Commodity futures and importance of liquidity in commodities, 5 Reasons Commodities Are More Volatile than other assets

Commodity futures and importance of liquidity in commodities, 5 Reasons Commodities Are More Volatile than other assets

What Are Commodities?

Raw materials are exchanged in a variety of ways. The physical commodities market is the first. Physical staples at the heart of commodities markets include a barrel of oil, a bar of gold, a truckload of grain or soybeans, a bag of coffee, or even a herd of cattle.

Derivatives are anything else that trades. This is a Financial Instrument whose price reflects the value of a hard commodities asset. Physical commodity trading takes place between producers, traders, and end-users. Speculators, investors, arbitrageurs, and other interested parties make assets liquid in the derivative markets.

Consider commodities markets to be a pyramid. The assets themselves are at the very top. Derivatives are listed below that. The over-the-counter (OTC) market is the next step. Forwards and swaps are principal-to-principal contracts that are often monetarily resolved. They can, and often do, facilitate actual delivery of the commodities asset. Futures and options contracts, which trade on Exchanges, are the next level up the pyramid.

These contracts allow many market participants to have an interest, or “position,” in commodity price changes. ETF and ETN products, which are meant to replicate price swings in the assets they profess to represent, make up the next pyramid level.

Commodity futures

Commodity futures contracts are contracts to purchase or sell a raw commodity at a set price at a given date. The contract stipulates a specific sum. It states the date on which the seller will deliver the asset. It determines the cost. Some contracts provide for a monetary settlement rather than delivery.

Food, energy, and metals are the three basic categories of commodities. Meat, wheat, and sugar are the most popular food futures. Oil and gasoline are the most common energy futures. Gold, silver, and copper are some of the metals that use lots.

Futures contracts are used by buyers of food, energy, and metals to set the commodity price they are purchasing. As a result, their risk of price increases is reduced. Futures are used by sellers of certain commodities to ensure that they will get the agreed-upon price. They eliminate the chances of a price decline.

Commodity prices fluctuate on a monthly or even daily basis. Contract pricing is subject to change. That’s why meat, fuel, and gold prices fluctuate so much.

How They Work

The buyer of the futures contract gains money if the price of the underlying commodity rises. He gains the thing at the agreed-upon reduced price and may now resell it at the current market price. The futures seller gets the money if the price falls. He can purchase the commodity at today’s lower market price and then sell it to the futures buyer at the agreed-upon higher price.

Few individuals would provide the merchandise if commodities dealers were required to do so. They can instead complete the contract by giving confirmation that the merchandise is in the warehouse. They can alternatively pay the difference in cash or issue a new contract at market value.

Commodities Exchanges

A commodities Futures Exchange is where future contracts are transacted. The Chicago Mercantile Exchange, Chicago Board of Trade, and New York Mercantile Exchange are included in them. The CME Group at present owns all of them. They are governed by the Commodities Futures Trading Commission. 4 The CFTC requires both buyers and sellers to register.

The contracts pass through the clearinghouse of the Exchange. The clearinghouse technically buys and sells all contracts.

By making contracts fungible, the Exchanges make them easier to purchase and sell. That is to say, and they may be used interchangeably. They must, however, be for the same product, quantity, and quality. They must be for the same month and area of delivery.

Buyers can use fungibility to “offset” contracts. That’s when they buy the contracts and then sell them. It gives them the option of paying off or terminating the contract before the agreed-upon deadline. As a result, futures contracts are considered derivatives.

How Futures Contracts Affect the Economy

Futures contracts are used by businesses to lock in a set price for raw resources like oil. They’re used by farmers to lock in a fee for their animals or grain. Futures contracts ensure that they will be able to purchase or sell the item at a set price. They plan to hand up custody of the products in accordance with the contract. They may find out how much money they’ll make or how much money they’ll spend thanks to the arrangement. Contracts decrease a large amount of risk for them.

Futures contracts are used by hedge funds to obtain extra leverage in the commodities market. They have no desire to transfer any commodities. Instead, they want to purchase an offsetting contract at a profitable price. They are, in a sense, betting on the cost of that item in the future. Commodity futures have an impact on the economy by assessing and forecasting raw material prices. These figures are determined by traders and experts.

Benefits

- Come harvest or selling time, these contracts ensure that the commodity producer receives a predetermined sales price.

- The producer does not lose money being a result of a price decline. He receives the agreed-upon sum.

- In the event of a price reduction, producers can reduce their risk.

- Producers or businesses probably improve their production strategy.

Disadvantages

- Producers may lose out on major benefits in the Case of a price hike. Contract pricing is set in stone.

- Trading these contracts carries a high level of risk. Commodity prices throughout the world are pretty volatile.

- Even when demand and supply are equal, world events, traders’ emotions, and market speculations have an impact on commodity prices.

- This is an investment that should be left to the professionals.

How to Invest

Commodity funds are the safest way to invest in commodities futures. Commodities exchange-traded funds and commodity mutual funds are options. These funds make an investment in a variety of commodity futures, depending on what is available at the time.

Commodity futures and options trading is both challenging and dangerous. The price of commodities is quite variable. Fraudulent practices abound in the industry. If you don’t know what you’re doing, you probably lose more than your original investment.

Read up on commodity profiles and day trading in commodities futures before you invest. Examine the CTFC’s Guide to Fraudulent Activity and Education Center too.

How They Affect Prices

Because commodities futures trade on an open market, they correctly determine the price of raw resources. They predict the future worth of the commodity. Traders and their experts decide the prices. They Investigate their specific commodities all day, every day. Each day’s news is promptly included in forecasts. If Iran threatens to block the Strait of Hormuz, for example, commodity prices will fluctuate substantially.

Commodity futures can sometimes reflect the trader’s or market’s emotions rather than supply and demand. Speculators buy up prices in anticipation of scarcity in the event of a catastrophe. When other traders see that a commodity’s price is soaring, they start a bidding war. As a result, the price rises even more. The fundamentals of supply and demand, however, have not changed. Prices will fall back to earth after the crisis is gone.

Commodities are Exchanged in dollars. Between the dollar and commodities, there is an inverse connection. The price of commodities lowers with the rise in the value of dollars. This is because merchants may be able to gain the same number of commodities at a lower price.

Examples

The impact of commodities futures trading on prices can be seen in a variety of ways. Here are some examples of when this happened in the oil, metals, and food industries.

Oil

Oil traders evaluate all available data on oil supply and demand, and geopolitical factors. This has an impact on oil prices. These assumptions about oil prices are what have such a big impact on the economy.

Every commodity and service produced in America is influenced by the price of oil. Oil prices, for example, has a direct effect on gasoline prices since 54 percent of the cost of gasoline is determined by Crude Oil prices. 7 The price of gas will grow in tandem with the price of Crude Oil.

Oil prices are expected to go into negative territory in 2020.

To combat the coronavirus pandemic, governments throughout the world began limiting travel and halting companies in January 2020. The demand for oil has decreased. Oil usage in the first quarter of 2020 was 5.6 percent lower than in the first quarter of 2019.

A struggle between Russia and OPEC exacerbated the supply surplus. Russia declared on March 6 that it would expand output in April. 9 OPEC said that it would pump more oil in order to maintain market share. Ten prices plummeted even further. OPEC and Russia agreed to cut output to improve prices on April 12, 2020.

Traders trying to roll forward expired futures contracts (and avoid taking physical delivery of oil) drove the price of a barrel of oil down to -$40.32 a week later, exacerbating the issue. This historical oddity, however, was only temporary. By June, the price had returned to positive territory and was trading at about $40.00.

Metals

Gold reached an all-time high of $1,895 per ounce on September 5, 2011.

12 Traders pushed up gold prices in reaction to concerns about the economy. Gold is often purchased during times of crisis because many people regard it as a safe refuge.

The economy of the United States is reflected in gold prices.

A rise in gold investments, which drives up gold prices, probably suggest that the economy is in bad shape. On the other side, a reduction in gold prices probably imply that the economy is improving.

Food

/GettyImages-671580278-0afe7f196a43485eb3654ba6f4017225.jpg)

Commodity merchants inflated food prices during the financial crisis. In 2007, food costs increased by 4.0 percent, and by 5.5 percent in 2008. 13 In less developed countries, this resulted in rioting. The Arab Spring revolutions may have been sparked by these food riots.

Why Is Liquidity So Important in Commodities

Because commodities are more volatile than other types of investments, liquidity is crucial. A liquid asset is one that can be bought or sold quickly without affecting the market price. When an asset has a high amount of trade, liquidity will probably occur. Liquid assets are frequently safer to invest in than illiquid ones since they are easier to enter and exit.

What Is Liquidity in Commodities?

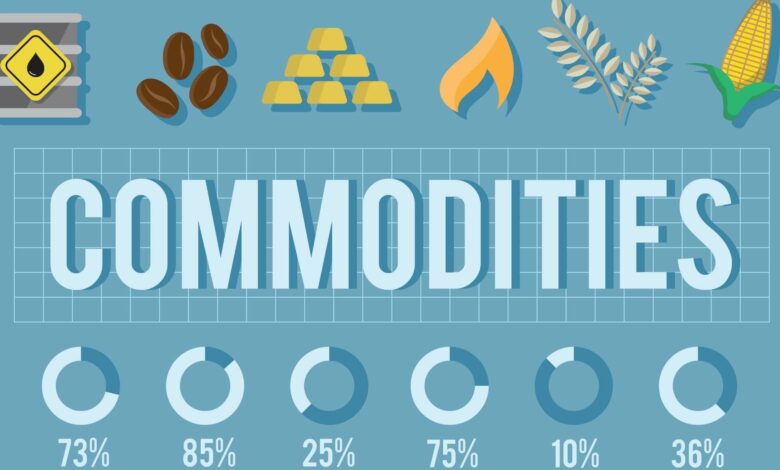

Liquidity levels vary depending on the commodity raw material. To further grasp the idea of liquidity, consider some of the more liquid and less liquid commodities sectors and specialized marketplaces.

Precious metals: Gold is the most liquid precious metal, with the highest trading activity of any precious metal. Gold is traded in both the physical and the OTC forward and swap markets. On Exchanges, there are liquid gold futures and options contracts, and gold-based ETFs and ETNs. On the other hand, other precious metals are less liquid. There’s rhodium, for example, which is a valuable metal. Rhodium is exclusively traded on the open market. Because rhodium futures are not available to trade, gold is majorly more liquid than rhodium.

Energy: Crude oil is perhaps the world’s most liquid and widely traded commodity.

Meanwhile, coal does not have the same level of trading activity or as many derivatives as crude oil. As a result, crude oil has higher liquidity than coal being a source of energy.

These are only two examples of commodities with varying levels of liquidity within the same industry. Other metals, energy, cereals, soft commodities, and animal proteins or meats are only a few of the big industries that have them.

What Are the Signs That a Commodity Market Is Liquid?

A market becomes liquid when specific requirements are met. Look for the following traits, which are common in all liquid commodity markets:

- In the physical commodity, there is an active spot or cash underlying the market.

Hedgers, speculators, investors, and others are among the buyers and sellers. - A method of distribution that is open, transparent, and non-discriminatory.

- The derivative and the physical commodity have a well-defined connection.

- A method of exchanging cash commodities and derivatives.

- The cash price and prices that represent future delivery over time converge.

Because futures markets satisfy all of these criteria, they are more liquid. - Daily trading volumes and open interest, as well as the number of available (but not closed) long and short positions, can be used to determine the liquidity of certain futures products.

- The more volume and open interest a market has, the more liquid it is.

Why Is Liquidity Important?

All assets, not just commodities, require liquidity. Traders may readily purchase and sell because of liquidity. This attracts traders and investors to a market. Because there are fewer deals in an illiquid market, it is far more volatile than in a liquid market. The essential characteristic of liquidity is that it reduces the cost of trading or investing.

When investing in commodities—or any asset class—make sure to use liquid instruments that allow you to purchase and sell with ease and at the lowest possible cost.

The cost of buying and selling an asset is represented by the bid/offer spread. The narrowest bid/offer spreads are seen in the most liquid assets. The disparity between buying and selling prices tends to be larger in less liquid marketplaces.

For a variety of reasons, commodities are more volatile than other investments.

An asset is a valuable property or item. Many tangible and intangible objects are assets, but there are several types of assets in investment and trade. The volatility of an asset is a major worry for individuals who invest or trade their money.

The price variation of an asset over time is known by the term volatility. The more the volatility, the more extensive the price range from low to high daily, weekly, monthly, or longer-term, and vice versa. Some assets are more volatile than others, and the variation of a market frequently makes it appealing or unappealing to market players with varying risk profiles. One of the most significant factors to consider when deciding which asset to invest in or trade is the variance.

Volatility: A Trader’s Paradise but an Investor’s Nightmare

/ETF-and-ETN-commodity-piece-for-About-56a1a76a5f9b58b7d0c1577b.jpg)

Active traders rather than investors are drawn to assets with a higher degree of volatility. Speculative and short-term trading activity increases when an asset’s price is very volatile. As a result, markets with a significant price variance tend to be a trader’s dream, with plenty of opportunities shortly. At the same time, it’s an investor’s nightmare because investors like to receive consistent returns through capital appreciation or dividends.

There are several classifications from which to pick for the most popular marketplaces that a sizeable addressable market of participants use to increase their nest eggs. The four most popular classes with varying degrees of volatility are stocks, bonds, currencies, and commodities.

Equity Volatility

Shares in entities and indexes that represent volatility in the general stock market or several sectors within the equity class make up the equity asset class. The most common option for investors is to invest or trade in the stock market.

While not all equities have the same level of volatility, significant indexes like the Dow Jones Industrial Average and the S&P 500 tend to have comparable variation or beta over time. Of course, stock prices will change a lot from time to time. The stock market crashes of 1929 and 1987 and the global financial crisis of 2008 are all instances of periods when equities fell sharply.

The stock market crashes of 1929, 1987, and the global financial crisis of 2008 are just a few instances of stock market crashes.

Because of contagion from a selloff in the local Chinese equities market, the S&P 500 index fell 11.5 percent in six weeks at the start of 2016.

Because the United States has the world’s most stable economy, its equities are less volatile than other countries. When it comes to S&P 500 volatility, the E-Mini S&aP 500 index has quarterly historical fluctuations of less than 10%. Following the 2008 financial crisis, it has varied from lows of 5.35 percent to highs of 27.23 percent during the last two decades.

Bond Volatility

Bonds are debt securities with a yield or payment attached—companies and governments worldwide issue bonds. Bonds are a type of financing or borrowing used by governments and enterprises; investors and traders look at different periods along the yield curve in the bond market. Investors in very long-term bonds are looking for a steady source of income, whereas short-term debt instruments probably be more volatile.

When it comes to government debt in the United States, the central bank, or Federal Reserve, controls the concise end of the yield curve. The Fed’s Fund Rate is the overnight interest rate at which banks and credit unions lend reserve balances. The Fed Funds rate is controlled and dictated by the Open Market Committee of the United States Federal Reserve. The discount rate is the federal reserve’s minimum interest rate for lending to other banks in the United States.

While the central bank controls the Fed Funds and Discount rates, the pricing of longer-term bonds and debt instruments are determined by market forces. Short-term rates can have an impact on medium- and long-term rates, although divergences are common.

Bond traders often take long or short bets about interest rates, depending on their outlook. A long bond position is a wager that rates will fall, whereas a temporary bond position is a wager that rates will rise.

Most bond traders will position themselves along the yield curve to take advantage of market anomalies, shorting one maturity and longing for another on the spread. Bond investors are looking for a safe and regular return on their money. For more than two decades, quarterly volatility in the 30-year bond market in the United States has ranged from 6.22 percent to 17.5 percent. Following the financial crisis of 2008, volatility increased.

Currency Volatility

The dollar is the world’s reserve currency because the United States has the world’s most prosperous and most stable economy. Because governments regulate money creation, release, and flow into the global monetary system, currency volatility is lower than most other asset classes. The stability of a government determines currency volatility.

As a result, the dollar trades with less volatility than the Russian Ruble, the Brazilian real, or other Foreign Exchange Instruments that are less liquid and less likely to be kept in form of a reserve currency by governments worldwide.

The dollar index’s quarterly historical volatility has varied from 4.37 percent to 15 percent since 1988, although volatility readings below ten percent have been the norm.

Commodities volatility

Volatility in commodities is the greatest asset types discussed in this article. Since 1983, crude oil’s quarterly volatility has varied from 12.63 percent to over 90 percent. Natural gas has ranged from 22.56 percent to over 80 percent in the same measure. On a few occasions, the natural gas variance has surpassed 100 percent on a shorter-term basis.

Since 1970, quarterly soybean volatility has varied from roughly ten percent to over seventy percent. Over the same period, corn prices ranged from slightly under 12 percent to approximately 48 percent. The quarterly volatility of the sugar futures market has varied from 10.5 percent to 100 percent, while coffee futures volatility has ranged from 11 percent to over 90 percent. In the CCCCCase of silver, the range has been from roughly 10% to over 100%.

Finally, gold is a cross between two commodities. Because the yellow metal is held as a reserve asset by central banks globally, it serves as both a metal and a financial asset. As a result, since the mid-1970s, quarterly volatility has ranged from 4% to nearly 40%, reflecting the mixed character of gold prices. Commodity volatility is high over time, as the examples show, and there are a variety of reasons why commodities are more volatile than other investments.

5 Reasons Commodities Are More Volatile

Commodities have piqued investor attention throughout the years in form of assets. On the other hand, that behavior tends to occur during bull market periods. The emergence of new market vehicles that trade on traditional equities exchanges, like ETF and ETN products, has extended market participants’ options during the last decade. For people without a futures account, the only way to invest in commodities was to own the actual commodity or own stock positions in entities that created the raw materials before they were introduced.

Commodities have always been considered alternative investments by the majority of investors. Nonetheless, the increased volatility makes them the asset of choice for short-term trading possibilities for the world’s traders. For five key reasons, commodities are more volatile than other assets:

1. Liquidity

Each day, the equities, bond, and currency markets draw massive trade. Buying and selling of several asset types have increased dramatically over the years. Many commodities traded on futures markets, on the other hand, have substantially lower liquidity and trading volume than other popular assets. While oil and gold are the most liquidly traded commodities, given the potential for endogenous or exogenous shocks, these markets may become highly volatile at times.

2. Mother Nature

The weather and natural calamities that strike the earth from time to time are determined by Mother Nature. An earthquake in Chile, the world’s largest copper producer, could send the red metal’s price soaring. As agricultural yields drop due to a drought in the United States, maize and soybean prices may surge.

In 2012, we witnessed just that. The chilly and windy winter season improved demand for natural gas, driving prices for futures contracts for the energy commodity soaring. Hurricanes Katrina and Rita wreaked havoc on the Louisiana coast between 2005 and 2008, destroying natural gas infrastructure and driving up futures prices to all-time highs. These are just a few examples of how natural disasters may wreak havoc on commodity markets.

3. Demand and Supply

Supply and demand are the primary determinants of the path of least resistance for raw material pricing. Commodity production occurs in parts of the globe where the soil or climate supports agriculture, where reserves exist in the earth’s crust, and where extraction can be done at a cost lower than the market price. On the other side, demand is universal.

Almost every human being on the globe consumes commodities, which are the necessities of existence. As a result, the supply and demand equation for raw materials often causes them to be among the most highly volatile assets in the world.

4. Geopolitics

Because commodities deposits are concentrated in specific locations of the globe, political events in one region can majorly impact pricing in another. When Iraq invaded Kuwait in 1990, for example, Crude Oil prices on the NYMEX and Brent crude oil futures contracts doubled in the weeks that followed. When the President of the United States released oil from the strategic petroleum reserve, the price of oil decreased to half its prior level (SPR).

Furthermore, conflicts or violence in one part of the world probably shut down logistical channels, like the Panama Canal, making it difficult or impossible to carry goods from producing regions to consuming zones globally. Tariffs, government subsidies, and other political instruments often alter a commodity’s price dynamics, increasing volatility.

5. Leverage

The futures markets are the usual avenue for trading or investing in commodities. Futures provide a major amount of leverage. To hold a dramatically bigger financial stake in a commodity, a buyer or seller of a futures contract simply has to make a small down payment or good faith deposit, known as margin.

Initial margin rates for commodities typically range from 5% to 10% of the overall contract value. As a result, traders and investors have substantially more leverage in commodity futures than in other assets.

Commodities are the most volatile asset class out there. For both investors and traders, understanding and managing volatility is critical. Volatility is a statistical indicator that helps establish criteria for analyzing any asset’s risk vs. reward profile.