What does the merger of HDFC Ltd and HDFC Bank mean for financial investors, and how might they benefit?

HDFC Bank: The prices are now at a reasonable level. Suresh Ganapathy, an associate director at Macquarie Capital Securities, sent an email to investors after the stock prices of both HDFC Ltd and HDFC Bank fell sharply after the merger announcement. “Please don’t pass this up,” he said.

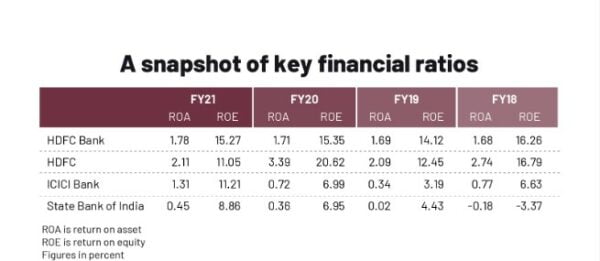

“Don’t ignore this low price for HDFC Bank.” A bank with a 2% ROA (return on assets), a 20% growth in earnings, a 2.3x P/BV (price-to-book value), and a 16x P/E (price-to-earnings) ratio “is indeed exciting,” he wrote.

Over the last three years, earnings at Indian banks have grown by 15% a year. The average ROA for Indian banks is 1%. If you want to buy HDFC Bank, you can get it for 2.3x the price of its book value, which is less than Nifty Bank’s 2.7x.

Ganapathy doesn’t say things in a way that isn’t very kind or polite. To share his thoughts with investors, he is one of the first analysts to do so. In a few weeks, Ganapathy had made up his mind about what he thought about the merger. An “outperform” rating was written on a note by him, and HDFC Bank was the message’s subject.

Investors had a lot of questions, but they didn’t know the answer. Ganapathy wasn’t the only analyst who thought the merger would work out well. He is cautious, and he was stumped when he didn’t know the answer to a question. With each question that he tried to answer, it became more difficult.

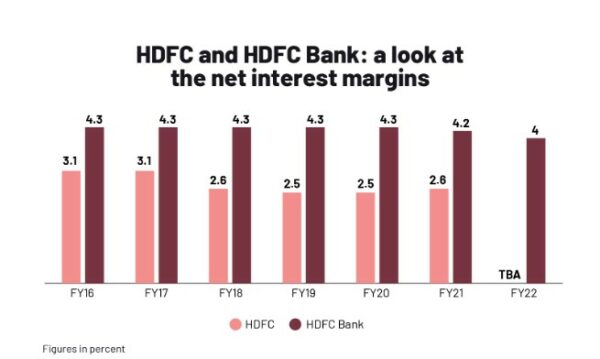

When you think about banking at its most basic level, it’s all about getting money and giving it away for a fee. It has been a long time now that both HDFC, the largest mortgage lender, and HDFC Bank, the largest private-sector bank, have been doing this well, which has led to their net interest margins being high (NIMs). That’s true, but HDFC’s NIM has gone down over the last five years, while the same for HDFC Bank hasn’t changed at all. The twins should merge to bring in new money at a lower cost.

Pleasure or pain in the ass?

He says he had a lot of angry talks with investors after HDFC Bank’s Q4FY22 results came out. They said that a weak core pre-provision operating profit growth should be considered. It isn’t good that HDFC Bank’s ROA isn’t excellent because it’s based on low provisions, they said

Some people said that until the merger uncertainty is settled, the stock might not move much. With all the talk about MSCI and index rebalancing, it was better to stay away from it, so I didn’t go. It also didn’t help some investors because it was almost the same company. Axis Bank bought Citibank’s retail assets so it could benefit from the customers of the other bank. How does HDFC Bank make money?

These feelings were shown in the prices of the stock of the HDFC twins. Many people bought shares in both HDFC and HDFC Bank at the start, and it went up 15% for HDFC and 18% for HDFC Bank after the April 4 news about them. TCS had a market value of INR13.73 lakh crore, but the value of the twins was INR14.22 lakh crore, which was more than TCS.

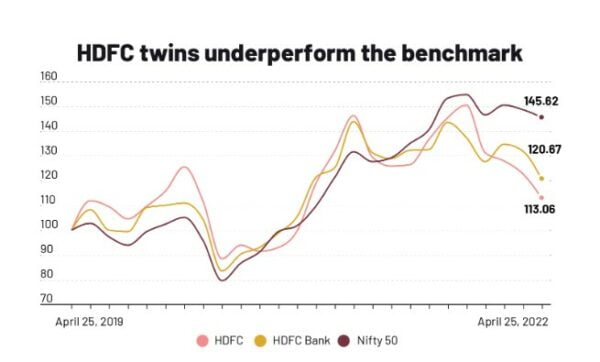

However, in less than a week, the stock prices went down: HDFC fell from INR2,450, while the stock of HDFC Bank fell from INR1,506. Both of these companies have made a lot of money for long-term investors. HDFC and HDFC Bank have given 18.4% and 23.6% returns every year since they were first listed in the 1990s. This is a lot better than the Nifty ’50s 12% return over the same period.

Investors now think that HDFC will hurt HDFC Bank, which will make them less money. There are fears that the merger won’t go as smoothly as it’s been made out to be because they have different types of customers, and it’s not clear how they will work together.

The way that foreign investors feel

At least in the short term, investors are worried about India’s high inflation and high-interest rates. It’s been a challenging year for banks, and the Nifty 50 has done better than them. In addition, it’s worrying that both of them are behind the rest, which is not good. Last two years, the HDFC twins made only 16% and 37%, respectively, while the Nifty 50 went up by 74%.

Further, interest rates are going up, too, which makes things even worse. People who borrow money could benefit from this, and it might also hurt banks’ NIMs (Net Income Margin). According to a report from Kotak Securities, bond market rates fell sharply until July 2020, which narrowed the spread between bank funding and bond rates. Bond yields, on the other hand, seem to be rising now.

Term spreads and credit spreads in the bond markets have gone down recently, so it’s not likely that the NIM on a company’s book will go up any time soon. Rising benchmark rates will help yields, but more competition can make things difficult, the company said.

Deposit costs are going up, and there is no sign of a repo rate rise shortly. This means that margins could go down even sooner, which is a big problem for foreign investors.

Foreign portfolio investors (FPIs) own most of the Indian banks. When foreigners own HDFC Bank, it has gone down from 37.5% to 29.5% in the last year, a significant change (as of March 2022). For HDFC, it has gone down from 72% to 69%. They say the global economy has a lot to do with why FIIs have cut back on their investments in Indian banks. It’s even worse for ICICI Bank. Their share of the bank has gone down from 45.3% to 35.6% since last year.

When the two organizations are combined, they will also ensure that the combined market cap will put them on a level playing field with other companies worldwide. As of this year, Fitch Ratings thinks it will have assets worth about $340 billion.

That’s about half as big as the biggest bank in the country (State Bank) and double the size of its closest competitor (ICICI Bank). It will make up about 14 percent of system loans and 9 percent of system deposits. That’s almost a 300 percent rise in loan market share and about a 100 percent rise in sediments from the standalone HDFC Bank, which will make up about 9 percent of the system.

The world’s most influential companies and banks look at India, and they see a company that’s on par with them.” A lot of attention is paid to India, so that’s why It’s a good idea to raise the capitalization of businesses in India; Mark Mobius, a well-known fund manager, says this is one way to do it: “This is one way to do it.”

He is happy that two big groups are merging without any fights. After the global financial crisis, Bank of America bought Merrill Lynch for USD50 billion, Wells Fargo bought Wachovia for USD15 billion, and PNC bought National City Corp for USD5 billion, among other things. It was part of the deal to get the American economy back.

Mobius thinks that HDFC and HDFC Bank can work together to make a global giant that will attract foreign investors to the merged company and the Indian banking industry.

For example, Bank of America and Merrill Lynch merged two very different cultures, which made it very hard for them to work together. It often leads to the destruction of one culture and the rise of another one. This is not a good thing to do. Some cultures don’t get along well together, but in this case, “I think it will be easier for them to work together.”

When the two companies merge, many people think that the new company will have to pay more money for things like the SLR (statutory liquidity ratio) and CRR (capital ratio requirement) (cash reserve ratio). The new company will also have to say which industries it wants to lend money to (PSL).

In an interview with Moneycontrol, Keki Mistry, vice-chairman and CEO of HDFC said that the company has asked the Reserve Bank of India (RBI) for some time to set up CRR, SLR, and PSL over the next three years. The company is waiting to hear back from the RBI.

What’s next?

The cost of funds for HDFC Bank may go up due to the merger. HDFC Bank has a debt of about INR2.8 trillion. When HDFC Bank merges with another bank, the cost of funds may go up because the price of debt is lower than the cost of deposit.

Many people don’t think the stock will move up soon. In the short term, everything that had to happen to get better has already happened, and we also saw the store lose those gains. Ambareesh Baliga, an independent market analyst, says that the deal has come together faster than he thought.

There is no denying that there are synergies and that it will be good for the long run. He says that we have HDFC Bank’s earnings that didn’t go over well with investors for now.

According to Marcellus Investment Managers, about 70 percent of the people who use HDFC and its subsidiaries don’t bank with HDFC Bank. About 8 percent of people who use HDFC Bank have mortgage products from other companies. After the merger, the bank will be able to reach many people who haven’t yet been sold mortgages or other products from the HDFC empire, and they can cross-sell both mortgages and other products.

Here’s a question that gets value investors to think about what they do. They make more money together than TCS does in FY21, but their combined market value is less than TCS (INR13 lakh crore), even though they make more money together.

Because banking and finance are cyclical industries, they have their problems. Credit hasn’t been picking up for a long time, and FII investors have cut back on their investments in these industries. This is the kind of stock that value funds like to buy because they are cheap compared to their actual value. He has been trying to tell his investors that this is what he’s been up to.

“If not HDFC Bank, then which bank?” has been asked for a long time now. First, he also has an answer. Competitors are getting close enough to HDFC Bank that they can get their attention. One other bank, ICICI Bank, looks like it’s running the marathon, too.

So many times have I been asked, “Who do you think will be the next HDFC Bank?” Guess that search is over. It’s been a long time coming, but finally, we have an ICICI Bank that can compete with, and even outperform, HDFC Bank, Ganapathy writes to his clients in an email. If you want to know how much it costs to own the company’s core P/BV, it costs 2.3x FY23E. That’s cheap for its ROA of 1.8 percent, which he thinks is fair

edited and proofread by nikita sharma.