LG allows private offices in Delhi to run with 50% staff

LG allows private offices in Delhi to run with 50% staff

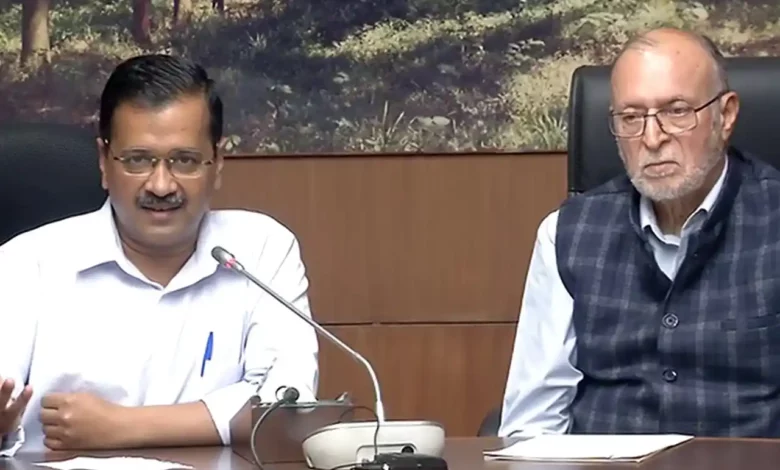

Lt Governor Anil Baijal on Friday approved the Delhi government’s proposal to allow private offices to function with 50 per cent staff but suggested maintaining the status quo on lifting weekend curfew and removing odd-even rule for the opening of shops in the markets, LG office sources said.

Any decision on lifting the weekend curfew could be taken once the COVID-19 situation in Delhi improves further, they said.

“The proposal of Pvt offices working with 50 per cent staff has been agreed with. With regards to Weekend Curfew and opening of markets, it has been suggested that the status quo be maintained since positivity is yet hovering above 21 per cent and the number of positive cases is more than 12000,” said an LG office source.

Once the situation improves, a review would be done by the Delhi Disaster Management Authority along with member experts, he added.

Earlier in the day, Deputy Chief Minister Manish Sisodia said in a press conference that the Delhi government has proposed lifting weekend curfew, ending the odd-even system for opening of shops and allowing private offices to run with 50 per cent staff in the city.

The proposal approved by Chief Minister Arvind Kejriwal has been sent to Lt Governor Anil Baijal for his consent, he said.

The decision to ease the restrictions was taken in view of the declining number of Covid cases in the city and its effect on livelihood and business activities, he said.

The traders in many parts of the city have demanded the lifting of curbs, including the opening of shops of non-essential goods on alternate days based on the odd-even system.

The weekend curfew imposed because of rising in Covid cases will be in place from 10 PM Friday and continue till Monday 5 AM.

Article Proofread & Published by Gauri Malhotra.