Why Grade when construction and land prices rise, and margins shrink? A rent revision is required for warehouses

Why Grade when construction and land prices rise, and margins shrink? A rent revision is required for warehouses

People in India’s grade industrial cities used to see these small, unattractive buildings on the dusty, bumpy roads a few years ago; now, they’re gone. And the old trucks that would come and go in the middle of the night to load and unload?

You could rent one of these small godown sheds for INR12 or less in the old days. Since then, India’s warehousing industry has gone a long way. There are now massive, state-of-the-art warehouses in the country. People worldwide have come and invested more than $5 billion in the last few years. They built Grade A or modern warehouses constructed to the most up-to-date standards because every long journey has its twists and turns.

Demand and supply are still strong, but the last two years of the pandemic and global supply-chain disruptions have led to a significant rise in construction costs for the warehousing industry. In contrast, rent corrections have been slow, putting a strain on developers’ profits. Developers worldwide want to raise the prices of warehouses that are grade A. Are they making progress on that? Soon, we’ll be there—some good news.

Making space: India’s warehousing industry is getting bigger.

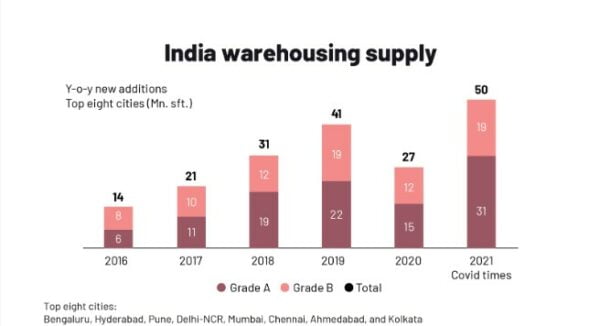

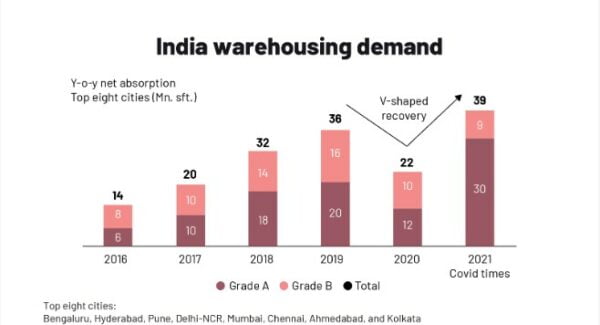

If you look at the top eight warehousing markets, which account for 70%-80% of the organized warehousing supply, 50 million square feet of space was added in 2021 alone. The total number of square feet taken up was 39 million (Grade A-plus grade B warehouses together). This was a significant change from 2019, when there were 41 million square feet of supply and 36 million square feet of demand. India now has 287 million square feet of warehousing space, which is a lot.

Grade A warehouses are less likely to have empty spaces than warehouses that are Grade B, which is why. This is a good sign that there is more demand. When it comes to vacancies, Grade A is at 8.8%, while Grade B is at 14.9%.

“Shortly, for 2022, the net absorption of grade A and grade B warehouses should be between 43 million square feet and 45 million square feet.” E-commerce companies, which bought a lot of big warehouses last year, are now clamoring for in-city warehouse space.

Chandranath Dey, head of operations and business development at property management company JLL India, says this: Several cities in India’s Tier II and Tier III cities are expected to have more than 12 million square feet of space available in 2022. These cities are Rajpura, Lucknow, Coimbatore, Jaipur, Guwahati, Bhubaneswar, Nagpur, Kochi, Ernakulam, Indore, Patna

Total warehousing space in India is expected to grow to 500 million square feet by 2025, growing at about 20% per year.

Grade A warehouses are expected to grow faster than Grade B warehouses.

Also, by 2025, there will be 300 million square feet of warehouse space, Grade A, which is about 60% of the total warehouse space.

Warehousing is now seen as a more stable investment than commercial and residential real estate, which are more volatile. However, this high-volume, the low-margin business hasn’t yet grown up. And a knot in the growth story is that there isn’t a balance between “stable rents” and “rising costs.”

A lot of the problems are hard to deal with

It has been hard for people who build warehouses to make money in the last year.

There are many problems with the warehousing industry, says Balbirsingh Khalsa, an executive director at real-estate firm Knight Frank India. He talks about them. Because rents haven’t gone up, “the business model itself is a question mark,” he says. Because of high commodity prices, land and building costs have gone up.

They usually want an entry yield of 9 percent to 10 percent and an internal rate of return of 18 percent to 20 percent. Builders have an entry yield of around 7% to 7%, depending on the location, land prices, etc. The IRR would not be more than 14%.

Here are some of the main things that are slowing down developers:

Because construction costs have gone up so much, this has been a challenging year for us. In the last few years, the warehousing industry has dealt with the most significant problem it has ever had. Abhijit Malkani, CEO of logistics-infrastructure company ESR India, says this: “That is a real problem. It is the biggest problem the industry has had in the last few years.”

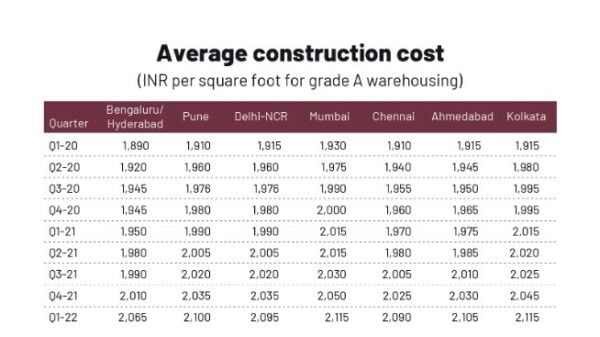

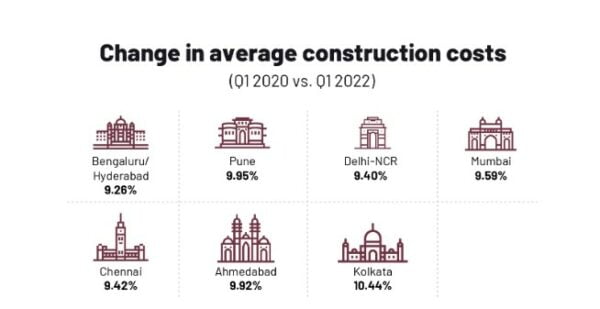

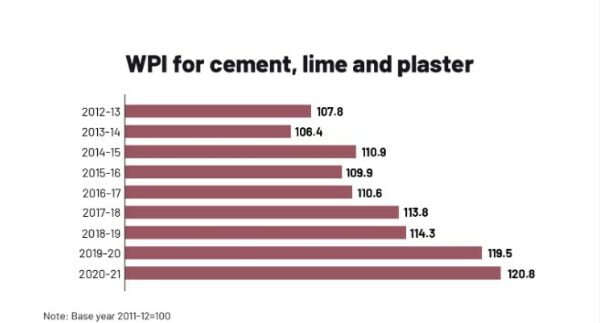

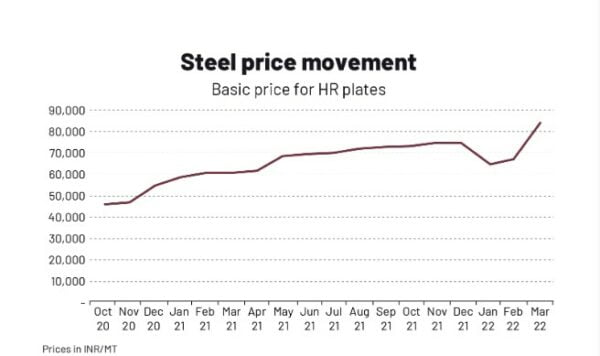

An estimate by Knight Frank says that the cost of building Grade A warehouses has gone up from INR1,600 per square foot in pre-Covid-19 times to INR2,000-INR2,100 per square foot now. This is because essential goods like steel and cement have gone up a lot. The cost of pre-engineered buildings, which use steel, has also gone up by 30% to 35%. It went from INR130-INR140 per kilo to INR180-INR190 per kilo, which is a lot more.

Khalsa says that if interest rates go up even more, the problem will get worse because finance is a big part of the cost of building.

There has been a significant rise in the cost of land, which is a big part of warehousing because there is a lot of money competing for the best land parcels. Costs for land in most of the most important warehouse markets are over INR 2 crore per acre.

A lot of land needs to be bought at a price of INR1.5 crore to INR1.75 crore per acre for warehousing projects to last. Warehousing income is also affected because there is only one FSI (floor space index), which is the maximum amount of construction that can be done on a piece of land. There is enough land (43,560 square feet) for a developer to have up to 50% ground cover and a single-story building.

Pain point #3: Rents that can’t be kept up: Amidst rising costs, the rents for high-quality warehouses in some of the most important markets are not sustainable, say warehousing providers. Using the weighted-average method, JLL says rents in the most critical warehouse markets have not grown more than 3% CAGR from 2015 to 2021. At the moment, Grade A warehouses rent for INR21 per square foot per month, and grade B warehouses rent for INR18 per square foot per month.

The CEO of real estate company Hiranandani Group says that if they don’t make at least 10%, it won’t be worth buying land, getting approvals, and building warehouses at INR2,100 per square foot. “Otherwise, what’s the point?” There must be a rise in prices, and getting Grade A warehousing at the cost of 20 or 21 Indian rupees is not worth it. Somebody has to say, “No, I can’t.” INR21 has to be changed to INR23-INR25.”

People in the business say that big-ticket developers are walking away from deals that don’t make enough money. In 2023, most developers think there will be a change, and the new homes coming on the market are expected to rent for more money.

Industry insiders say that there is still a lot of demand for Grade A products that haven’t been met and that supply could have been better by at least 10% if the environment was better for new projects.

But why can’t developers pass on the extra costs to the people who rent warehouses?

They don’t want to live there.

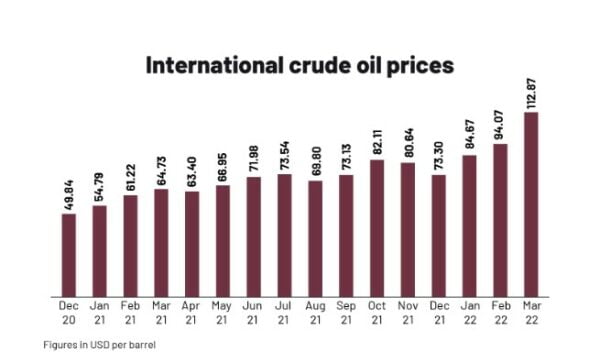

For businesses, warehousing rents make up only about 20% of the total logistics costs they have to pay. However, because fuel prices have gone up, renters have to pay more for transportation. So, they don’t want to spend more money on warehousing, which means that the prices of products go up.

As a result, some insiders say that high-growth industries, such as e-commerce, should be able to handle a rent rise of INR3 or INR4 per square foot per month. It doesn’t matter, though. Grade A rents in India are still cheaper than in other parts of Asia-Pacific like Ho Chi Minh and Melbourne. It doesn’t matter that Grade A warehouses are almost the same worldwide. In India, you can get top-notch quality at a great price.

The rent is already set in stone as soon as a lease agreement is signed, making it hard for the developer to pass on the rising costs to the tenant, putting pressure on the developer’s profits and yields. Companies that agreed to work together before the pandemic and then delivered projects after the outbreak of Covid-19 are in a tight spot because the cost-return equation has changed. It’s easier to pass on the costs of speculative projects where the price hasn’t been agreed upon ahead of time.

But most institutional developers who build warehouses with a lot of space, like half a million square feet or more, prefer to develop warehouses made to order rather than speculative properties because of the risk.

More and more people from the same area are becoming big players.

For high-quality Grade A buildings, there is little room to cut costs, which means rents will go up. In the end, it’s only the small-time local builders who can cut costs here and there and build grade A-like structures. Even big companies like P&G and HUL are still paying INR9 to INR10 per square foot because other businesses in the market can offer Grade A-like space for INR12.

The best institutional developers are having a hard time competing with local developers in some of the most important markets in the country. Only 50 million square feet of the 130 million square feet of Grade A warehousing available now is with the best people in the country (Indospace, Blackstone, ESR, Logos, Mapletree, Ascendas, Morgan Stanley, Xander, Welspun One, NDR, and Global Group). About 200-300 local developers run the rest.

It’s now out of the running to be Blackstone and Welspun One’s competitor. It turns out that all of them (institutional players) help each other. They have to compete with many unorganized or semi-organized local developers in tier-I and tier-II markets. Chandranth Dey, the head of operations and business development at JLL India, says that.

The bottom line is:

Warehousing will be a very competitive field, but it also has a lot of chances. When there isn’t much demand for residential and commercial properties, some intelligent developers are getting into warehouses because they can be built just six to eight months. Many real-estate companies with land that isn’t being used are also getting into warehouses. On the other hand, these developers can change the use of the land at any time, unlike the global companies who stay in the warehousing business for a long time.

This is good news for developers with a mixed portfolio. Industrial growth has been rising in the last three to six months, which is good news for them. In the last few years, many manufacturers, including electric-vehicle manufacturers and retailers, have been getting into this field. Most people pay about INR20 a square foot per month for warehouse space and about INR24 to INR30 per square foot for industrial projects.

Having a variety of stocks and bonds helps to balance out low warehousing rents. India is a country where you need to have a mix of industrial projects and warehouses to build the right portfolio. The number of clients in industrial may be more, but the amount of business in warehousing will always be more. This is what Malkani from ESR says. To understand why to look at the average sizes of industrial projects. They range from 50,000 square feet to 200 square feet. The average size ranges from 100,000 square feet to 500 square feet for warehouses.

In India, warehousing is a new type of asset that doesn’t exist in other places. New: The road from godowns to modern warehouses has only been going this way for the last seven to 10 years. In the future, it will take two to five years for this asset class to reach the level that it should.

edited and proofread by nikita sharma