Another boosting factor that allowed rapid growth of retail investment was online brokerages that were enabled by the payment per order flow. As seen in the recent events, the result has been new balances of different forces in the market that have reformed are democratized investment in a plethora of ways. However, whether this new paradigm will last or not, only time will tell, or this narrative will!

Believe it or not, but financial markets have long been associated with high-net-worth investors and retail investors. In the first half of 2020, while markets flopped and recovered, retail investors used the opportunity to invest. Greater ease of access to technology and information has created a new paradigm in the financial market.

The Deutsche Bank asserted that increased retail trading is massively responsible for elevated stock prices, which shows that retail investors are driving the stock market. Due to the Zero-commission investing apps and other alternatives, retail investors are trading speculative stocks with low share prices.

However, the gyrations fuelled by an army of factors have chronicled many constraints on the investment front. To make investment straightforward, and to democratize investment for retail investors, here are some factors to consider. Dive in!

#1 Better investor education

The lack of expertise among the investing masses may affect basic market assumptions, such as the precise allocation of resources and overinflating process. Due to the deficit in investor education, retail investors end up underestimating their own market power. For that very reason, access to financial literacy is the best way to reduce the negative aspects of broader market access. Individuals should utilize the mountain of financial information at their fingertips and plan financial decisions accordingly.

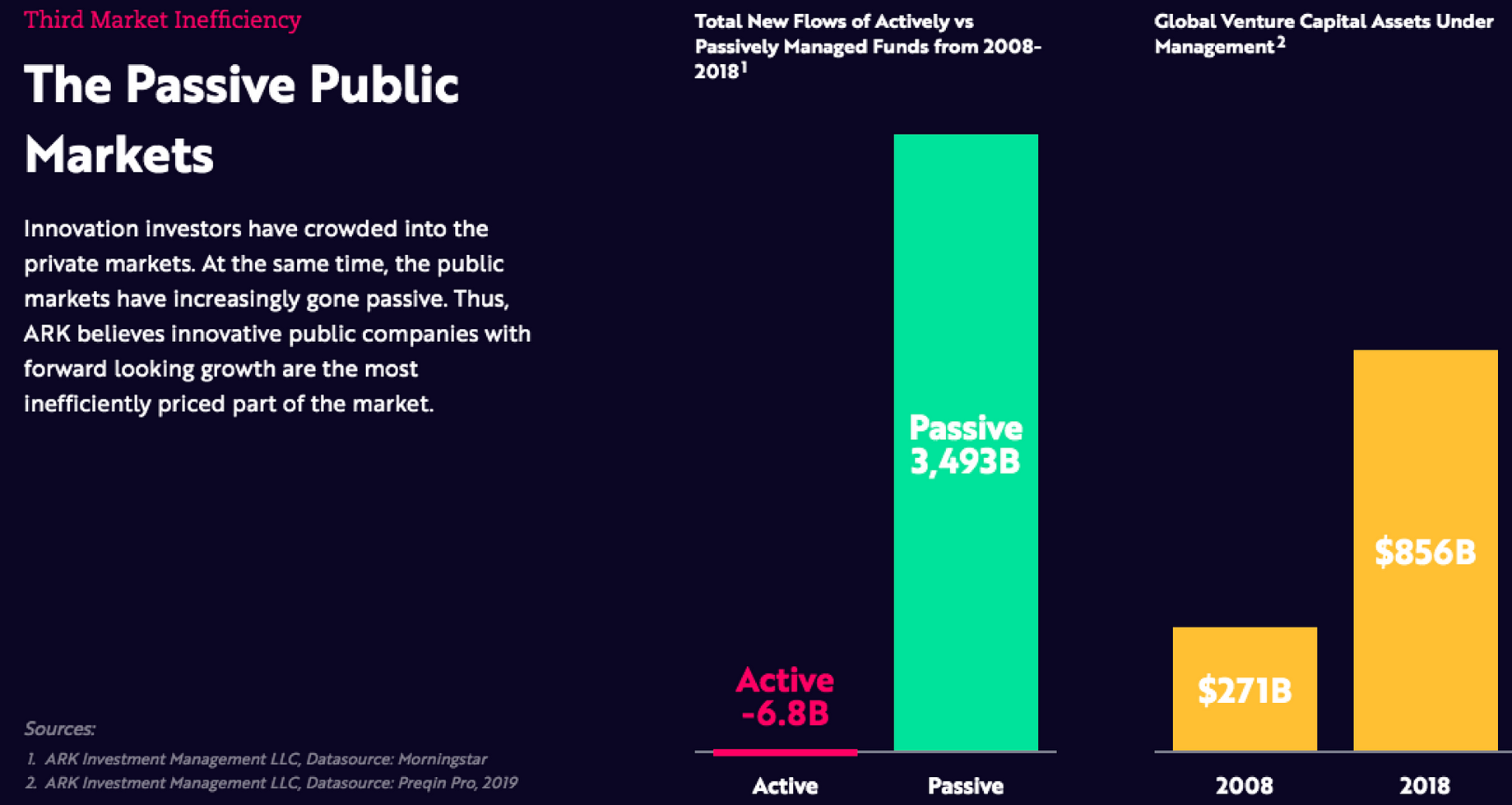

#2 Access to new markets

There is no denying that retail investors flood the market whenever barriers to the market decrease. When the markets get crowded, and the resources become insufficient, it is wiser for investors to move to new markets for better prospects. Platforms that drive alternate investments are going mainstream, so, retail investors can easily invest by using these platforms.

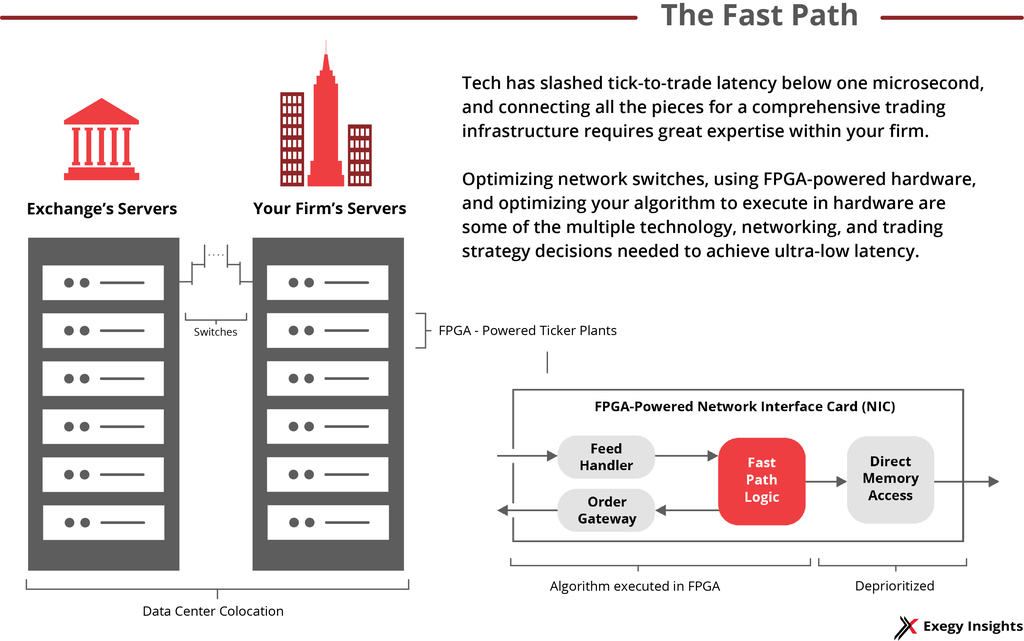

#3 Improved trading infrastructure

Vision without execution is a hallucination, and so investors who want to bring about a radical change in democratizing the financial market must proceed with upgraded financial infrastructure. With a seamless trading framework, investors can have better financial freedom and keep up with the typical investment trends without any contingencies.

Vision without execution is a hallucination, and so investors who want to bring about a radical change in democratizing the financial market must proceed with upgraded financial infrastructure. With a seamless trading framework, investors can have better financial freedom and keep up with the typical investment trends without any contingencies.

#4 A tech-based investment blueprint

Technology is a great equalizer in stabilizing investment platforms. With new-age technology, investors can get more sophisticated and automated online money management systems. In turn, this can replace hands-on, DIY investing by supplementing them with smarter, long-term decisions and strategies.

A new epoch for retail investors is just about to dawn

Look beyond the mania and memes, and you will observe deep structural changes in the financial markets. The reduction of friction in trading stocks and investments is a testament to technological advances.

When retail investors embrace digital transformation with arms wide open, they can buy shares on an app while they wait for their coffee in a queue. The prices are whisker-close to the wholesale price, and the convenience of getting higher ROI is everything.

“With that in mind Lendbox set out to build an investor focused platform to give India’s retail investors easy access to non-market linked alternate investment products previously unavailable to them. We’ve been able to disrupt the space of Debt products and are now working towards building products for several other asset classes.” shared Bhuvan Rustagi, Co-Founder & COO, Lendbox.