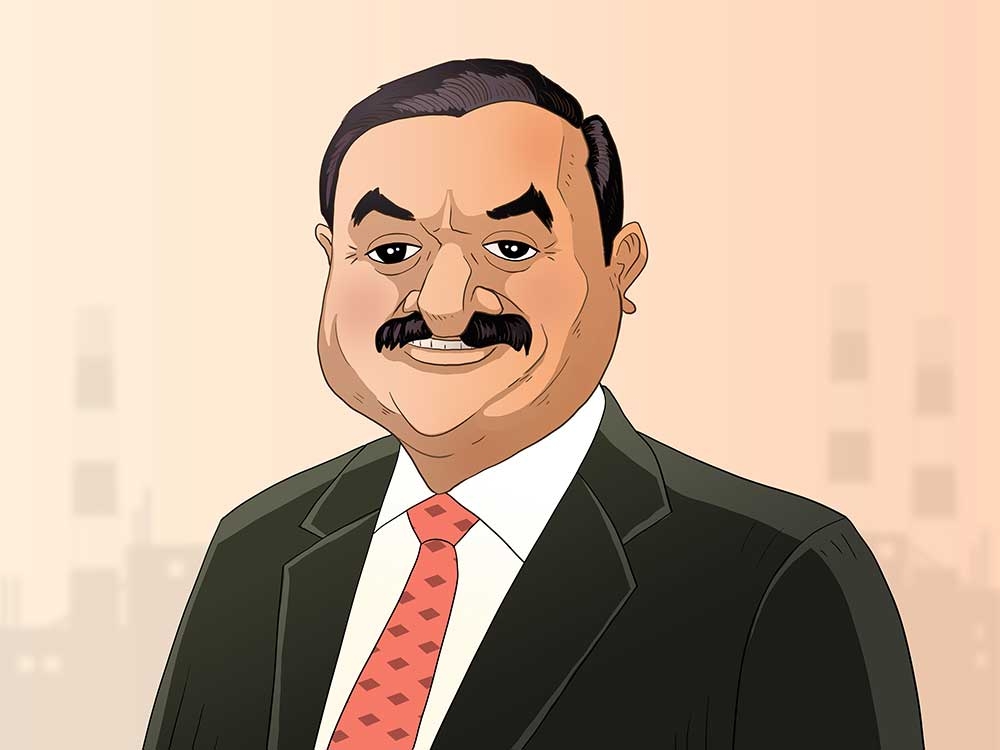

Is the task of saving Adani FPO been given to India’s wealthiest billionaires?

Despite the sturdy and hectic allegations made about Adani’s group recently by Hindenburg Research Report, it emerges that the confidence shown by the Indian billionaires in Adani’s FPO still held good.

According to reports, certain Indian conglomerate family offices were allegedly supposed to implant their funds in Adani Enterprises’ Rs 20,000-crore FPO; meanwhile, the HNI (high net worth investor) layer of the FPO was subscribed to 3.31 times, which would have allowed for the FPO to sail through had he not taken the decision to withdraw the FPO.

According to industry insiders, the family offices of several of the country’s largest industrialists initiated their hands in favor of the shares. The names of the investors could not be verified at this moment. Adani Enterprises did not publish the names of its investors either. Sunil Mittal of Airtel and Sajjan Jindal of JSW Group, whose family offices revolved in the favor of the affair, were mentioned on social media.

In a last-minute effort, Sajjan Jindal and Sunil Mittal subscribed to the FPO. Research says that the transactions were made using cash. In addition, there are statements saying that the case could not find any involvement of their publicly traded companies, like JSW Steel Ltd. and Bharti Airtel Ltd.

Folks who made purchases and rescued the Adani FPO have been non-institutional participants, primarily from super-rich family offices. It is worth noting that the institutional players have nearly completed their purchases. The institutional players are concerned that if they had targeted their funds in this atmosphere, their boards would have objected.

What matters is how the market moves ahead from here. Will they continue to be concerned about the Adani counters? Will a foreign debt crisis be created by the short selling of Adani’s US bonds, sending a negative signal?

The Hindenburg report caused the Adani group’s shares to lose $70 billion in four trading days.

Adani Enterprises’ share price fell below their offer price on the first day of the FPO last week after Hindenburg Research said the company had been involved in a blatant manipulation of stocks and fraudulent movements in accounting for the last 10 years.

Adani Group has denied the allegations, claiming that it adheres to all regulations and transparency commitments. It has declared the Hindenburg claim to be false and has vowed to sue the little New York short seller.

While a percentage of a follow-on share sale earmarked for anchor investors in Adani Enterprises Ltd was completely subscribed last week, institutional and other non-retail investors helped the offer reach its desired subscription levels hours before the auction concluded, according to data.

Even though the offer price was much beyond the rate at which the firm stock was trading on the stock exchanges, 5.08 crore shares were sought against an offer of 4.55 crore. Adani Industries sold shares in the Rs 3,112-3,276 price range. On the BSE, its share price finished at Rs 2,975.

According to BSE statistics, non-institutional investors bought more than three times the 96.16 lakh shares allowed for them and qualified institutional buyers (QIBs) bid for 1.2 times the 1.28 crore shares reserved for them.

Anchor and other investors competed for 6.45 crore of the 6.14 crore shares on sale. Adani Group successfully Raised 5,985 crore from key investors last week. According to a circular posted on the BSE website, the business granted 1.82 crore equities to 33 funds at Rs 3,276 each, bringing the total transaction amount to Rs 5,985 crore.

Abu Dhabi Investment Authority, Societe Generale, Morgan Stanley Asia (Singapore) Pte, Goldman Sachs Investment (Mauritius) Ltd, BNP Paribas Arbitrage, Nomura Singapore Ltd, and Citigroup Global Markets Mauritius are among the foreign investors that purchased shares.

The anchor book was also attended by several domestic institutional investors, including LIC, HDFC Life Insurance Company, SBI Life Insurance Company, and State Bank Of India Employees Pension Fund.

Retail and individual investors and firm personnel, on the other hand, had a subdued reaction.

However, the price manipulation suspicions surrounding Adani equities drove individual investors away from the offering, with only 12% of the book being subscribed to. Ironically, while announcing the FPO, management stated that the issuance sought to broaden the subscriber base and allow retail investors the opportunity to participate in the company’s growth.

Retail investors, who were allocated almost half of the offer, bid for only 12% of the 2.29 crore shares allotted to them. Employees want 55% of the 1.6 lakh shares set aside for them.

The last call.

On the last day of Adani Enterprises’ FPO, the complete book was subscribed 1.1 times, assisted by HNIs and competent institutional purchasers.

Despite the harsh allegations leveled by short-seller hedge fund Hindenburg Research, which swabbed out a principal share of promoter Gautam Adani’s wealth and the group’s market capitalization, the company’s confidence in the FPO confirmed earned.