The Struggle Of Stagnant Wages And Soaring Inflation Is Leading To A Growing Debt Problem For Individuals And Families India

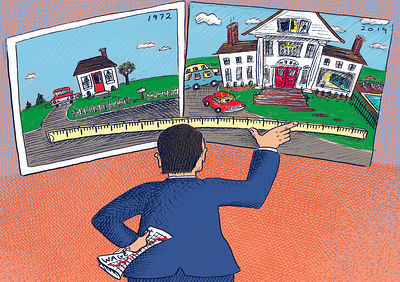

In India's current harsh economic conditions, families and individuals find themselves at the crossroads of stagnant wages and ever-escalating inflation, confronting formidable challenges in maintaining financial stability—the struggles households face, particularly those with dependents such as children and elderly parents. As the cost of living rises and wages remain static, retail debt has witnessed a staggering surge, with loans from banks and NBFCs almost tripling in the past six years.

Recently, India has been grappling with the unsettling combination of stagnant wages and surging inflation, creating a financial conundrum for its citizens.

The net financial savings of households in the country have plummeted to a near five-decade low, standing at just 5.1% of the GDP in FY2023.

Simultaneously, retail debt has witnessed a staggering surge, with loans from banks and NBFCs almost tripling in the past six years, reaching INR 51.7 lakh crore, constituting 30% of overall bank loans as of March 2023.

The predicament is worsened by the fact that wage growth has failed to outpace inflation, particularly in sectors such as manufacturing, where labour costs have fallen.

In contrast, the United States demonstrates a more favourable scenario, with wage growth surpassing inflation, possibly shielding the country from a recession.

However, in India, the wage bill growth of BSE 500 companies has decelerated to a decadal low of 11% YoY in the September quarter, signalling a potential consumption slowdown.

The Trap Of Credit

Individuals facing minimal salary increments and high inflation are increasingly turning to credit to sustain their consumption.

The growing trend is reflected in the Reserve Bank of India’s report, revealing that approximately 80% of consumer durables purchases are facilitated through consumer financing schemes, enticing consumers with attractive equated monthly instalment (EMI) offers.

The inflationary pressure is a significant driver behind the escalating credit growth. Notably, corporates have deleveraged their balance sheets, and public debt has largely been under control; in contrast, household debt, including housing loans, is ballooning.

The unsecured retail loan segment, including credit cards, personal loans, and consumer durables loans, has experienced rapid growth, outpacing secured credit like home and gold loans.

The Heavy Step

The Reserve Bank of India recently tightened capital norms to curb the surge in unsecured lending. The move aims to prevent exuberance among lenders and address potential risks, especially in the sub-INR 50,000 personal loan segment, such as Buy Now Pay Later (BNPL) schemes.

The step has already prompted companies like Paytm and Bajaj Finance to scale back their personal loan offerings, acknowledging the potential risks associated with unsecured lending.

Despite concerns over rising debt, some argue that increased borrowing is justifiable for an aspiring economy like India, given its burgeoning middle class and young demographic.

Saurabh Mukherjea of Marcellus PMS contends that the majority of Indians, being in the opening decade of their careers, have a logical basis for borrowing money, especially if they can service the loans on time.

However, a more pessimistic view suggests that the growth in unsecured loans coincides with a worsening financial position of India’s household sector over the past decade – rising debt and falling savings are interconnected, with estimates indicating a surge in the household debt-service ratio (DSR) to 12%, up from 10% in FY13.

This indicates that an increasing share of income is being allocated to meet debt obligations, posing a substantial challenge given the absence of a robust social-security system in India.

The Vicious Cycle

In the current economic scene, stagnant wages and soaring inflation pose significant challenges for families, particularly those with dependents such as children and elderly parents.

As the cost of living rises, households are grappling with the dilemma of maintaining a decent standard of living while contending with financial constraints.

The declining net financial savings, coupled with a nearly five-decade low at just 5.1% of the GDP in FY2023, stresses the stark reality that families are facing increased financial stress.

For families with children, the strain is further heightened by the escalating educational expenses. Private schools, often the choice for quality education, demand substantial fees, and the burden of these costs falls directly on parents’ shoulders.

Additionally, the absence of a robust social-security system in India means that families must bear the brunt of medical expenses, which have become more pronounced in the wake of rising healthcare costs.

The impact of stagnant wages is felt acutely when one considers the financial responsibilities that come with a family, including dependent parents.

While inflation continues its upward trajectory, the incremental salary increases fail to keep pace, making it challenging for individuals to meet the diverse needs of their families.

The household debt-service ratio of 12%, significantly higher than the median of other major economies, indicates that families are allocating a substantial portion of their income to debt obligations.

Medical bills, a significant component of household expenditures, are becoming more burdensome, particularly when coupled with the expenses associated with children’s education.

Hence, the need to resort to credit becomes a coping mechanism for families and individuals attempting to helm these financial challenges; however, this reliance on credit introduces a precarious dynamic as debt accumulates and potentially snowballs into an overwhelming burden.

The Last Bit, the confluence of stagnant wages, high inflation, and escalating debt, poses a significant challenge for citizens and India’s economy.

Left with little choice, the trap of borrowing has never been as deep as it is in the present – potential risks remain a delicate task for policymakers, especially as the nation aspires to become the world’s third-largest economy by 2030.