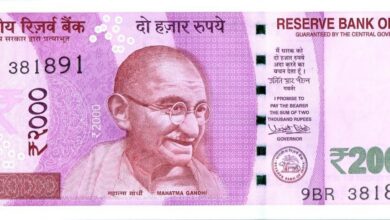

rbi bank

-

Trends

The RBI extended the deadline for card tokenization by three months.

The Reserve Bank of India (RBI) stated on Friday that the implementation date for card data storage and tokenization will…

Read More » -

Trends

RBI Payments Vision 2025: Increase Digital Transactions by 3X

An increase in Digital Transactions is a goal of the RBI Payments Vision The Reserve Bank of India (RBI) has…

Read More » -

Fintech

How NeoBanks are changing the fate of India’s banking system

How NeoBanks are changing the fate of India’s banking system Banks are undergoing rapid changes. Banks are changing their behaviour…

Read More » -

Trends

Fraud Of Total Rs. 4.92 Trillion Reported By Several Banks In India During FY19-20, SBI’s Amount Largest

Several Indian banks have reported a fraud of Rs. 4.92 trillion as of March 31st, 2021. This humongous amount conveys…

Read More » -

Trends

The current financial crisis is different from 2008, economy is entangled with internal problems more than external reasons

The economy was at a high level during 2007 to 2012, at the same time most loans were given, which…

Read More »