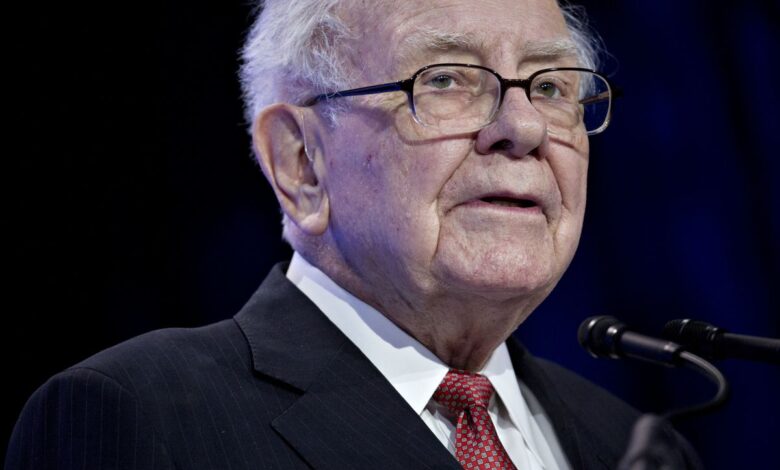

Buffett’s Berkshire Further Cuts BYD Stake 2022

Berkshire Hathaway, according to a filing on Tuesday, decreased its ownership in Chinese electric vehicle manufacturer BYD by more than 15% by selling 1.3 million shares that were listed in Hong Kong.

Berkshire Hathaway, according to a filing on Tuesday, decreased its ownership in Chinese electric vehicle manufacturer BYD by more than 15% by selling 1.3 million shares that were listed in Hong Kong. The investment firm has already sold more than 25% of its position in the past five months, based on this report.

In August, Warren Buffett’s company dropped its ownership in BYD, a Shenzhen-based company, from 20.49% to 19.92%, starting to formally reduce its stake in the company. The rate of sales increased in November. Berkshire is only required to report sales of 1% or more, and any transactions to counterparties below that amount are not required to be declared. Berkshire owns 14.95% of the business at present.

According to Webb-Site.com, BYD’s stock has dropped about 31% since a Berkshire-sized share was disclosed to have entered the Hong Kong exchange clearing system on July 11.

According to Webb-Site.com, BYD’s stock has dropped about 31% since a Berkshire-sized share was disclosed to have entered the Hong Kong exchange clearing system on July 11. This has reduced its market value by HK$248 billion ($31.9 billion).

Stella Li, a senior BYD employee, said in a recent interview with Bloomberg News that Buffett still had faith in the business but defended his justification for wanting to get some returns on his long-held investment in the Chinese auto behemoth.

In September 2008, Berkshire made an investment in the automaker by purchasing 225 million shares for around $230 million. Berkshire is still BYD’s largest shareholder in Hong Kong. Through June of this year, when BYD reached a record high, the value of that shareholding rose by more than 2,700% to HK$331 per share.

As of Tuesday, Berkshire still owned 164 million shares, which are valued at about $4.4 billion at present.

As of Tuesday, Berkshire still owned 164 million shares, which are valued at about $4.4 billion at present. Despite representing less than one-third of what has been stated, the corporation has recovered around HK$3.4 billion from the six significant share sales of 1% or more.

It may be mentioned that BYD was formerly the third-most valuable automaker in the world, behind only Toyota Motor Corp. and Tesla Inc.

BYD continued to set monthly sales records in November, selling about 230,000 new-energy vehicles despite the recent market dip.

BYD continued to set monthly sales records in November, selling about 230,000 new-energy vehicles despite the recent market dip. Additionally, it sold 534,164 units in the third quarter of this year, about evenly split between hybrids and pure electric vehicles, compared to Tesla’s 343,830 pure battery-powered vehicle sales.

Fund manager Andy Wong of LW Asset Management Advisors Ltd. stated that he expects BYD to stick to its initial plans, citing the automaker’s efforts to lead the market, grow, and hold its strong position with a pipeline of new designs.

Regarding BYD’s, so far rather positive response to the legendary investor’s disposal, Wong stated that he was surprised that they didn’t care about the price movement in the last few months.

American multinational corporation holding firm Berkshire Hathaway Inc. is based in Omaha, Nebraska. Insurance is its primary line of work and source of funding, and it invests the retained premiums in a broad group of subsidiaries, equity holdings, and other securities. Warren Buffett, the company’s chairman and CEO since 1965, and Charlie Munger, the vice chairman since 1978, are noted for their advocacy of value investment ideas. Under their leadership, the company’s book value has increased by 20% on average, compared to 10% for the S&P 500 index during the same time period when dividends were taken into account while using significant amounts of capital and little debt.

Berkshire is the top-ranked firm in the Forbes Global 2000, which considers both market valuation and fundamental information, and it makes up the 7th largest portion of the S&P 500 index. Due to Buffett’s decision not to split the stock, its class A shares have the highest share price of any publicly traded corporation in the world, hitting $500,000 in March 2022.

Edited by Prakriti Arora