ICICI Bank: A Transformational Journey of Financial Excellence

In banking, few institutions have carved a path as remarkable as ICICI Bank. From its humble beginnings, the bank has emerged as a leading player in the financial industry, offering a wide range of innovative products and services. As we delve into the captivating story of ICICI Bank, we will explore its origins, challenges, growth, current standing, and notable achievements.

1. Foundation and Founders

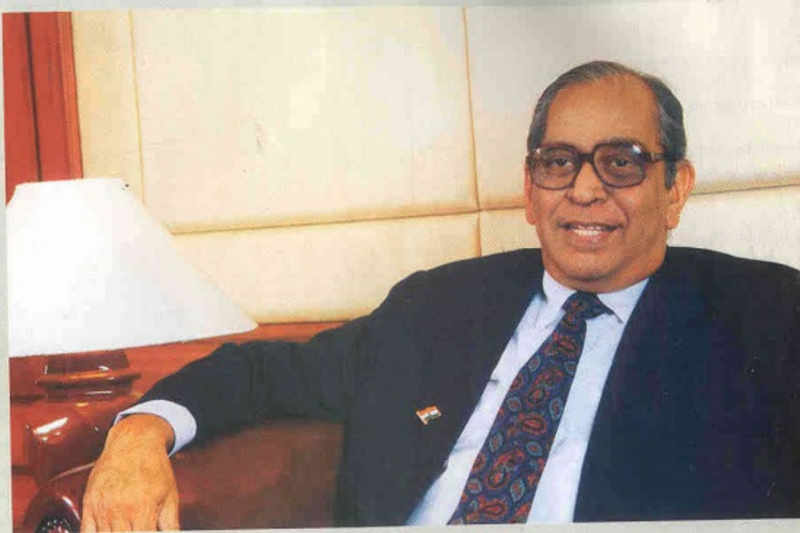

ICICI Bank’s foundation in 1994 marked a significant milestone in the financial landscape of India. The bank was founded by a group of visionary individuals, including the Industrial Credit and Investment Corporation of India (ICICI), with Mr. Narayan Vaghul at the helm. Their collective goal was to establish a robust financial institution that would provide comprehensive banking solutions and contribute to the country’s economic development.

ICICI itself was formed in 1955 through the efforts of the World Bank, the Government of India, and representatives of Indian industry. Its primary objective was to create a development financial institution offering medium-term and long-term project financing to Indian businesses. ICICI focused on project finance for several decades, providing long-term funds to various industrial projects.

With the liberalization of India’s financial sector in the 1990s, ICICI underwent a transformation. It diversified its business from a development financial institution to a diversified financial services provider, offering a wide range of products and services through its subsidiaries and group companies. This expansion allowed ICICI to capitalize on the opportunities presented by India’s market-oriented economy and its integration with the global economy.

Incorporated in 1994, ICICI Bank became a part of the ICICI group. In a notable milestone, ICICI became the first Indian company and the first non-Japan Asian bank or financial institution to be listed on the New York Stock Exchange in 1999. This listing solidified ICICI Bank’s position as a leading player in the Indian banking industry.

Recognizing the potential benefits of universal banking, which involved converting long-term lending institutions like ICICI into commercial banks, ICICI and ICICI Bank explored various corporate structuring alternatives. They concluded that a merger between ICICI and ICICI Bank would be the optimal strategic move. This merger would allow ICICI Bank to accept low-cost demand deposits, offer a broader range of products and services, and earn non-fund-based income through banking fees and commissions.

Their respective boards approved the merger of ICICI with ICICI Bank in October 2001 and subsequently received approval from shareholders, regulatory bodies, and the courts. Integrating ICICI’s financing and banking operations, wholesale and retail, into a single entity cemented the ICICI group’s position as a formidable force in the financial sector.

2. Inception and Initial Products

In its early years, ICICI Bank, initially known as the Industrial Credit and Investment Corporation of India Limited (ICICI), embarked on a mission to redefine the financial landscape of India. Established in 1955, ICICI began its journey as a development finance institution focusing on providing financial assistance to industrial projects.

The objective behind the formation of ICICI was to foster India’s industrial growth by offering specialized financial products and services. As a development finance institution, ICICI aimed to bridge the gap between capital requirements and the availability of funds for industrial ventures. It played a crucial role in fueling industrialization, supporting infrastructure development, and facilitating the establishment of critical sectors in the Indian economy.

Initially, ICICI focused on offering long-term project finance, term loans, and working capital facilities to businesses. It provided financial assistance to companies across various sectors, such as manufacturing, infrastructure, and services. The institution also catalyzed foreign investments in India, facilitating joint ventures and promoting collaboration between Indian and international companies.

Over time, recognizing the evolving needs of its customers and the changing dynamics of the banking industry, ICICI Bank transitioned into a full-fledged commercial bank. This transformation allowed ICICI Bank to expand its product portfolio and offer a comprehensive range of banking services, including retail banking, corporate banking, wealth management, insurance, and investment solutions.

3. Initial Challenges and Hindrances

In its early years, the transformation from a development finance institution to a commercial bank posed numerous challenges and hindrances for ICICI Bank. As the institution embarked on this ambitious journey, it encountered several obstacles that tested its resilience and determination.

One of the primary hindrances was navigating the complex web of regulations and obtaining the necessary licenses and approvals to transition into a commercial bank. The regulatory framework was intricate, and ICICI Bank had to diligently navigate the bureaucratic processes to ensure compliance while meeting the stringent capital adequacy requirements.

Adapting to new banking technologies was another significant challenge. As ICICI Bank transitioned, it had to embrace advanced banking systems and modernize its infrastructure to provide its customers with efficient and technologically driven services. This required substantial investments in technology, training, and infrastructure upgrades, all while maintaining seamless operations to avoid disruptions for its existing clientele.

Building a robust customer base was yet another hurdle. As a new entrant in the commercial banking sector, ICICI Bank faced fierce competition from well-established players. It had to strategize and differentiate itself by offering innovative products, competitive interest rates, and superior customer service. Gaining customers’ trust and confidence was a gradual process that required extensive marketing efforts and ongoing relationship-building.

Additionally, attracting skilled professionals to join the bank’s workforce was challenging. As ICICI Bank aimed to deliver exceptional services, it needed a talented team with expertise in various banking domains. Recruiting and retaining top talent in a highly competitive job market demanded comprehensive HR policies, attractive compensation packages, and a strong organizational culture that fostered growth and career advancement.

4. Current Ownership and Name

ICICI Bank, a leading financial institution, has undergone significant transformations since its inception. While the initial owners, including ICICI, continue to hold a substantial stake in the bank’s operations, the current ownership structure reflects a diverse group of stakeholders. ICICI Bank is a publicly traded company listed on the Bombay Stock Exchange and the National Stock Exchange of India.

The bank is governed by a board of directors, with Mr. Girish Chandra Chaturvedi serving as the Non-Executive Chairman. With his wealth of experience and expertise, Mr. Chaturvedi plays a pivotal role in shaping the bank’s strategic direction and ensuring effective corporate governance. Heading the bank’s day-to-day operations is Mr. Sandeep Bakhshi, who holds the position of Managing Director & CEO. With his strong leadership skills and deep understanding of the banking industry, Mr. Bakhshi drives the bank’s growth initiatives and oversees its diverse range of operations.

5. Current Products and Services

Regarding deposit accounts, ICICI Bank provides customers with options such as savings and current accounts. Savings accounts offer individuals a safe place to park their funds while earning a competitive interest rate. Current accounts, on the other hand, are tailored to meet the banking requirements of businesses and corporations.

ICICI Bank understands the importance of loans in fulfilling aspirations and goals. It offers various loan products, including home loans, personal loans, two-wheeler loans, car loans, education loans, gold loans, commercial business loans, and Pradhan Mantri Mudra Yojana loans. These loans provide financial assistance to individuals and businesses at competitive interest rates, ensuring that customers can achieve their dreams and meet their financial obligations.

In terms of investment options, ICICI Bank provides fixed deposit and recurring deposit accounts. These investment instruments allow customers to park their surplus funds and earn attractive returns over a specific period. ICICI Bank empowers customers to grow their savings by offering flexible tenures and competitive interest rates. ICICI Bank understands the importance of convenience and provides a range of cards to facilitate seamless transactions. Credit cards enable customers to make purchases and manage their expenses with added benefits and rewards. On the other hand, debit cards provide easy access to funds for day-to-day transactions.

ICICI Bank provides a host of convenient solutions in the realm of banking services. These include balance enquiry services, allowing customers to track their account balances easily. Additionally, mobile banking services empower customers to access their accounts, make transactions, and avail of various banking facilities on their smartphones, ensuring banking services are just a few taps away.

Recognizing the importance of foreign exchange services, ICICI Bank offers customers the ability to exchange currencies for international travel, remittances, and other foreign exchange requirements. This service ensures a seamless experience for customers traveling abroad or engaging in international transactions. ICICI Bank also provides customers with a Demat account facility, enabling them to hold and trade securities electronically. This service simplifies the process of buying, selling, and managing investments in stocks, mutual funds, bonds, and other financial instruments.

6. Global Expansion

ICICI Bank’s pursuit of global expansion has been instrumental in establishing its presence across various countries and continents. The bank’s international operations have allowed it to serve a diverse customer base and tap into new markets. ICICI Bank has subsidiaries in the United Kingdom and Canada, solidifying its foothold in these regions.

Furthermore, the bank has established branches in the United States, Singapore, Bahrain, China, Hong Kong, and Dubai International Finance Centre. These branches serve as essential hubs for delivering a wide range of financial services to customers in these regions. By strategically positioning its branches, ICICI Bank has ensured convenient accessibility and enhanced customer engagement.

In addition to its subsidiaries and branches, ICICI Bank maintains representative offices in key countries such as the United Arab Emirates, South Africa, Bangladesh, Malaysia, and Indonesia. These representative offices act as liaisons, fostering relationships with local stakeholders and exploring potential business opportunities.

8. Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) are essential metrics that organizations use to assess their performance and gauge their progress towards achieving strategic goals. ICICI Bank, being a leading financial institution, employs various KPIs to evaluate its operational excellence and ensure that it continues to deliver exceptional financial services. Here are five key performance indicators that ICICI Bank focuses on:

- Customer Satisfaction: ICICI Bank emphasizes measuring and enhancing customer satisfaction levels. By regularly collecting feedback, monitoring customer complaints, and conducting surveys, the bank ensures that it meets and exceeds customer expectations. Positive customer experiences contribute to customer loyalty and retention, driving the bank’s success.

- Asset Quality: Maintaining a healthy asset quality is crucial for a bank’s stability and profitability. ICICI Bank closely monitors metrics such as non-performing assets (NPAs), asset quality ratios, and provisioning levels. By effectively managing credit risk and minimizing NPAs, the bank safeguards its financial health and maintains the confidence of stakeholders.

- Cost Efficiency: Controlling costs is imperative for sustained profitability. ICICI Bank focuses on the cost-to-income ratio, operating expenses, and productivity KPIs. The bank ensures efficient operations while maximizing shareholder returns by optimizing processes, leveraging technology, and implementing cost-saving measures.

- Technological Advancements: In today’s digital era, staying at the forefront of technology is crucial for banking institutions. ICICI Bank tracks digital adoption, online transactions, and mobile banking usage KPIs. By investing in innovative technologies and providing seamless digital experiences, the bank enhances customer convenience and strengthens its competitive position.

- Market Share: ICICI Bank monitors its market share in various segments, including retail banking, corporate banking, and wealth management. This KPI helps the bank assess its competitive position and identify areas for growth and expansion. A larger market share signifies the bank’s ability to attract customers and gain a more significant portion of the market.

8. Lawsuits and Scams

In 2021 and 2022, ICICI Bank has been embroiled in a few legal controversies, including lawsuits and settlements. One notable case involved the former CEO of the bank, Chanda Kochhar, and her husband, Deepak Kochhar. According to a report, they were accused of financial irregularities and conflict of interest concerning a loan granted to Videocon Group. The case gained significant media attention, and both Chanda Kochhar and Deepak Kochhar were sent to judicial custody until January 10, 2022, to facilitate further investigation into the matter.

Additionally, ICICI Bank faced a settlement with the Securities and Exchange Board of India (SEBI) in another case. The bank agreed to pay a fine of Rs. 28.40 lakhs to settle allegations of violating disclosure norms. The settlement was reached to resolve SEBI’s charges related to the bank’s failure to comply with information disclosure regulations promptly.

These legal issues and settlements have impacted ICICI Bank’s reputation and have called for stricter governance and compliance measures within the institution. However, it is essential to note that ICICI Bank has been addressing these challenges, focusing on strengthening its internal processes, risk management frameworks, and corporate governance practices to regain trust and maintain transparency in its operations.

9. Financial Snapshot

The financial snapshot of ICICI Bank reflects its strong market position and consistent performance. With a market capitalization of a staggering 6.57 trillion INR, ICICI Bank demonstrates its substantial presence and market value. This indicates investors’ confidence in the bank’s growth potential and ability to deliver value to its shareholders.

In terms of profitability, ICICI Bank has reported impressive results. For the quarter ending March 31, 2023, the bank recorded a standalone net profit of Rs 9,122 crore, representing a remarkable 30% jump compared to the corresponding period in the previous year. This increase in profit underscores the bank’s efficient operations, effective risk management, and its ability to capitalize on growth opportunities in a competitive market.

Regarding borrowing, ICICI Bank has maintained a prudent approach to managing its debt obligations. The latest available information shows that the bank’s borrowing stood at INR 119,325.49 crores. This indicates the bank’s strategic management of its borrowing activities and focuses on maintaining a healthy balance between its funding requirements and financial stability.

Conclusion

ICICI Bank’s remarkable journey from a development finance institution to a global banking powerhouse is a testament to its unwavering commitment to excellence. By adapting to market changes, expanding its operations globally, and offering a comprehensive suite of financial products and services, ICICI Bank has transformed the lives of millions and played a pivotal role in India’s economic growth. With its customer-centric approach and continuous focus on innovation, ICICI Bank is poised to shape the future of banking and inspire the next generation of financial institutions.

Published By Naveenika Chauhan