When the Common Man Becomes the Comedy Central of Corporate Escapades, Bad Bank Loans and Public Mockery!

In the wonderful world of high-flying tycoons and corporate shenanigans, the common man often finds themselves unwittingly cast in the role of the ultimate performer. It's a tragicomic tale where the actions of personalities like Vijay Mallya, and so many others, their companies, and the banking system combine to create a spectacle that leaves the commoner holding the bill!

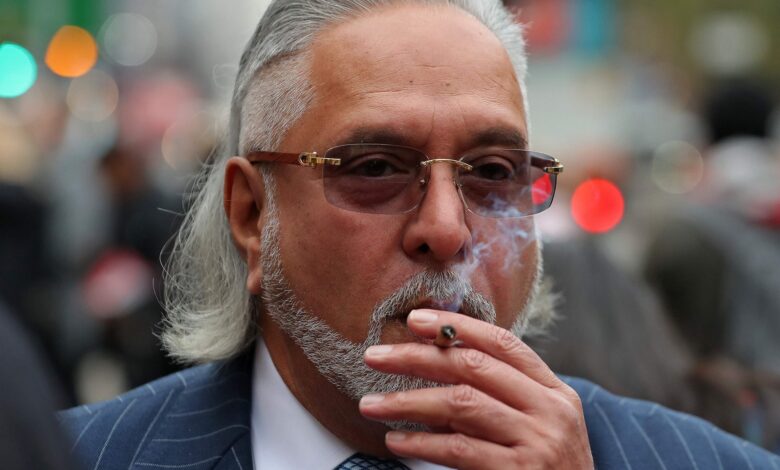

Once upon a time, a flamboyant corporate tycoon named Vijay Mallya lived in the magical land. Known for his larger-than-life persona and exquisite taste in beverages, he embarked on a mission to prove that loans are the newest form of public entertainment.

And how he succeeded! With over 9000 crores owed to the Indian public, Mallya proved that even in the realm of finance, laughter (for him) truly is the best medicine.

The flamboyant business magnate, Vijay Mallya, fled the country and now likely resides in a luxurious sanctuary across the seas, merrily tweeting away, mocking the people who funded his extravagant lifestyle.

Meanwhile, the Indian public, whose hard-earned money was lent to his companies, finds themselves in the uncomfortable position of involuntary patrons of this extravagant show. It’s almost like attending a comedy club, except the laughs are at our expense.

Sitting comfortably in his luxurious abode somewhere in the United Kingdom, Mallya became a Twitter virtuoso. Every public holiday was an opportunity for him to grace our timelines with his witty remarks, all at the expense of the Indian public.

It’s quite heartwarming to know that he spends his time wisely, ensuring that his debts are a constant source of amusement for the masses. Kudos, Mr Mallya, for your dedication to making us laugh!

The Indian Masterpiece

Now, let’s take a moment to appreciate the “Tragedy of the Commons” phenomenon in all its glory. Banks, in their boundless generosity, have transformed lending into a public good.

When a business graciously accepts a 1000 crore loan and conveniently forgets to pay it back, who do you think foots the bill? You guessed it right – It’s the ever-resilient and ever-obliging Indian public. We bow down to us noble citizens for our unwavering commitment to funding the lifestyles of the rich and the infamous.

But Mallya’s escapades are just the tip of the iceberg. The banking system, once designed to safeguard the common man’s savings and facilitate economic growth, has inadvertently transformed into a three-ring circus where the audience pays for every act.

While the tycoons and their companies may go bankrupt or conveniently disappear, it is the common man who ultimately suffers the consequences. High taxes are levied, putting a strain on already burdened wallets. Inflation creeps up, gnawing at the purchasing power of hardworking individuals. It’s as if the comedy show has extended its performance beyond the theatre, infiltrating the everyday lives of ordinary citizens.

The Bountiless NPA’S

Enter the tragicomedy of non-performing assets (NPAs). When businesses take loans worth millions or even billions, only to default on them, who bears the brunt of the consequences? You guessed it—the common man, once again.

One cannot overlook the magnificent Yes Bank episode, a true masterpiece of public-subsidized NPA. The public, in their infinite wisdom, gladly stepped up to pay for the sins of the banking world. We applaud your generosity, dear taxpayers!

Yet, despite the audacity of these escapades, the common man’s outcry is often met with fleeting attention. The tragedy of the commons rears its head once more as the burden becomes diffuse, affecting everyone but owned by no one in particular. It’s as if the show goes on, the audience chuckles for a moment, and then promptly forgets, moving on to the next act of life’s absurdities.

The sheer indifference with which the public shrugs off these incidents is a testament to the Tragedy of the Commons at its finest. After all, who cares about a little thing like high taxes or inflation when there’s so much comedy to be found in economic misfortune?

The Forgiving Indian Masses

But let’s not forget the most intriguing part of this tragicomedy—how quickly we move on from these outrageous episodes. We, as a society, have mastered the art of a momentary hue and cry, only to forget about it faster than you can say “loan default.”

It’s quite understandable, really. The bank loan NPA problem is a burden shared by all, and what better way to deal with it than by burying it under the rug of collective indifference?

We, The Public, Know Better

But let us not despair entirely. In this sea of laughter and tears, there is room for change. Public awareness and demand for accountability can be the driving force that reshapes the narrative.

Holding both corporate entities and the banking system to a higher standard, demanding transparency and responsible lending practices, we can strive to rewrite this tragicomedy into a tale of justice and fairness.

So, as we bid adieu to our dear friend Vijay Mallya, let’s raise a toast to his remarkable contributions to the world of finance. May his tweets continue to bring us joy, and may his debts forever serve as a reminder of the hilarity that ensues when loans become a public spectacle.

After all, who needs financial stability when we can have a good laugh at the expense of the Indian public? Cheers to you, Mr Mallya, and may your legacy of debt and mockery live on!

The Last Bit, this article is a satirical take on the situation and should not undermine the importance of addressing these issues seriously.

It is crucial to work towards a system that promotes transparency, accountability, and fairness for all.