Is The Government Fooling Us With Numbers?

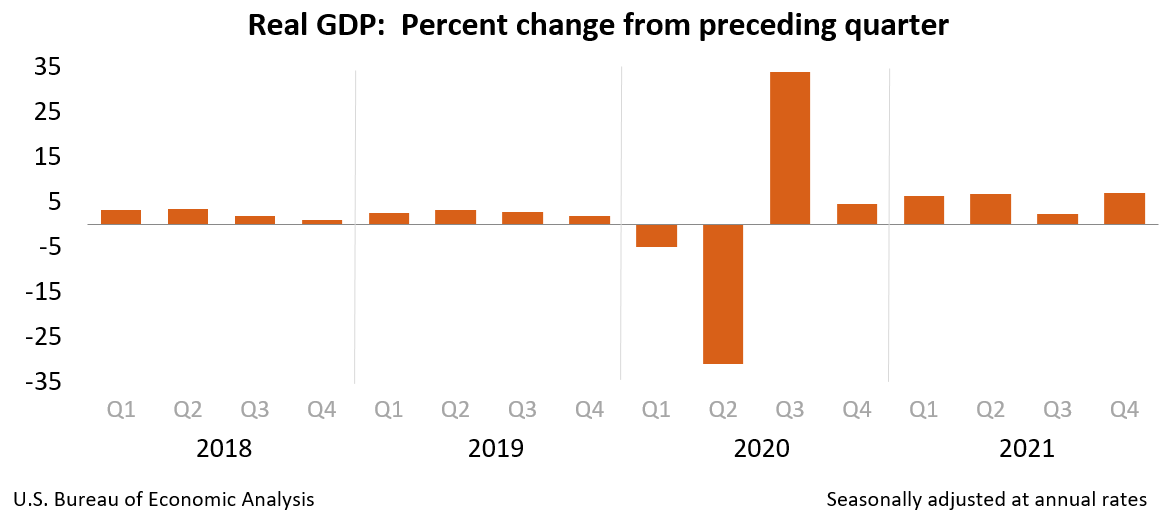

Governments across the globe are known for manipulating the results by number. this does not mean that they change the correct number, but it is more of changing the formula of estimating the indicators of growth like GDP, etc. To put an example, the real GDP growth in 2021 was shown to be 6.9%. For those who don’t know real GDP is dependent upon the GDP of the previous year i.e. 2020 and hence in that year annual growth rate was -8%. Therefore, you understand that while the celebration stands on 7% real GDP growth it was measured against -8%. Is this a fooling proposition?

This allocation spreadsheet primarily focused on giving a big push to the CAPEX to promote infrastructure, employment creation, and thus overall growth. An eye has been kept on fiscal consolidation and the MSME sector has been given out certain extensions of relief.

Tax rationalization measures have also been taken care of. The assumption of the next fiscal year did have been assumed with a conservative mindset, given the possibility for a covid wave. Keeping these key highlights into consideration, this article is a walkthrough of all crucial takeaways from the government’s annual forecasts.

The Thrusting of Capital Expenditure

The CAPEX push is given in three ways. The first is the direct way through infrastructural growth. The allocation has been increased by 35.4% to 7.5 trillion. This is done keeping in mind the multiplier effect for the promotion of growth in terms of employability, asset creation, and boost of investments. The figure, however, is the impact of a large bump in revised estimates of CAPEX.

The second way is through grants-in-Aid, exclusively designed for the creation of capital assets with a financial estimate of 2.68 trillion leading to effective capital expenditure being budgeted at 10.68 trillion. This grant-in-aid is allocated towards Gati Shakti Master Plan enhancing connectivity throughout the nation. This digital plan aims to bring 16 ministries for integrated planning and coordinated implementation for future infrastructure projects.

Lastly, a 50-year interest-free loan of Rs 1 lakh crore for the state government is implicitly planned to be provided for the creation of infrastructure.

These big pushes are supposed to create employment and give a boost to housing, roads, and highways.

National highways are planned to be increased by 25000 km. It is surprising to note that NHAI has seen a 133% rise in 2022-23 as compared to budget estimates for 2021-22. The implication of this is a surge in labor demand and a trickle-down effect leading to not only labor class employability but also contractual employment.

Parvatmala, which is the national roadways developments program is implemented for the creation of infra and jobs in hilly regions. Gramin Sadak Yojana fund allocation has also been surged from 14 crores to Rs 19 crores, followed by a plan for the development of 80 lakh houses under Pradhan Mantri Awas Yojana.

Celebration drinks for MSMEs

To provide relief from the mounting losses experienced by MSMEs, the government initiated the Emergency Credit Guarantee Scheme. This measure was essentially taken to curb unemployability. The studies that were conducted by agencies operating outside India showed this measure to be an advantageous proposition for small-scale businesses. It had impacted 130 lakhs of such businesses. Considering this, the scheme has been extended till March 2023. The total fund allocation has also seen a surge from Rs 50,000 crore to Rs 5 Lakh crore. This cover is ballooned by additional cover exclusively earmarked for hospitality and related enterprises.

Also, a customs duty exemption to secondary MSMEs steel producers has been granted.

Allocation spreadsheet at a Glance

If we look at the financial estimates for the 2021-22 financial year against the revised estimates of the same, the following conclusion can be drawn:

Despite the pandemic, there has been a surge of 16.24% in revenue receipts of the government both from tax and non-tax revenues.

- The Centre’s tax revenue exceeded the target by more than 14%.

- Corporate tax exceeded its target by 16% and income tax by 9.63%.

- Non-tax revenue also registered a growth of 29.12%

The surge however is combated by the plunge in the capital receipt section, excluding the borrowing and other liabilities section. It is because the disinvestment target has fallen short by more than 55%.

The total expenditure section of the budget has escalated through an increase in each head falling under it. The major variation was in the civil aviation sector followed by customs, crop husbandry and food, storage, and warehousing.

- The civil aviation sector variation was the outcome of meeting expenditures on cash losses in terms of equity infusion and loans provided to Air India Limited during the Covid period.

- As a large chunk of the population spilled into rural areas again, the demand for employment increased leading to higher requirements for funds under the MNREGA scheme.

- Also, due to covid waves, the free distribution of food led to an increase in food subsidies under National Food Security Act.

The revenue deficit of the government has been decreased from 5.1% to 4.7% orchestrated to come down to 3.6% in the fiscal year 2022-23.

The fiscal deficit, however, has seen a small increase from 6.8% to 6.9% of GDP, planned to be down to 6.4% this year.

The converted estimates

The financial blueprint estimates are conservative for this fiscal year. It is as follows:

| Revised estimates 2021-22 |

Budget estimates 2022-2023 |

|

| Fiscal Deficit | 6.9 | 6.4 |

| Revenue Deficit | 4.7 | 3.8 |

| Primary Deficit | 3.3 | 2.8 |

| Tax Revenue | 10.8 | 10.7 |

| Non-tax Revenue | 1.4 | 1.0 |

| Central Government Debt | 59.9 | 60.2 |

The GDP of any country is made up of two components i.e., Real GDP and Nominal GDP. The nominal GDP is estimated to rise at 11.7%. It is rather surprising as nominal GDP is 17% in the financial year 2021-22.

The explanation which comes forward is that the government pegged it at such a low estimate so that when actual nominal GDP overshoots, the government wins additional room on expenditure while keeping the fiscal deficit percentage constant. The question, however, is on the GDP deflator. It is important to note that the real GDP is estimated at 8-8.5% of GDP, which doesn’t seem plausible as the GDP deflator comes to be between 2-2.5%, and well, we know for sure this isn’t the inflation rate of India.

Very contradicting estimates have been made concerning tax revenues. The budget estimates assume tax revenue to expand by just 9.6% over revised estimates for the year 2021-22. From budget estimates to revised estimates for 2021-22, we saw a 14.2% rise in the center’s tax revenue.

Non-tax revenue on the other hand is estimated to shrink.

Disinvestment receipts have also been pruned down from Rs 78000 crore to Rs 65000 crore.

Expenditure has seen a marginal rise of 4.6% over revised estimates of 2021-22.

Expenditures on subsidies and MNREGA have been pruned as well.

Sources of financing fiscal deficit

The government decides to borrow 11.6 lakhs out of 16.6 lakhs through the bond market by the issue of G-secs and T-bills. This is the net borrowed amount that is after the repayment of past loans and redemptions.

The implication of this is a rise in 10-year bond yields will be seen as the supply of government bonds will be greater than its demand. A rather positive outlook lets us see an emergence of green bonds that is environmentally friendly project investments that are likely to attract a new set of investors.

Other major instruments are borrowings from small savings collections. Some of the examples are PO, NSC, KVP, and PPF which also provide the investor with tax benefits.

The Renowned Discussions

The question which the opposition as well as many of us raised was: what was there for the salaried, informal sector who are the drivers of demand and hence the economic growth?

Well, the address hasn’t been direct as in through changes in the taxation regime. There are two ways to generate the demand in the economy. The first is through giving the money in the hands of people and the second by the generation of employment. This time the government chose the latter one. If we see this at a macro level, it’s a win-win situation for the economy—asset creation along with employment generation. Though it might be true there isn’t the direct relief to the suffered middle class but to hold your argument because the middle class is an economic driver is in vain.

Another squabble is over the healthcare expenditure that instead of increasing its fund allocation, we have reversed it. The idea behind this is that the vaccination drive has been over and the government is more focused on improving the subsidiaries or linkages that lead to health perils. The bedrock is put upon sanitation and a clean drinking water supply. Moreover, with around Rs 20,000 crores still left from the earlier budget fund allocated for healthcare, it is believed that this fund is quite flexible and variations can take place anytime, or in times of distress.

Conclusion

Summing it all up, the government aims at a more agile approach but it’s more said than done. What we, as a nation have to see and observe is how well the government addresses the implementation hurdles for CAPEX. Also, the disinvestment of LIC is something each one of us is waiting for. The necessity for financial sector reforms- the bank privatization can’t be denied. We, as a country, should also take step towards the inclusion of Indian bonds in global bond indices for generating a smoother flow to finance the fiscal deficit. A proper analysis led me to personally believe that this, if not the best then a considerably good budget for the broken economy. The distinct approach has led to many misconceptions and if what is been said, actually gets implemented the dream we dreamt of Amrit Kal will indeed be a celebration.