Indian Top Life Insurance Companies by 2022

Life is unpredictable and uncertain. Dealing with unpleasant situations can only be achieved through proactive measures. Therefore, ‘insurance’ was developed to mitigate risk and provide protection. It is an essential tool to manage life’s troubles. Today, you can protect your loved ones and the things you cherish with various insurance policies. The purpose of life insurance is to pay a certain sum of money to the insured’s family in the event of his death.

Several insurance companies in India on the market provide a variety of unique insurance plans, so you are spoilt for choice when it comes to choosing the right insurance policy.

The Insurance Regulatory and Development Authority of India (IRDAI), which regulates India’s insurance and reinsurance industries, has approved and recognized 24 life insurance companies in the country.

Suppose you are interested in finding the best term insurance plan according to your unique needs. In that case, we recommend clicking this button, filling in a few insurance-related fields, and letting our system recommend a suitable insurance plan.

Insurance: its importance

To protect one’s family, insurance is an essential purchase. Investing in insurance before planning your financial future is even recommended by financial advisers. The benefits of insurance are numerous. Among them are the following:

- Insurance provides financial security and safety nets. If the family bread-earner becomes ill or dies, their financial situation may collapse. Families may rely on insurance compensation for income and financial stability. When an insurance policy is in place, your family has financial security.

- Your future goal is protected with insurance: The sudden death of a family’s breadwinner can have devastating effects on the family’s financial stability. Financial stability for your family can be achieved even when you are absent. Your family’s future financial goals will also be protected.

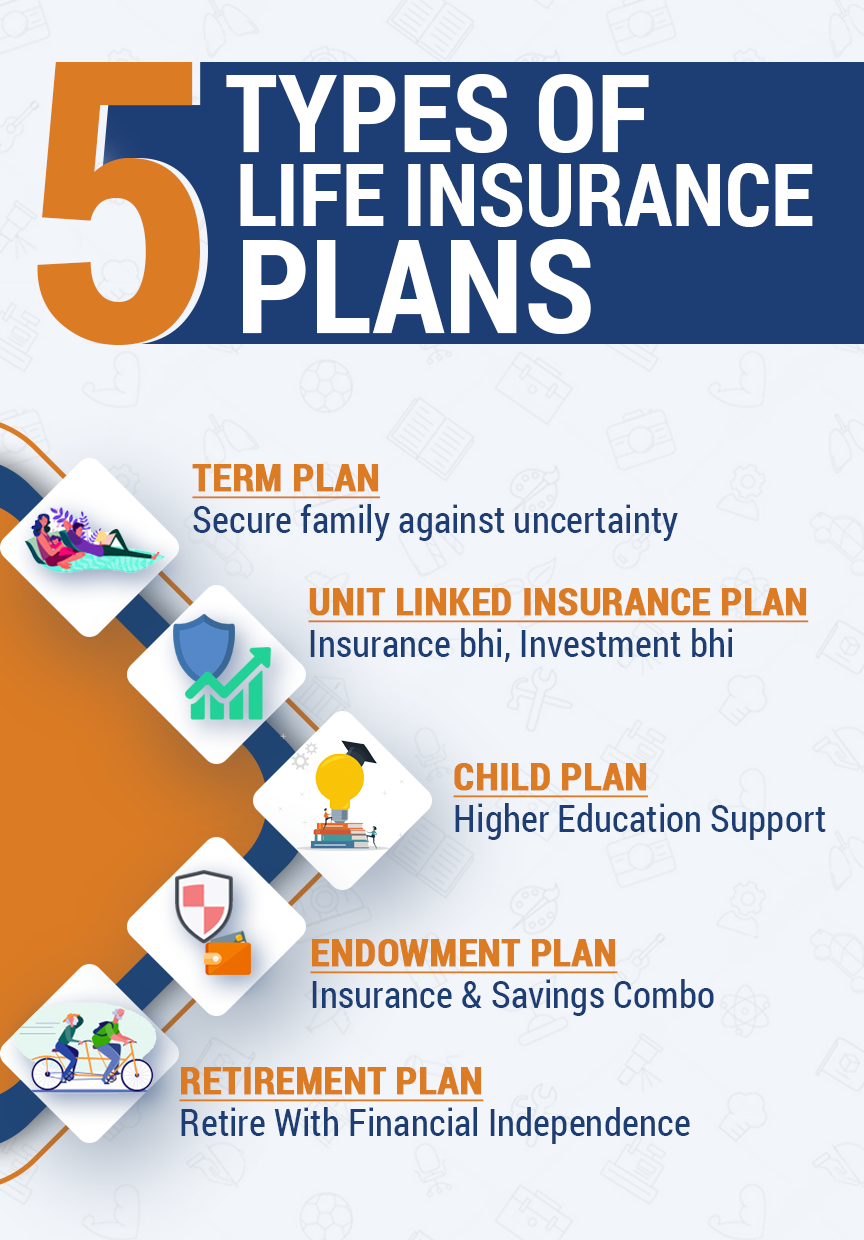

- Insurers encourage savings: There are various products offered by life insurance companies that provide life coverage and allow the creation of wealth for reaching future goals. By requiring periodic investments into such products, insurers encourage savings. The most common investment plans are endowment plans, money back plans, and unit-linked investment plans, among others.

- Insurers are practical risk management tools, as they cover uncertain risks like death, getting hit by a car, falling ill, and many others. The purpose of insurance is to manage these risks efficiently. A policy of insurance protects a person from a particular risk.

- You can only stay tension-free if you keep regular payments for insurance as it manages risk effectively. Insurance gives you peace of mind.

India’s top 15 life insurance companies:

In this list, you will find a list of the top insurance companies in India.

- Life Insurance Corporation of India:

In India, the government owns the Life Insurance Corporation of India, also known as LIC. 1956 was when LIC, one of India’s top 10 insurance companies, was founded. The LIC has 2048 branches, 113 divisional offices, eight zonal offices and 1408 satellite offices in every corner of the country. Today, LIC manages a total of USD 450 billion (INR 3,111,847 crores).

LIC, the leading insurance company, insures over 29 crores of policyholders. Through its excellent customer services on the digital platform and branches, and other tie-ups, LIC is a trusted insurance brand that offers great convenience to customers. There are several life insurance products available through LIC that can satisfy the needs of different market segments. LIC has consistently been recognized and awarded for all its milestones. Among the awards LIC has received are:

- The Reader’s Digest Trusted Brand Award had always been granted to LIC

- In the BFSI category, LIC has consistently been rated as ‘India’s Most Trusted Brand’ according to the Brand Trust Report

- Best Life Insurance Company and Most Preferred Life Insurance Company of the Year awards were won by LIC

- Max Life Insurance Company

Max Life Insurance Company, India’s largest non-bank private sector insurer, was founded in 2000. Founded by Mitsui Sumitomo Insurance Company and Indian Max India Ltd, Max Life Insurance Company operates as a joint venture. In India, Max life company has assets under management of 90,407 crores and a customer base of over 32 lakhs. Max life insurance company is among the fastest-growing insurance companies in the country.

The Max Life Insurance Company provides high-quality customer service through its online presence, a wide range of products, and multiple distribution channels. The company has consistently received awards and recognitions. Claims Service Leader and Excellence in Claims Service were given to Max Life by the CMO Asia Awards for its high claim settlement ratio. They offer a wide range of products in the market that you can choose from.

- HDFC Life Insurance Company

HDFC Life Insurance Company is a joint venture between HDFC Ltd, one of India’s top lending institutions and Standard Life Aberdeen, one of the world’s largest investment firms. The HDFC Life Group was founded in 2000. It offers multiple insurance and investment products to a broad range of customers. In addition to 390 branches and additional distribution touchpoints, HDFC Life partners with 22 bancassurance companies across India.

Customers have easy access to services due to a robust digital platform. In recognition of HDFC Life’s contribution to the Indian insurance industry, the company has received many accolades and awards. Here are a few examples:

- According to the survey, HDFC Life is India’s most valuable private life insurance brand.

- In the INDIA 2018 awards, HDFC Life won the ‘Creative Excellence Award.’

- It received the ‘Best Life Insurance Company’ award, ‘Best Analytic Initiative of the Year’ award and ‘Best Underwriting Initiative of the Year’ award at the BFSI Awards.

- As per the PCI Companies Best 50 for 2019, HDFC Life has been recognized.

- YUVA Unstoppable Changemaker award was bestowed upon HDFC Life in 2021

- Awarded the Superbrand 2021 award by HDFC Life

A 99.07% claim settlement ratio makes HDFC life insurance quite impressive as well, with a considerable amount of flexibility.

- ICICI Prudential Life Insurance

Prudential Corporation Holdings Limited and ICICI Bank Limited jointly promote ICICI Prudential Life Insurance Company. With a strong bancassurance channel and multiple distribution channels, ICICI Prudential Life is one of the best insurance companies in India and was founded in the year 2000. ICICI Prudential Life manages INR 2,231.71 billion worth of assets on 30th June 2021.

Through ICICI Prudential Life’s customer-centric approach, the company offers a variety of long-term protection and savings plans to meet the needs of a wide range of customers. Many accolades and awards have been bestowed upon ICICI Prudential Life Insurance Company for its excellence in insurance. Listed below are just a few of such recognitions.

- BrandZ ranked ICICI Prudential Life one of the ‘Top 75 Most Valuable Indian Brands 2020’ while the Customer Fest Leadership Awards 2021 honoured the company as the ‘Best Contact Center.’

- The India Summit and Awards 2019 have named ICICI Prudential Life as the ‘Life Insurance Company of the Year’

- The Outlook Money Awards 2018 have named ICICI Prudential Life ‘Life Insurance Provider of the Year’

- The Money Today Financial Awards 2017-18 have recognized ICICI Prudential Life as the ‘Best Term Insurance Provider of the Year’

- The Emerging Asia Awards 2018 awarded ICICI Prudential Life the ‘Best Customer Orientation in Life Insurance’ award.

- The Emerging Asia Awards 2018 has recognized ICICI Prudential Life as the ‘Best Growth in Life Insurance company.

- Tata AIA Life Insurance Company

AIA Group Limited, Asia’s largest insurance company, and Tata Sons Private Limited, one of the world’s largest business groups, have formed a joint venture to form Tata AIA Life Insurance Company. The assets under management for Tata AIA Life Insurance Company in 2021 will be INR 46,281 crores. In addition to the many insurance solutions it offers, Tata AIA Life provides wealth management services and protection. Customers receive excellent service and straightforward, practical solutions for their unique insurance needs.

- Bharti AXA Life Insurance Company

In 2006, Bharti AXA Life Insurance was India’s largest life insurer. XL Catlin and Bharti Enterprises have partnered to create the joint venture. This company has been able to build a solid foundation on these companies’ financial expertise and business excellence. To cater to customers’ unique needs, Bharti AXA Life has offered a variety of innovative insurance products. Bharti AXA Life’s distribution network covers India’s 123 cities. The company provides a variety of plans, including protection plans, savings plans, and health plans, many of which are available online. The ASSOCHAM Award for Excellence in Insurance and Customer Service was presented to Bharti AXA in March 2019!

- Bajaj Allianz Life Insurance Company

Bajaj Finserv Limited, part of the Bajaj Group, and Bajaj Allianz Life Insurance Company are joint venture partners. Currently, Bajaj Allianz Life has 759 offices across the country, where it offers innovative insurance solutions to different segments of the population. Known for its innovative products and timely customer service, Bajaj Allianz Life Insurance is a leader in the life insurance industry. The company has received numerous awards for its contributions to the insurance industry. Bajaj Allianz Life Insurance has received the following awards:

- Among the insurance companies, Bajaj Allianz Life has been named a ‘Digital Marketer of the Year 2018.’

- In the 2018 NASSCOM BPM Strategy Summit, Bajaj Allianz won the ‘Customer Service Excellence Award’.

- As one of the most valuable Indian brands, Bajaj Allianz Life is ranked among the Top-75

- Digital Technology Senate Awards 2021 have been presented to Bajaj Allianz Life.

- Bajaj Allianz Life has won as part of the Red Hat APAC Innovations Award 2020.

- SBI Life Insurance Company

BNP Paribas Cardiff, the world’s largest bank and financial services company and State Bank of India (SBI) formed SBI Life Insurance Company in 2007. The authorized capital of SBI Life Insurance is currently USD 290 million (INR 20 billion). Since it was founded as a bancassurance business, SBI Life has expanded into a multi-distribution business. Company growth has been attributed to excellence in customer service and product innovation. As a result of its work in the field, SBI Life has won numerous awards and accolades. Here are a few:

- In the insurance category, SBI Life won the ‘Brand of the Year award 2016-17.’

- The prestigious Private Sector Life Insurance Company of the Year award has been presented to SBI Life at the Fintelekt Insurance Award ceremony.

- Banking and Insurance Leader, Life Insurance, was awarded to SBI Life.

- The FICCI awarded SBI Life its ‘Insurer of the Year’ award for 2020

- At ASSOCHAM 13th Global E-Summit 2020, SBI Life won the Best Customer Experience Award for its Customer Response Towards Communities.

The SBI Life Insurance Company policies are among the most popular in India. Policyholders can choose from several different plans that have several benefits.

- Reliance Nippon Life Insurance Company

The Reliance Nippon Life Insurance Company was established in 2001 and catered to a wide range of population segments. Approximately 10 million people have policies with the company. Through its strong distribution network of 713 branches, the company has made insurance affordable for many people. The product line of Reliance Life caters to the needs of every individual. Many awards have been given to the company.

- TechCircle Business Transformation Awards 2021 were given to Reliance Life for the best digital customer experience.

- The ET BFSI Excellence Awards 2019 have named Reliance Life the ‘Innovative Insurance Provider of the Year.

- We have received an award for ‘Best Risk Innovation of the Year’ from Reliance Life.

- ‘Best Life Insurance Company (Innovative Products)’ has been awarded to Reliance Life.

- AEGON Life Insurance Company

Established in 2008, AEGON Life Insurance Company specializes in life insurance. One of the best carriers offering various life insurance solutions, AEGON Life Insurance Company was founded in 2008. As a new-age company with a diverse product portfolio and a strong digital presence, AEGON Life is a company of the future. Many authorities have given awards and recognition.

- This year, AEGON Life has been recognized with the ET BFSI Award and the Digital Company of the Year Award.

- Indian Insurance Awards have honoured AEGON Life with the ‘E-business Leaders Award.’

- AEGON Life has won the excellence in insurance award for Asia

- Life insurance company AEGON Life was named the most recommended brand in 2013

- Aviva Life Insurance Company

An Indian conglomerate and a British insurance company formed a joint venture to operate Aviva Life Insurance Company. Since its establishment in 1887, Aviva Life has offered a wide range of insurance products, including protection plans, savings, and retirement plans. There are more than 121 branches and 9,000+ employees. One of the top insurance companies in India is known for its online products, customer service, and many other aspects. Aviva Life has been awarded as the most trustworthy brand for 2018 and 2019. TRA’s Brand Trust Report – India Study declared Aviva Life the most trusted life insurance brand of 2018.

- Birla Sun Life Insurance Company

The company was founded in 2000. Aditya Birla Capital Limited owns the company. One of Canada’s largest international financial services organizations, Sun Life Financial, combined forces with Aditya Birla Group to form Aditya Birla Sun Life Insurance Company. A top Indian insurance company, Birla Sun Life offers a diverse range of products and services ranging from protection plans to pension plans, savings plans, and several more modern insurance products. The company managed INR 5,26,151 million in assets as of March 2021.

With 386 branches, seven bancassurance partners, six distribution channels, and 90,000+ direct sales agents, the company has a presence across the country. Birla Sun Life Insurance Company has received many awards and accolades for its continued contribution to the industry Birla Sun Life Insurance Company has received many awards and accolades.

Birla Sun Life Insurance Company was presented with The Indo-Canadian Business Chamber’s “Successful Performance” Award in April 2005.

- Kotak Life Insurance Company

A leading insurance company in India, Kotak Life Insurance Company, has over 30 million policyholders, and it’s the fastest-growing. The parent company of Kotak Life Insurance is Kotak Mahindra Bank. In addition to a range of insurance products tailored to every facet of society, Kotak Life Insurance Company offers unique features. There are currently 32+ products, 18 riders, ten unit-linked investment plans and 9 group products. Kotak Group has achieved many milestones in the financial services industry and has consistently been recognized for its successes.

In addition to providing protection and wealth creation, Kotak Life Insurance also offers tax benefits. Among the plans provided by the company are savings and investment plans and child plans, retirement plans, and savings plans.

- PNB MetLife Insurance Company

Since its founding in 2001, PNB MetLife Insurance Company has been one of India’s finest insurance companies. The company offers a wide range of life insurance and investment products to customers in over 7,000 locations through multiple distribution channels. Many awards have been given to PNB MetLife in the insurance field.

- The People Matters Awards 2019 have recognized PNB MetLife for its commitment to diversity and inclusion.

- At the National Awards for Excellence in Insurance, PNB MetLife’s Mera Heart and Cancer Care plans have won the ‘Best Product Innovation’ award.

- In 2018, PNB MetLife named the Indian company that is most sustainable.

The flexible insurance options offered by PNB MetLife help its customers reach their financial and security goals. Customer support is also excellent, ensuring a smooth purchase and resolution.

- Canara HSBC OBC Life Insurance Company

In India, a leading life insurance company, Canara HSBC OBC Life Insurance Company, was founded in 2008. HSBC Insurance Holdings merged two of India’s most prominent public sector banks, Canara Bank and Bank of Commerce. There are around 60 million customers of Canara HSBC OBC Life. An extensive network of channels and banks in the country makes the company’s insurance products accessible to the general public.

How do you choose an insurance company?

There is nothing unusual about choosing a life insurance product depending on the recommendation of friends, colleagues, advisors, or just on the price alone. However, it is more important to select a trustworthy insurance company, which involves many factors.

When choosing a life insurance company that will provide the most coverage during your need, you should consider some of the following factors when choosing a life insurance company.

When choosing the right insurance company, you should consider the following:

- Financial solidity

Because life insurance is a long-term investment, choosing a financially sound company is crucial. Make sure that the company has a good solvency ratio. Solvency ratios indicate how well a firm protects itself against the risk of going bankrupt during uncertain times.

- Service quality

Choosing a life insurance company should be based on customer satisfaction and service quality. To receive good customer service and high levels of customer satisfaction, one must choose an insurance company that offers both.

- Claim settlement ratio

It settles a selected percentage of its claims against the total number of claims received each year as an insurance company. Annual reports from the industry regulator, IRDAI, provide the claim settlement ratio for each life insurance company. Choosing an insurer with a high claim settlement rate is always wise.

- Premium and cost

Various expenses will have to be borne by insurance companies, such as commissions for agents and intermediaries, advertising costs, underwriting, etc. These expenses, however, are deducted from the premiums charged. So, the higher the ratio of costs, the higher the premium. When insurance plans are purchased online, they are offered reduced. Depending on your age, type of plan, features, and coverage, the cost of life insurance differs from the insurance company opting for. The cost and benefits of life insurance products should be considered when choosing a life insurance company.

- Product portfolio

A wide selection of life insurance products is available in India from most major insurance companies. New insurance products with unique features are introduced frequently by insurers. The type of products that the insurance company offers and its components that satisfy your life insurance and investment needs should be checked before selecting it.

Frequently Asked Questions (FAQs):

- How does the claim settlement ratio compare?

The claim settlement ratio (CSR) is the total amount of all the death claims approved and received by an insurance company in a financial year. The claims settlement ratio reveals a company’s capability of paying or compensating claims.

- Why do we need life insurance?

Essentially, life insurance is an agreement between the policyholder and the insurer. In exchange for premiums paid by the policyholder, the insurer compensates the named nominee if the policyholder dies.

- The process of life insurance: how does it work?

It protects against death. If the policyholder dies during the policy term, the designated nominee of the holder will receive compensation, according to the terms of the life insurance agreement.

- How do life insurance plans offer tax benefits?

Section 80C of the Income Tax Act, 1961, allows taxpayers to deduct premiums paid for life insurance investments. According to Section 10 (10D) of the Income Tax Act of 1961, benefits paid in Lump Sums are exempt from income tax.