Faircent.com ties up with wealth creation firm Cube Wealth; enables members of the advisory platform to invest directly on the P2P lending platform

Members of Cube Wealth app will now be able to add P2P lending to their investment portfolio and choose from thousands of P2P loans to invest in from Faircent.com

New Delhi, January 10, 2019: In an announcement highlighting its focus on delivering the highest levels of convenience to its users, India’s largest NBFC-P2P, Faircent.com, has tied up with Cube Wealth, a tech first wealth creation firm for urban Indian professionals. The partnership, which went live recently, will enable members of the wealth platform to invest on the P2P lending platform directly through the Cube Wealth app.

In March 2018, Faircent.com announced opening its’ API platform for developers with the aim to enable fintech and offline businesses to leverage the company’s extensive technological infrastructure to build new digital lending products, as well as to integrate existing solutions into their offerings. Faircent.com’s technology stack offers a wide range of solutions pertaining to online lending such as borrower and lender verification, credit evaluation and underwriting, payments and disbursement of funds, research and analytics, and payment collection and recovery. Cube Wealth helps urban Indian professionals plan their finances, invest their money and achieve financial independence. This partnership integrates Faircent.com’s technology stack with Cube Wealth app, enabling their members to add P2P lending to their overall investment portfolio and choose from thousands of P2P loans to invest in.

Commenting on the association, Karun Thareja, Chief Product Officer, Faircent.com said, “Over the past few months with a rapidly growing number of disbursements through the platform, we wanted to make it accessible to a more diverse segment of investors. An increasing number of investors today demand a comprehensive solution to access a wide range of investment products and financial services and build a diverse financial and investment portfolio. Given Cube Wealth’s user base of mid to high income individuals looking to maximize their investments and wealth, Faircent.com will give them the perfect chance to enhance their portfolio with a risk-adjusted product that delivers regular and lucrative returns.”

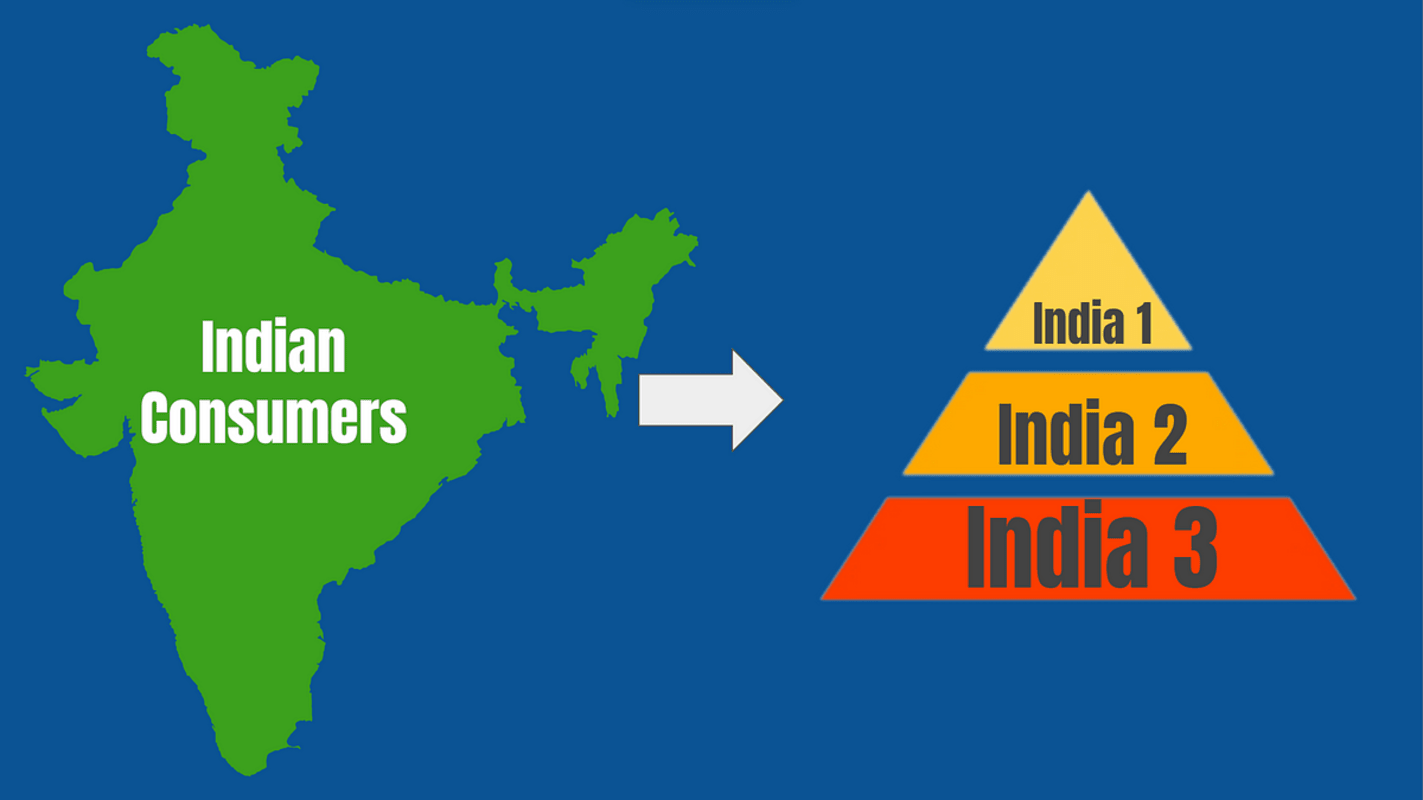

Mr. Satyen Kothari, Founder and CEO, Cube Wealth, said, “The goal behind Cube Wealth is to simplify financial planning and make it jargon-free for individuals with an annual income of INR 10 lakh and above. P2P lending is an alternative investment opportunity with strong fundamentals, delivering high returns at manageable risk. We are delighted to partner with Faircent.com which is among the pioneers of alternative, digital investing in the country, not to mention the leading P2P lending company. We are confident that both our existing as well as future members will appreciate the opportunity to build a diverse portfolio with a dynamic investment product like P2P lending.”

With P2P lending, investors/lenders can build their wealth over the long term by investing in multiple borrowers from diverse risk and return brackets. More importantly, they can do so with the help of the cutting-edge tools offered by Faircent.com, like ‘Auto Invest’ and ‘Portfolio What If Analysis’. These tools not only help them efficiently manage risk, but also target the highest possible annualized returns on their P2P portfolio.

About Faircent.com:

Faircent.com is India’s largest peer to peer lending website which caters to retail and business loans. It is an online platform where, people who have spare money lend it directly to people who want to borrow, thereby eliminating intermediaries and the margins they used to make. Established in 2013, Faircent.com pioneered the concept of P2P lending in India and closely worked with industry bodies, government and regulatory authorities to establish guidelines for the sector. In May 2018, it became India’s first RBI certified NBFC-P2P. Faircent.com was the first P2P lending platform to launch mobile apps for lenders and borrowers to transact on the go. It has launched tech-enabled features such as Auto-Invest and Escrow Account (under the trusteeship of IDBI) to help in faster and smoother flow of funds and increase customer ease.

As India’s largest NBFC-P2P platform, Faircent.com currently has more than 6.5 lakh registered borrowers and over 95,000 registered lenders, while the number of registered borrowers is rapidly growing at 30,000 month-on-month. Till date, the platform has facilitated loans worth INR 65+ crore, and currently disburses more than 400 loans each month with a cumulative value of approximately INR 4 crore.

In a development which reflects its technological prowess and market leadership, Faircent.com has been awarded the status of a ‘Super Start Up 2017’ by Superbrands. This latest achievement marks another addition in the long list of accolades garnered by Faircent.com for its disruptive and effective business approach. In its nascent history, Faircent.com has been able to garner recognition from the Industry – It was showcased as one of the top start-ups at Start Up India, selected for the first batch of NASSCOM 10,000. It is part of the Microsoft Accelerator Winter Cohort and BizSpark programme and was one of the top 10 companies from India to be selected for Web Summit in 2013. It is the only P2P lending company that has been acclaimed as the ‘Interbrand Breakthrough Brand in Finance’ by Interbrand in its Breakthrough Brands report 2016 in partnership with Facebook, NYSE & Ready Set Rocket. Recently, it was also awarded the NASSCOM Emerge50 given to India’s high potential top 50 emerging companies in different domains.

For More Info Please Visit – https://www.faircent.com/

About Cube Wealth

Cube Wealth helps users plan their finances, invest their money to create wealth and find ways to maximize returns on savings. Cube Wealth enlists the expertise of advisors registered with Securities and Exchange Board of India and Reserve Bank of India, who usually only advise high net worth individuals. International investment options in mutual funds are accessible to users. In addition, Cube Wealth also provides its members access to modern investments options, personalized portfolios with SIP, Lumpsum and al a carte investment option. There is also an automated bank debit for secure transactions. The app counts career professionals from companies such as Ernst & Young, Google, Flipkart and Tata Capital, among others, as its users.

One of the key USPs of Cube Wealth is that it provides access to highly experienced and expert wealth creation advisors who in the past were largely accessible only to wealthy individuals and HNIs. In addition, the platform also provides a range of assets to help meet the short and long-term financial needs of investors, by diversifying their investments across debt and equity products. This also includes new asset classes that aren’t widely available and have great performance. Besides this, Cube members also enjoy both the flexibility and convenience of SIPs that allow them to be in control of their money and how it is allocated. The simple user interface with smart automation helps investors save time, while the portfolio tracking feature on the app is transparent and extremely easy to operate.

Satyen Kothari, Founder and CEO of Cube Wealth, is a Stanford Alumni in computer science, HCI, and tech entrepreneurship and spent 15 years in Silicon Valley learning his craft with Apple and Frog design before moving to his own startups in the US and India. He is the founder of Citrus Pay and now Cube Wealth