Does India’s economy experience a K-shaped recovery in 2021-22?

Does India’s economy exhibit a K-shaped recovery?

India had been experiencing a recovery in the formal sector, far from a robust economic recovery before Omicron’s arrival. Informally employed individuals and labour had been neglected. The recovery follows a classic K-shaped pattern.

Several headlines were published in November 2021 before dark clouds began to gather in the form of the Omicron variant of Covid-19, including “Asia’s third-largest economy has been seeing a rebound from last year’s deep slump” and “Morgan Stanley says the economy will recover strongly after Covid”.

Investing in the economy and reforming the underlying structures would create a virtuous cycle of high-productivity growth. During 2021–22 and 2022–23, the International Monetary Fund (IMF) forecast India’s Gross Domestic Product (GDP) growth rate to be 9.5% and 8.5%, respectively.

A year of slow growth followed by deep slumps in the second half of the year due to a stringent lockdown can result in ridiculously high growth numbers the following quarter. The growth rates alone may not provide an accurate picture of recovery, as the activity levels may still be below those before the pandemic.

To overcome this problem, we need to look past growth rates. It will be beneficial to assess the shape of the current recovery in India by examining the size of GDP, quarterly growth rates, sector performance, bank credit growth, and tax collection.

Increase in gross value-added

In 2019-20, the country’s GDP at constant prices was projected to rise to Rs 146 lakh crore from Rs 140 lakh crore in 2018-19. The growth rate is less than the 8% experienced in 2016-17. After that, the government imposed stringent lockdowns. As of 2020-21, the economy grew by Rs 135 lakh crore, lower than that in 2018-19.

Considering that most of this fall occurred in the first quarter (April-June) of 2020-21, we cannot determine if we were on a path of recovery or what kind of recovery it was in 2021-22. We can draw a more accurate picture of the economy by monitoring the Gross Value Added (GVA) in each quarter.

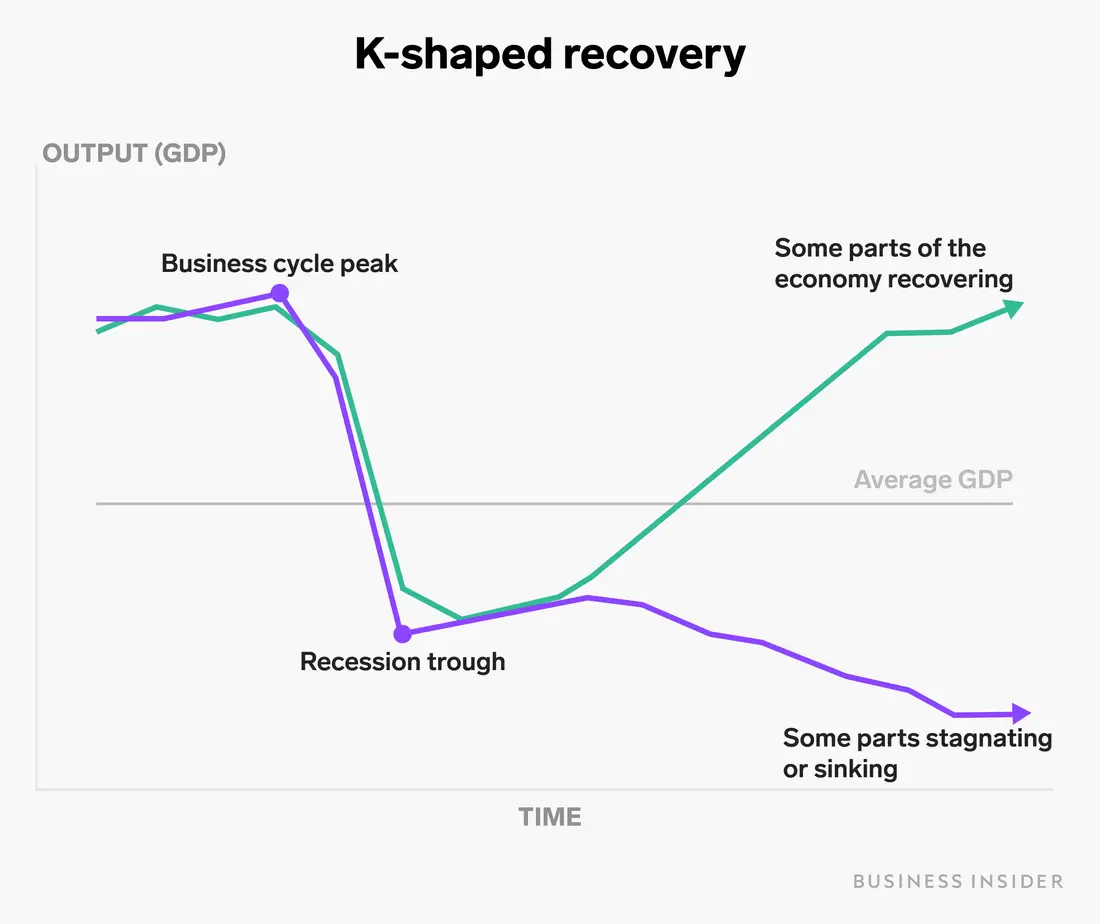

The recovery can be divided into two directions according to the shape of the K. Generally, large businesses and public enterprises recover most quickly. In contrast, small and medium-sized enterprises and blue-collar workers don’t recover nearly as quickly.

In April-June of 2020, the country experienced a national lockdown which caused GVA to drop by 22.4% compared to last year. By the second quarter (July-September), the decline moderated to 7.3%. It exceeded the level of GVA in the corresponding quarter in 2019-20 in the third quarter of 2020-21. Compared to the same quarter of last year, it was slightly higher in the fourth quarter.

Some of these gains, however, were undone by the second wave. A robust growth rate of 18.8% in the first quarter of 2021-22, the current financial year, and 8.5% in the second quarter appears promising. GVA fell to Rs 30.48 lakh crore in the first quarter of 2020-21 from Rs 33.05 lakh crore in 2019-20. At Rs 32.89 lakh crore, the company’s gross value-added was only marginally higher than two years ago in the second quarter.

As a result, we had bounced back to the level reached two years ago by the second quarter of 2020-21.

What sectors gained?

In 2020-21, agriculture growth remained strong. According to the available data, the first two quarters (April-September) of the 2019-20 fiscal year saw an increase of around 8%.

Mining and quarrying, the supply and delivery of electricity, gas, and water, and the provision of public administration, defence, and other services have also shown good growth. Overall, although these sectors together account for less than 20% of GVA, they have been strong performers. The agricultural activity makes up only one-third of GVA.

While manufacturing activity fell by 4% in the first quarter of 2021-22 compared with two years ago, it exceeded in the second quarter by a small margin. Building activity is just about at the two-year level. Over the last two years, the GDP of the remaining two sectors -Trade, Hotels, etc.; and Financial Services, Real Estate, etc. – has decreased.

Hence, the picture of a recovering economy can be seen in the presence of a recovering agricultural sector and the more formal sectors of electricity and gas and public administration. Compared to the levels of 2019-20, trade, hotels, and real estate activity in the largely informal sectors remains low. These patterns indicate a recovery for the formal sector – but not for the informal sector.

- Credit and deposit trends in banks

An economy that is experiencing increased economic activity should show increased credit flow. With more frequent disaggregated data, like those provided by the RBI’s bank deposit and credit data, it becomes easier to observe the decline and ensuing recovery in economic activity in various parts of the country.

- Trends in deposits

No quarter of 2020-21 saw a drop in deposit growth in India. As a result of a national locking down during Covid-19 and the recovery that followed, more deposits were brought into the banking sector. The 2nd wave, which occurred during 2021-22, ended with a slightly slower expansion rate but with higher growth rates.

Even after a nationwide lockdown in early 2020-21 and multiple lockdowns in almost every state that followed, household savings in the form of bank deposits kept growing. Although some states experienced a slowdown in the growth rate of bank deposits during the first half of 2021-22, others did not.

Despite signs of recovery in certain areas, the credit growth rate is still well below those before 2019-20.

This increase in deposits has a distressing dimension in that poorer and more agricultural states like Odisha, Bihar, and Assam have seen a slowdown in growth rates, with the situation worsening toward the end of 2020-21 and the beginning of 2021-22. By contrast, states with a higher standard of living (like Maharashtra, Gujarat, and Punjab) showed a minimal decrease in their deposit growth.

- Trends in credit

In early 2019-20, bank credit growth began to slow. According to the Bureau of Economic Analysis, credit growth declined sharply after the national lockdown, falling from 11.7% to 6.4% in the first quarter of 2020-21. The decline continued into the first quarter of this fiscal year. Despite some signs of improvement in the second quarter, credit growth remains below 7%.

Credit growth varies considerably across states as well, as with deposit growth. Maharashtra, Odisha and Kerala show a deceleration in credit growth from the first quarter of 2019-20, but only from the second and third quarters: this is the case in several states.

In major industrial and service centres in the south, west, and Punjab-Haryana region, credit growth is not occurring. The credit growth rate is still well below the levels prevailing before 2019-20, which is clear in some parts.

Credit growth should have been higher if the V-shaped recovery we’ve heard about was proper. But only in the North East is this true.

- Recipients of tax

The central government’s revenue receipts grew strongly in the first half of 2021-22 (April-September) on the back of increased tax revenues. This compares to the revenue receipts of the previous year. The centre’s direct tax collections rose by 28.7% and 23.8% over the first half of the current fiscal year, respectively.

(Centre plus states) GST collections increased 12.5% in the first half of 2020-21 over the same period in 2019. Government tax receipts (central and state) and bank deposits are projected to grow at healthy rates in 2021-22, which are in line with the trends in bank deposits.

Tax receipts grew faster than GVA in 2019-20, which might also indicate distributional effects. Indirect taxes grew by over 10%, and direct taxes increased by 25%, while GVA remained steady in the first half of 2021-22.

The formal sectors of the economy are expected to receive more income, which impacts the shape of the current recovery.

Recovery’s shape

Recovery comes in a variety of forms. A V-shaped recovery is the best as the economy recovers immediately after a slump. An economy that experiences a prolonged recession, followed by a gradual recovery, has a U-shaped recovery. Even after an extended period, the economy fails to regain its peak GDP in the event of an L-shaped recovery. The economy stages a temporary comeback after falling for a second time during a W-shaped recovery.

There are two branches of a K-shaped recovery. Small and medium-sized businesses, along with blue-collar workers, are left out of the recovery process since large companies and public enterprises recover quickly.

On the right-hand side of the Y-axis is the GVA in absolute terms (the right side), the growth rates of GVA, and the growth rate of actual credit.

Following an extended period of under-5% growth over eight quarters from the end of the fiscal year 2019-20, a period of a deep slump for the next two quarters, and growth below 5% for another two quarters, the quarterly GVA growth rates indicate a robust V-shaped recovery. We have exceeded 5% growth only twice in 2021-22, the first and second quarters.

When we analyze the absolute GVA, the story becomes somewhat different.

In the 12 quarters before the pandemic and ensuing slump, the economy grew by approximately Rs 0.36 lakh each quarter. Growth has returned to pre-pandemic levels in the third and fourth quarters of 2020-21. Nevertheless, we were again pushed down in the first and second quarters of 2021-22.

The economy has stagnated for a while, resembling an L-shaped non-recovery following the growth of over 8% in 2016-17. It’s thus misguided to be overly optimistic about robust growth in 2021-22. With the addition of Omicron, future growth could equally well look something like AB, starting with the dip in the first two quarters of 2021-22. The recovery of India’s economy would take at least another ten quarters and not be completed until 2023-24.

As far as the non-formal, non-farm sectors are concerned, things haven’t turned around for them. In this sense, the current economic recovery in India is probably shaped like a K.

Bank credit growth patterns support our prediction that recovery will be slow. By the fourth quarter of 2019-20, commercial bank credit growth, averaging over 10% in the fourth quarter of 2018-19, was almost zero compared with nearly 10% in 2018-19. The decline has continued, and the growth rate is still below zero, so the recovery will take time to accelerate. The second quarter of 2020-21 saw a slight upturn, but it is still below zero.

Furthermore, it suggests a new dimension to the process of recovery. Unlike medium- and small-sized enterprises, larger formal sector firms cannot run their businesses without bank credit. It may be that small businesses haven’t recovered from the slump and are still struggling in the south and west of the country, which has a high concentration of small businesses.

The picking up of GST collections over the last few months and the high percentage of income tax collections are both indicators that this is the case. A similar trend is evident in increased collections of corporate taxes as well.

The formal sector appears to be turning around based on preliminary indications, but the non-farm non-formal industry has not. India is probably going through a K-shaped economic recovery at the moment.

The composition of growth in different sectors supports the idea of a two-directional recovery. The first two quarters of 2020-21 saw a robust recovery in all sectors except mining and quarrying, electricity and gas, and public administration. Public enterprises make up the bulk of those sectors. A large portion of the informal economy is still present in construction, trade, hotels, and real estate.

Several developments have altered the structure of the Indian economy, including demonetization, GST, and Covid-19.