy by 2027.

India’s infrastructure development mirrors China’s transformative phase decades ago, with substantial investments in roads, ports, airports, and railways.

These investments, coupled with advancements in digital infrastructure, promise a substantial multiplier effect on the economy, creating irreversible progress.

Additionally, India aims to leverage the global reconsideration of supply chains, offering an attractive alternative to companies seeking to diversify away from China.

The pandemic-induced disruptions and geopolitical tensions have accentuated the risks associated with overreliance on China, prompting a reevaluation of global supply chain strategies.

Hubert de Barochez, a market economist at Capital Economics, stated India’s potential as a prime beneficiary of the “friend-shoring” trend in supply chains, particularly at the expense of China, in a January analysis.

As a result, major global corporations, including Apple supplier Foxconn, are expanding their presence in India.

Elon Musk, CEO of Tesla, expressed intentions to invest in India at the earliest opportunity, emphasizing Modi’s influence in driving significant investments in the country.

Too Much Optimism?

However, there are concerns that India’s growing confidence may verge on overconfidence.

Amidst growing interest in the world’s fifth-largest economy, the lofty valuations of Indian stocks are causing apprehension among international investors. Indian shares have historically carried a premium compared to other emerging markets, but now, this premium has further widened.

Despite these concerns, domestic investors, both retail and institutional, appear undeterred by the high valuations, propelling India’s stock market to unprecedented heights.

Macquarie reports that retail investors alone hold 9% of India’s equity market value, while foreign investors hold slightly under 20%. Analysts anticipate a surge in foreign investments in the latter half of 2024, post the election period.

Another potential hurdle lies in India’s capacity to absorb the capital flowing out of China, given the substantial difference in their respective economies, noting the challenge of accommodating the significant investments from China, which hosts several companies valued at $100 billion or more, a feat challenging to replicate in India.

Nevertheless, India’s domestic-driven market rally enhances its resilience and reduces reliance on foreign fund inflows, and this insulation from global dynamics strengthens India’s position.

Besides geopolitical tensions and economic uncertainties, foreign entities are increasingly cautious about political risks within China, such as regulatory interventions and legal uncertainties, impacting investor sentiment.

For one the difficulty in predicting the long-term trajectory of Chinese businesses amidst regulatory complexities and uncertainties is a major drawback.

On the contrary, India maintains strong relationships with Western nations and other major global economies, actively enticing large corporations to establish manufacturing facilities within its borders.

During her budget speech in February, Indian Finance Minister Nirmala Sitharaman revealed that Foreign Direct Investment (FDI) inflows since Modi’s assumption of power in 2014 have reached nearly $600 billion, doubling the amount from the previous decade.

“We are actively pursuing bilateral investment treaties with our international partners to foster sustained foreign investment, with a focus on prioritizing India’s development,” she affirmed.

Analysts assert that India’s economic momentum, once set in motion, is formidable and likely to persist regardless of China’s trajectory; even if China resolves many of its issues and returns to the forefront, India’s ascent is irreversible and firmly established itself.

Coming Back To Modi

In his speech, Modi drew attention to the Congress, criticising the party’s governance approach, stating, “Those who held power for an extended period lacked the will and sincerity to cater to the needs of the populace. Congress’s endeavors primarily centered around advancing the interests of a single family, neglecting the nation’s development.”

He further accused Congress of rampant corruption, highlighting various scandals such as the 2G scam in telecommunications, the Commonwealth Games scam, and corruption in defense procurements.

“The Congress has consistently failed to meet the nation’s requirements,” he concluded.

Modi asserted that his government, over the past decade, has successfully curbed corruption that prevailed during the Congress regime.

The Truth

Assessing India’s economic performance under Modi’s tenure compared to the Congress era and China involves a nuanced evaluation of various factors.

Under Modi’s leadership, India has experienced significant economic growth and development across multiple sectors.

Initiatives such as “Make in India,” “Digital India,” and “Skill India” have aimed to boost manufacturing, digitalization, and workforce development, promoting entrepreneurship and innovation.

The implementation of the Goods and Services Tax (GST) and structural reforms like the Insolvency and Bankruptcy Code (IBC) have aimed to streamline taxation and enhance business transparency, potentially attracting more investment.

Compared to the Congress era, where corruption scandals and policy paralysis were prevalent, Modi’s government has prioritized transparency and efficiency in governance. The crackdown on corruption and the implementation of measures to ease doing business have improved India’s reputation among investors and international partners.

Additionally, the focus on infrastructure development, including roads, ports, and airports, has also helped to enhance connectivity and facilitate economic growth.

However, challenges persist, including high unemployment rates, agrarian distress, and inequality. Despite efforts to address these issues through initiatives like “Skill India” and rural development schemes, progress has been uneven, and disparities remain pronounced.

Compared to China, India’s economic trajectory has been different. While China has experienced rapid industrialization and export-led growth, India’s growth has been more consumption-driven and service-oriented.

India’s democratic structure and diverse economy present both opportunities and challenges compared to China’s centralized planning model – while India benefits from a vibrant democracy and a large domestic market, it also faces bureaucratic hurdles, regulatory complexities, and infrastructure bottlenecks.

In terms of economic indicators, India’s GDP growth rate has fluctuated under Modi’s tenure, facing both highs and lows – while India has become the world’s fifth-largest economy and attracted significant foreign investment, sustaining high growth rates remains a challenge.

The COVID-19 pandemic exposed vulnerabilities in India’s healthcare infrastructure and highlighted the need for greater resilience and preparedness.

The Last Bit, India has made strides under Modi’s leadership in terms of economic reforms, infrastructure development, and attracting foreign investment.

However, addressing persistent challenges and ensuring inclusive growth will be crucial for India to realize its full economic potential and achieve sustainable development.

So, in the end, we can all make up our respective minds about whether India has genuinely done well under Modi’s leadership!