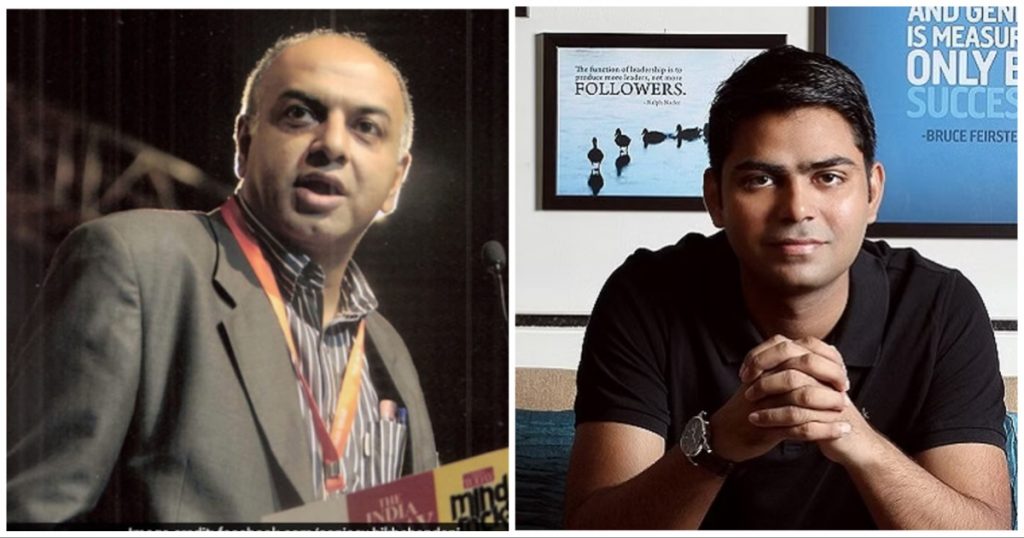

Rahul Yadav, Sanjay Sinha Of 4B Networks File Anticipatory Bail Application; 4B Network’s Allegations, Scandals, and Startup Implosion & The Questionable Pattern Of Indian Startups

Rahul Yadav, the founder of real estate startup 4B Networks, is at the center of a legal battle, facing accusations of cheating, financial mismanagement, and questionable business practices. In the latest, Rahul Yadav and Sanjay Saini of 4B Networks have approached a Mumbai court for anticipatory bail in connection to an allegation of cheating and defrauding a vendor, Interspace Communication Pvt Ltd, to the tune of Rs 10 crores. However, there is more to this; Yadav also founded Housing.com, and the company has been facing heat from its investor Info Edge for not disclosing details of financial transactions sought by the consumer internet group. At the same time, Broker Network marks the depths of Yadav's questionable entrepreneurial trajectory. Unfortunately, the employees are left in a lurch with an 'albatross around their neck' in requests to obtain "advance salary" loans, redirecting the funds to Yadav. Many of these employees have since departed the company, so these loans have transformed into personal liabilities. However, the most critical question, with yet another incendiary personality joining the ranks of Indian founders who have crossed ethical boundaries, will this incident catalyze reforms and instigate more stringent actions against those who transgress?

The Allegations

Rahul Yadav and his associate Sanjay Saini of 4B Networks have recently filed an anticipatory bail application in connection with allegations of cheating and defrauding a vendor, Interspace Communication Pvt Ltd, to the tune of Rs 10 crores.

The Economic Offences Wing (EOW) of the Mumbai Police had filed a First Information Report (FIR) against Yadav and Saini based on a complaint from Omprakash Nowal of Interspace Communication.

The complaint alleges that 4B Networks hired Interspace Communication for advertising services but failed to pay for the services rendered.

According to the complainant, 4B Networks had hired Interspace Communication to put up over 80 hoardings as part of an advertising campaign.

Om Prakash Nowal has alleged that between February 2022 and September 2022, 4B Networks offered installation printing, hoardings, display and other advertising-related services, and a total of 83 advertisement hoardings were put up by Nowal’s company in different places in Pune from April to August last year, for which the company failed to pay despite repeated follow-ups.

However, despite the services being delivered, the payment was not made. The complainant provided evidence of email trails, phone call logs, and messages to support their claims.

The police investigation reportedly uncovered technical evidence suggesting that Yadav and his company had deliberately delayed payments without valid reasons, constituting a breach of trust and cheating.

Incidentally, Yadav also founded the flop company Housing.com, and the company has been facing heat from its investor Info Edge for not disclosing details of financial transactions sought by the consumer internet group.

Founded in November 2020, 4B helps real estate developers and brokers communicate with each other and conduct business via the Broker Network Platform. It also helps brokers conduct site visits and provide home-loan-related services to clients.

Info Edge had written off its equity investment of Rs 276 crore in 4B Networks during the December 2022 quarter, citing “excessive cash burn, prevailing liquidity issues and significant uncertainty towards funding options.”

Info Edge, after initiating a forensic audit into 4B Networks, also started arbitration proceedings against the startup after it failed to provide crucial information about its operations and management for the audit.

On August 11, addressing a post-earnings analysts’ call, Info Edge cofounder Sanjeev Bikhchandani said that backing Yadav’s 4B Networks was a mistake. “You can’t write off Rs 288 crore; it was a mistake,” he said.

Rahul Yadav At The Center Of It All

At a moment when Info Edge, the major investor holding a 65% stake, has written off its INR 280 Crore investment in the principal shareholder and launched a forensic audit, the company’s foundation appears as unstable as a house of cards, and Rahul Yadav seems to be steering yet another startup toward catastrophe.

Insiders within the company have their own inputs to give, vendors, close associates of Info Edge, and regulatory records; it seems the Broker Network marks the depths of Yadav’s questionable entrepreneurial trajectory.

Broker Network’s Doom

Although the challenges at Broker Network, which 4B Networks Private Limited operates, surfaced shortly after Info Edge’s write-off in February, there was an undercurrent of deeper issues.

In contrast to Yadav’s previous ventures like Housing.com, the turmoil within Broker Network revolves around a disturbing financial mess, enclosing unpaid dues to various entities and allegations of illicit fund transfers from Broker Network to two other firms connected to Yadav and his wife, Karishma Singh.

What’s more to this story is the fact that it came to light that the INR 280 Crore plus investment from Info Edge and other venture debt investors had seemingly disappeared from the company.

Moreover, according to media reports, employees at Broker Network conveyed that the situation would have been different if the company had not overspent.

They also added that Broker Network’s funds had been diverted to Yadav’s holding company, RY Advisory from there, the funds were channeled to Kult App, a company where Yadav’s wife was a director.

Yadav, of course, has denied all these allegations.

The Fallout

Numerous criminal complaints have been lodged against Yadav and other company members in the last few months.

Reportedly, many employees awaiting salaries since September 2022 are caught in a trap as many of these individuals find themselves laden with personal debts and left with minimal options except to engage in a social media struggle.

Burdened by substantial employee costs, the company turned to Info Edge for financial infusion; however, Info Edge questioned the necessity of maintaining over 2,000 employees.

Broker Network’s employee count peaked at nearly 2,300 in July 2022, only to hastily decline to under 1,600 within a month.

An upper-tier employee, a former director at Broker Network, asserted that the management informed Info Edge about plans to release 400 employees. However, no such action was executed within the company.

These alleged dubious “layoffs” coincided with Broker Network’s sudden reduction in Employee Provident Fund Organization (EPFO) deposits.

Simultaneously, in August 2022, Yadav solicited personal loans from long-standing employees to cover employee salaries. A senior employee lent nearly INR 50 Lakhs to Yadav, later registering a criminal complaint against him.

Other employees were similarly requested to obtain “advance salary” loans, redirecting the funds to Yadav. Many of these employees have since departed the company, so these loans have transformed into personal liabilities.

Employees contended that Yadav maintained a lavish lifestyle throughout this period. In response, Yadav attributed these luxuries to earnings from his Anarock endeavors and even expressed interest in acquiring a Bentley.

Clues to the widespread disarray become evident in Broker Network’s financial records. FY22 results indicated total employee costs of INR 41 Crores, encompassing gratuity and tax expenses.

However, an email from Info Edge in January revealed a dramatic escalation to INR 20 Crores per month, equivalent to INR 240 Crores for the first eight months of FY23. How the company sustained this accelerated rate of expenditure remains unclear.

Insiders contended that around INR 9 Crores were expended monthly on the “home visits” segment and roughly INR 18 Crores to INR 20 Crores on the “home loans” division. This aggregate included operational costs and employee expenses, placing monthly burn rates slightly over INR 30 Crores by most calculations.

Vendors Join The Downfall

Beyond employees, numerous vendors remain unpaid by Broker Network since the previous year. Correspondence from vendors, including NeoSoft (a software development company), Interspace Communications (an advertising agency), and Finqy (a home loans agent), demonstrated that Broker Network owed more than INR 20 Crores.

Certain vendors refrained from stepping forward due to concerns about jeopardizing any outstanding dues. Amidst this turmoil, employees claimed that Yadav had vanished, leaving other executives to address their grievances.

Startup India And Their Leaders

The question that comes to mind is that this is not one of incident, but it has become a recurring pattern for most startups in India.

Rahul Yadav, as an entrepreneur, is not a successful one. Housing.com failed in 2015, yet he managed to attract investor funds twice, and playing on sentiments of ‘the one to rise from ashes to glory’ certainly did him good, not to mention he managed to raise millions from SoftBank.

The infusion of funds from Info Edge, known for supporting some of India’s most successful startups, further injected confidence despite Yadav’s history.

Here Is What We Have

- Rahul Yadav’s entrepreneurial journey paints a consistent picture, launching companies, securing funds, and subsequently shuttering operations within a year or two.

- Two years after its inception, Broker Network is verging on dissolution, and its operational landscape is fraught with turmoil.

- In late April, disgruntled employees not only disrupted the tech platform by revoking access to their work but also brought union representatives to the company premises to address their unpaid salaries.

- Insiders also alleged resistance from the home loan team regarding the transition to a technology-driven platform, as this would necessitate greater transparency. Employees contended that the team favored manual entries for recording home loan approvals and broker commissions, raising substantial concerns.

- Broker Network chose to undercut the market by offering commissions exceeding 75% to 80% in some cases. This was unsustainable for the business given the razor-thin margins,” a former company director stated, revealing one of the sources.

- One DSA, Finqy, voiced its grievances. The founder, Manish Aggarwal, shared that Broker Network owed his company over INR 1 Crore.

- In April, Finqy lodged a criminal complaint against Rahul Yadav, Pratik Chaudhary (a company director), and Broker Network at Goregaon East police station. Investigations are ongoing. Yadav and Chaudhary have ignored summonses by authorities. If they evade another summons, Finqy’s legal representative confirmed that an FIR will be filed against them.

- The conflict emerges from the transfer of funds from Info Edge to Broker Network. While INR 12 Crores were allocated to pay vendors and employees and extend a loan to 4B Realtech, these funds were funneled to 4B Realtech without any documentation of settled dues. This discrepancy catalyzed the massive write-off, as per an Info Edge insider.

- Numerous employees claimed that Broker Network relocated to a co-working space in Andheri in October 2021, then shifted to another office in September 2022. Allegations suggest these rental agreements pertained to spaces scarcely utilized by 15-20 employees. Interestingly, none of these leave and license agreements specified monthly rent to be paid by Broker Network.

)