On January 14, World Health Organization became the tool of ‘Chinese propaganda’: US

World Health Organization becoming tool of ‘Chinese propaganda’: US

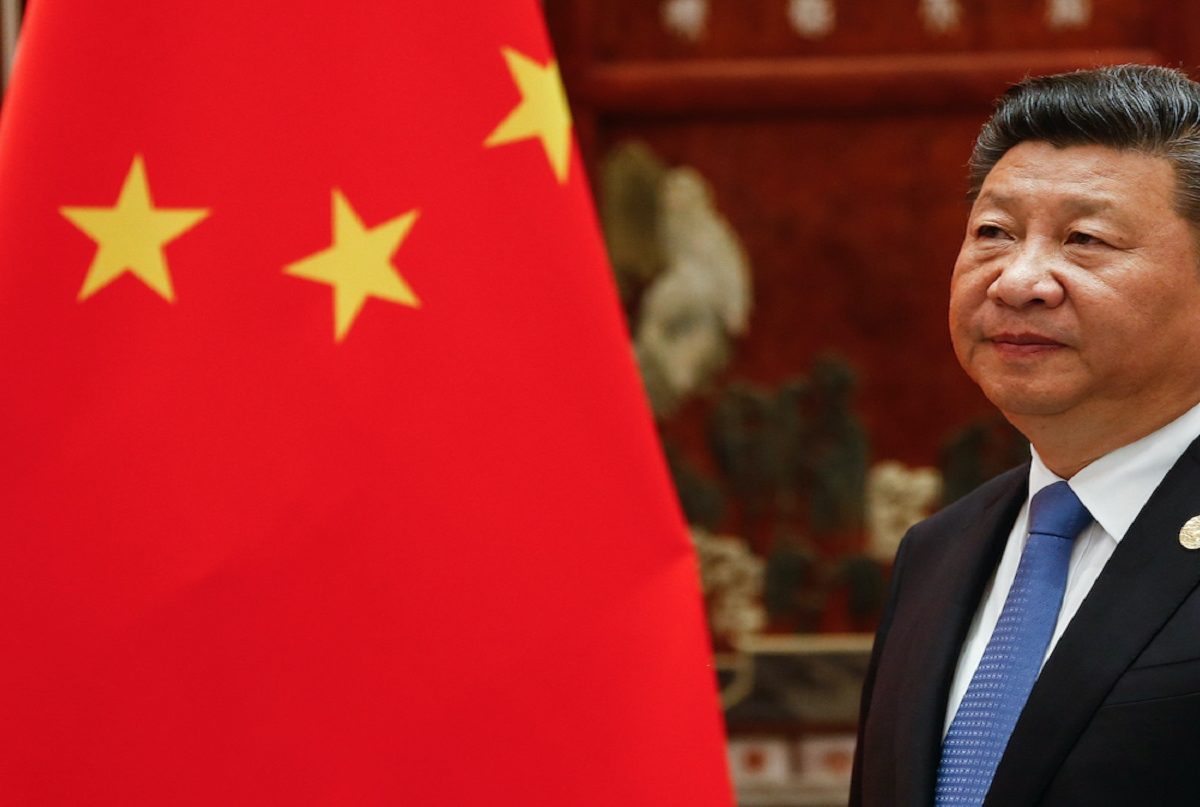

The World Health Organization has become a tool of the “Chinese propaganda”, the Trump administration has alleged, asserting that the global health agency has lost all its credibility during the ongoing coronavirus crisis.

US President Donald Trump recently announced he would put a hold on America’s funding to the World Health Organization (WHO), accusing the UN health body of becoming “China-centric” during the ongoing coronavirus pandemic.

The United States is the largest contributor to the Geneva-headquartered world body.

“The problem with the WHO is that they’ve lost all credibility during this crisis,” US National Security Advisor Robert O’Brien said on Tuesday.

“It’s not like the WHO has been a highly-credible organization for many years. The United States spends over half a billion dollars on the WHO. China spends about USD 40 million dollars on the WHO, about one-tenth of what the US spends, and yet the WHO has become a tool of Chinese propaganda,” he alleged.

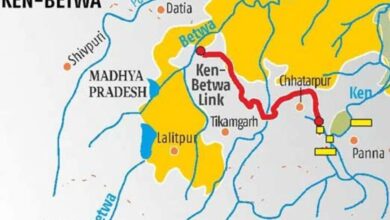

O’Brien said that on January 14, the WHO assured the US that there was no human to human transmission of the COVID-19, that well into the public health crisis in China, that turned out to be utterly false.

In February, the WHO criticized travel restrictions that were being placed on travel from China and other hotspots, not just by the US, but by other countries, he said.

“That turned out to be totally improper advice, and has been rejected by the public health professionals,” he noted.

On March 11, the WHO came out with non-medical advice and said that the Communist Party of China’s reaction to the virus has been an “amazing achievement” in containing it. And of now, the virus is in at least 184 countries, he said.

“So if that’s an amazing achievement, I don’t know what is. So we’ve got a real credibility problem with the WHO,” he said.

The United States is working with friends and allies to see if it can be reformed, he said.

“But one thing we will do, even though we’ve suspended funding, we’re going to make sure that the taxpayer dollars of hard-working Americans that they want to see help our friends and partners and folks around the world who need it, we’re going to make sure those dollars get delivered directly to countries, directly to the non-governmental organizations, the Red Cross, places that are fighting this disease on the front line,” O’Brien said.

“Unfortunately, the WHO has just lost credibility at this point, and you know, instead of stopping, when you hit rock bottom, you stop digging. But the WHO today, apparently, is going to keep digging,” he said.

The COVID-19 has claimed more than 45,000 lives and infected over 824,000 people in the US. Globally, the virus has killed 177,445 people and infected over 2.5 million, according to Johns Hopkins University data.