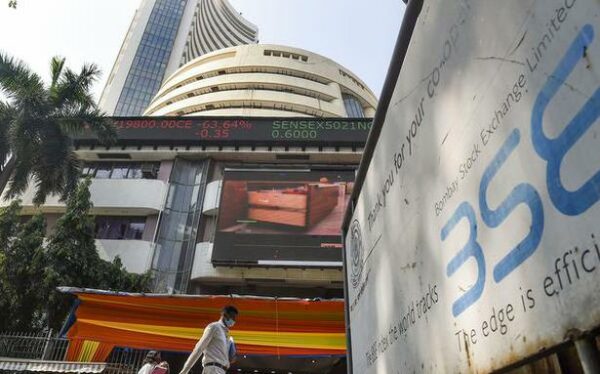

Sensex slumps over 600 pts in new early trade; Nifty slips below 16,650 level

Sensex slumps over 600 pts in early trade; Nifty slips below 16,650 level

Equity benchmark Sensex tumbled over 600 points in the opening session on Wednesday following a selloff in global equity markets amid escalating tensions between Russia and Ukraine.

Besides, surging international crude prices and unabated foreign capital outflows weighed on investor sentiment.

The BSE gauge was trading 613.55 points or 1.09 per cent lower at 55,633.73 in early trade. Likewise, the Nifty fell 175.30 points or 1.04 per cent to 16,618.60.

ICICI Bank was the top loser in the Sensex pack, shedding 3.46 per cent, followed by Asian Paints, Maruti, HDFC twins, Kotak Bank and Ultratech Cement.

On the other hand, Tata Steel, M&M, Reliance Industries, PowerGrid, NTPC and Tech Mahindra were the gainers.

In the previous session, the 30-share BSE index settled 388.76 points or 0.70 per cent higher at 56,247.28. Likewise, the broader NSE Nifty jumped 135.50 points or 0.81 per cent to end at 16,793.90.

Equity markets were closed on Tuesday for Mahashivratri.

In Asia, bourses in Tokyo, Hong Kong, Seoul and Shanghai were trading with deep losses in mid-session deals.

Stock exchanges in the US finished sharply lower in the overnight session.

International oil benchmark Brent crude surged 5.73 per cent to USD 110.98 per barrel.

The US and EU have imposed various sanctions on Russia. These include curbs on Russia’s biggest banks and excluding its financial institutions from the SWIFT global payments system. However, they have allowed its oil and natural gas supply to continue.

In the Indian capital markets, foreign institutional investors (FIIs) remained net sellers in the capital market, as they sold shares worth Rs 3,948.47 crore on Monday, according to stock exchange data