Can Gautam Adani’s objectives be achieved without easy access to capital?

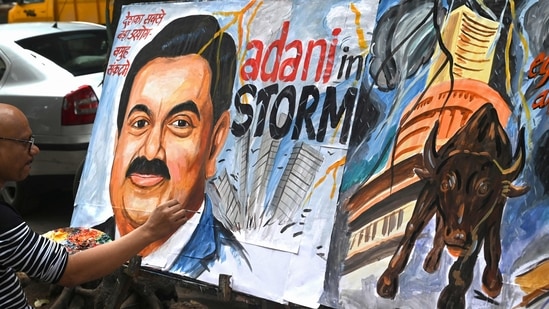

Gautam Adani has lost his position to be Asia’s or India’s richest person in the last 15 days following the release of the short-seller Hindenburg Research study on Adani Group. His firm’s overall market capitalization has collapsed from about INR19 lakh crore to less than INR10 lakh crore, and equity shares are in freefall or very volatile at the moment.

Adani Enterprises is now INR20,000 crore short due to the cancellation of the FPO (follow-on public offer), the large portion of which was to be used to fund capex plans for the construction of roads, airports, and assets of green energy.

On the other hand, Adani group’s US dollar bonds are falling, presently paying 30% rates (higher than even junk-rated bonds). According to reports, the business has canceled its intentions to raise INR1,000 crore (USD122 million) through its first-ever public bond issue. Standard Chartered joined a growing list of international lenders, including Credit Suisse and Citibank, in refusing to accept Adani dollar bonds as a security.

All these point to one conclusion: the Adani Group will have a tough time raising funds.

So, how will Adani, nicknamed the “King of Growth,” achieve his goals without easy access to capital?

Funding issues.

Raising debt or making loans in the Indian market would be challenging for the firm because Indian banks have around 32% of their overall debt. Equity raising can be more difficult now because the share prices have plummeted. According to certain stock market statistics, the group’s flagship firm Adani Enterprises has a weighted average cost of capital (WACC) of 14% and a return on invested capital (ROIC) of 3.15%. The ROIC of an efficient firm is higher than or equal to the WACC. Where the cost of debt is now more, the WACC is subjective.

The group must enhance its ROIC in a difficult environment. Adani Enterprises, the group’s new business incubator, is in the middle of the storm, with a big capex plan and a difficult time collecting funds. The alternatives can be asset sales, as it can be creative financing via SPVs. But it doesn’t look as easy to perform as it sounds.

It can be seen that considerable capex is being performed by the Adani Group, notably in multiple domains, which poses Adani Group with intrinsic project execution risk. The company’s management showed the willingness to slow the pace of conducting capex, thinking that a decent percentage of such capex is of a discretionary nature.

Increasing debt.

Jugeshinder Singh, Adani Enterprises’ chief financial officer, stated in an investor call in May last year that the business will invest something around USD60 billion (about INR5 lakh crore) between FY23 and FY29. Almost USD41 billion of this was allocated to energy, USD10 billion to transportation and logistics, and the remainder to all other commercial activities.

Adani’s brand identity has been aggressive investment dreams underpinned by a desire to be among the top players in every area into which it has diversified. Airports, highways, cement, and green energy are only a few examples of new businesses in which the organization swiftly became dominant or second-best. But all of this growth has come at a price. And, traditionally, the majority of it has been financed by debt.

Adani Enterprises has not been effectively injecting stock over the years, resulting in increased debt. However, they have also taken out long-term debts, which have already been repaid. Many of the projects they are taking over will provide cash flows in the future, but during the current enterprise’s growth period, some equity investment will be necessary for the first few years. So, it seems that what they’ve been doing is pledging their shares and raising stock and presenting it as their contribution, but they haven’t raised much outside money for the time being.

To be fair, the business did obtain INR7,700 crore in equity in May last year through preferential issuance of shares from UAE-based International Holding. This is the same corporation that announced a USD400 million investment in the FPO at a time when the issue was only 1% subscribed after the first day. The Adani Group also announced recently that it had paid USD1.1 billion in share-backed financing against pledged shares of Adani Transmission, Adani Green Energy, and Adani Ports and Special Economic Zone.

On the debt side, while rates on certain of the company’s bonds have reached 30%, market analysts argue that there is little chance of a payment default because interest liabilities are now within sustainable bounds.

While the firm has not disclosed its future equity obligations, an assessment from December 2022 indicated that Adani Enterprises had a capital investment of more than INR1.3 lakh crore during FY23-FY25, for which it expected the company will require roughly INR45,000 crore in equity.

Adani Enterprises generates free cash flows of INR1,000 crore to INR1,500 crore each year, according to the company. Apart from free cash flows, AEL has asset monetization plans of around INR30,000 crore, which include required share dilution in Adani Wilmar (translating to INR5,500 crore at existing market rates), INR20,000 crore funded through the primary issue and stake sale in airports. AEL will also profit from EPC margins on asset development through the ANIL platform.

However, this was a report written before the events of the last 15 days. Consider the situation of Adani Wilmar acquiring cash through a share sale. On December 20, 2022, the edible oil manufacturing firm had a market valuation of more than INR80,000 crore, but this has since dropped to less than INR50,000 crore.

Is there any ray of hope?

Although many are negative right now, some of Adani’s enterprises are rock strong and have a high asset value. However, the liabilities value of these assets must be calculated. Given the crash in Adani Group equities and bonds, there is a potential that these assets will be marked down. Buyers will have an excellent option for negotiation leverage over the group because the Adani Group is now in need of funds. Some folks assume that raising funds via equity or debt may take a long time before the firm can tap the market.

The last call.

An FPO was subscribed to but then called back. The stock price plummeted. However, Adani may be able to just pull a rabbit out of a hat. The corporation has a history of partnering with the greatest strategic actors in its new businesses, either its French energy powerhouse Total Energies or food-processing behemoth Wilmar International.

In the past, the firm has collaborated on projects with major, well-known corporations, finally receiving corporate-level financing from them. Bringing in a strategic partner at the project level can help Gautam Adani keep his ‘lord of growth’ title.

Edited by Prakriti Arora