India has now become the world’s seventh worst-hit country in terms of coronavirus cases with its tally of 1,82,143, according to the World Health Organization’s COVID-19 tracker.

According to the WHO tracker, a total of 59,34,936 cases have been recorded globally with 3,67,166 deaths as of 10:30 PM Sunday.

India registered its highest single-day spike of COVID-19 cases on Sunday with 8,380 new infections reported in the last 24 hours, taking the country’s tally to 1,82,143, while the death toll rose to 5,164, according to the Union Health Ministry.

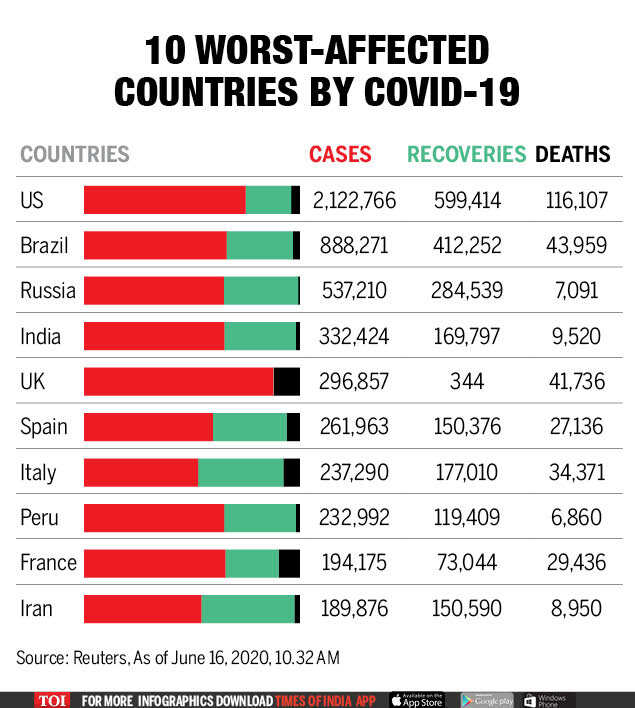

According to the WHO tracker, India is the seventh-most affected nation in terms of COVID-19 cases after US, Brazil, Russia, UK, Spain and Italy.

The US is the worst-affected country in terms of cases with 17,16,078 infections, while India is at the seventh spot with 1,82,143 cases. Germany has 1,81,482 cases, Turkey has 1,63,103 cases and Iran has 1,48,950, according to the WHO tracker.

The number of active COVID-19 cases in India stands at 89,995, while 86,983 people have recovered and one patient has migrated to another country, according to the health ministry.

“Thus, around 47.76 per cent patients have recovered so far,” a senior health ministry official said.

There has been a sharp spike in coronavirus cases in the last few days in India. On Saturday, India had also registered a record single-day spike of 265 deaths due to the pandemic.