Can fintech companies outperform traditional lenders by offering their own ‘credit’ cards?

Raj Savla’s last year at IIT Bombay fintech, and he was given the Slice credit card in June of last year. With no money, he didn’t have many options for getting a loan or credit. Savla, born and raised in Mumbai, was excited to try Slice. She is a big fan of the Indian startup scene.

People who use a food-delivery service can get good discounts. People like Zomato, McDonald’s, and many other restaurants use the card so that Savla can save a lot of money. To start with, he decided to start with a low credit limit of INR20,000. Soon, he was making at least two payments a week.

Banks don’t give credit cards to people like Savla because they don’t think they can pay them back. And this is where fintech companies have seen a big chance. Many people aren’t going to the bank because of this. What do you mean? We’ll answer that in a while.

Challenger cards are becoming more popular.

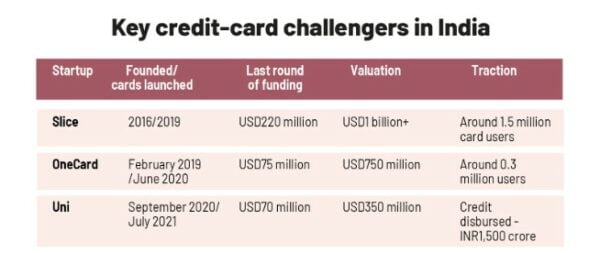

It’s been a good two years for cards made by companies like Slice and OneCard. Some of these aren’t credit cards, says the Reserve Bank of India (RBI). They’re prepaid cards with a credit line, and the way they’re paid back doesn’t follow the credit-card model, either.

Slice and Uni, for example, are giving customers the chance to pay off their debt without interest in three months instead of the usual 45 days that credit cards usually follow.

OneCard is the only credit card that isn’t, and this is what the business likes to call “challenge cards.” Slice says that it is a credit-card company that wants to change the rules on its website.

If you want to know which bank gave you your credit card, you must know its BIN (bank identification number). This number isn’t used for the card’s security features, and credit BIN is not operated by Slice or Uni. Fintechs have to work with banks in India because only banks can give out cards. They also have to work with the technology stack infrastructure that connects them like M2P, Zeta, and Setu.

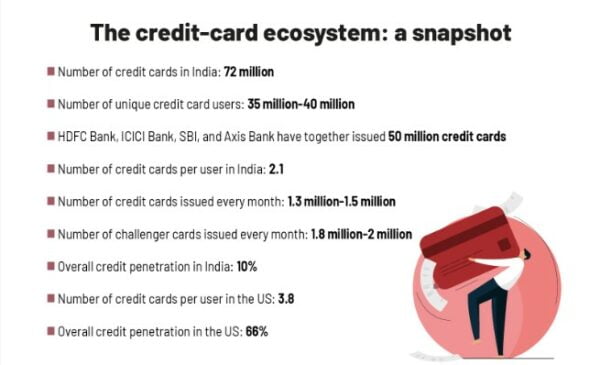

This year, the fintech companies have given out about 2 million cards each month. In the first two months of calendar 2022, traditional lenders gave out 1.3 million to 1.5 million credit cards. This is a lot more than that. However, this isn’t an exact comparison, but it gives a rough idea of how the cards space has changed over time, even though bank credit cards have grown at an average rate of 22% each year since 2016.

What’s making this growth happen?

Because digital data is now being added to credit data and even credit scores, there has been a massive rise in people getting credit. There is a mobile-based process called Know Your Customer that is a part of every payment, and that is linked to each person’s Aadhaar card. This means that every person is tagged and identified. This makes it easier for underwriters to determine a customer’s creditworthiness by looking at their payment history, including utility payments.

RBI data from February 2022 shows that India has close to 72 million credit cards. Only 35 million people in India have a credit card and use it every month, and the market has a lot of untapped potential. Major credit card companies in India include HDFC Bank and ICICI Bank. These companies control about 50 million credit cards that are used and active. These are also the most popular and used credit cards in the country, so they contain many.

If you look at private banks like Axis, ICICI, and HDFC, the number of credit cards they give out is about one-fourth of the number of debit cards. For top public-sector banks (PSBs), that number is usually less than 10%.” People who work for consulting firm Praxis Global Alliance say that personal credit cards are taking advantage of public-sector banks’ savings and fixed deposit markets, which shows that there is a lot of money to be made.

When it comes to credit, only 10% of people in India have it, and this is a lot less than the 66% in the United States and 64% in Britain. Even Brazil has a reasonable penetration rate of 30%. As India’s GDP per person grows from the current level of USD2,000 to USD5,000-USD6,000, credit penetration is expected to rise at the same rate as in Brazil. Watchers say it’s taking off and is now starting that growth curve.

“There’s a huge difference. India will likely have 200 million to 250 million credit cards in the next four to five years. Banks alone can’t handle this. There might be a need for new products like what fintechs are making. This is what Murali Nair, president for banking, Indian subcontinent, at banking-technology platform Zeta said. Banks have to follow the rules and processes.

He said they couldn’t keep up with the demand like these fintechs.

Vikram Chachra, the founder of 8i Ventures and an investor in M2P and Slice, says that the Western-style credit-card model is outdated because it doesn’t look at banking data the same way it does in the West. He says that many people’s payment data isn’t being kept by banks today. Banks want to know how much money you have, and fintech looks at customer intentions and honesty.” It looks, feels, and works just like a credit card, but it’s better than a credit card. Credit cards are a very profitable business, but they haven’t been broken up for too long, says the man.

They don’t want to push customers for credit cards, but that’s not the only reason.

People have to build and maintain the technology stack. They also keep working on it to better understand and write about it, but that’s not the only reason. In addition, there must be an in-house model for getting credit card customers, a vital issue network, servers that don’t break, and a well-oiled collection system. These things must also be in place. As for their retail business, PSBs don’t have a strong sales engine.

Credit cards can make money.

There are many ways for banks to make money. Revolving credit, when customers pay only the minimum due, and the rest is paid with interest, is one of the ways. It’s about 45 percent to 50 percent for the top five credit card companies, which means that many people don’t pay the total amount back. As long as the annual interest rate on a credit card is around 42% to 44%, banks can profit about 22% to 25% on their credit card business through direct means. People who work with credit cards also get money from merchant commissions and fees, which is in addition to the money they get from Visa and Mastercard.

All these cards have fees, but the most popular ones these days don’t charge them to get more people to use them. For most private-sector banks, there is always a chance to cross-sell products like EMI for big credit card purchases, personal loans on credit cards, and other things that can be sold together. Almost 20% to 30% of bank credit card customers choose to get these loans, which helps the cards business make more money. There are also companies in fintech that want to make money with these kinds of schemes.

As long as most people pay back their debts, credit card companies prefer people who use revolving credit. If a card has a lot of people who have a lot of money and pay their debts on time, it only makes money from the interchange. This would make credit cards a business that lost money. The customer must use a credit card to get cashback or reward points on purchases made with revolving credit at Uni or Slice. However, in banks, things are a bit different.

When people have a short-term lack of money, they don’t want to ask their family and friends for money. With no interest, they can pay back the money in three months, which helps them get through the crisis. For high-value transactions, they only use it, which shows that it is being used carefully, says Nitin Gupta, the founder and CEO of Uni.

If you want to keep borrowing money, you have to pay a lot of interest. But fintech companies have made this space more transparent and competitive, so this isn’t the case with banks anymore. Banks use the old credit card technology stack, and they can’t make new products that meet the needs of their customers. He says people won’t be able to develop new ideas, adding that customers will increasingly use fintech companies for revolving credit while using bank cards for merchant cashback, which will hurt banks’ profitability.

Because there are so many different types of horses for other jobs.

The biggest problem for these fintech card companies is that customers will move on to better things. When Savla started working at a financial institution nine months ago, he already had a lot of credit cards, and he had one from each of the three banks he works for: Axis, SBI Cards, and HDFC.

“I got two free flights from my Axis Vistara credit card because I met a certain goal.” If I spend the required amount on SBI Cards and HDFC Bank credit cards each year, I won’t have to pay them anymore. For big-ticket items like my iPhone, SBI and HDFC gave back more than INR5,000 in cashbacks. Slice gives cashback of up to INR100-INR200 for food orders. I don’t think this is worth it to me right now. As one moves up in income, the value proposition for Slice goes down a lot, he says.

People who work for an API infrastructure company say that credit cards are a well-established and well-oiled product for banks. “They make a lot more money from this business than before,” he says. This puts the banks in an excellent position to make better deals for customers who want to buy big things.

People around the world have a lot of credit cards. Most credit card markets, such as the US, have around four and 2.1 million people. In the United States, everyone has a credit card from their bank, Walmart, an airline, and a few other cards that are used to get the most points. This means that the card issuers lose money because some benefit from using the same card at many stores instead of just one.

The biggest threat to these fintech companies comes from co-branded credit cards, especially those made by companies like Facebook and Instagram for people who use them. Amazon Pay and MakeMyTrip from ICICI Bank and Flipkart and Vistara from Axis Bank have been the most popular co-branded credit cards in India for the last three years. Paytm and Times from HDFC Bank have been the second most popular. Most of the credit cards that ICICI Bank has given out since Amazon Pay came out have been under Amazon Pay, and one-third of Axis Bank’s credit cards have been under Flipkart since they came out. Both the Amazon and Flipkart credit cards have more than 2 million people.

People have always used airlines, retailers, and fuel cards. E-commerce platforms, which have a lot of people who use them, have become the new favorite. These cards have more money spent on each one than the normal ones because many rich people are now shopping online. People who use credit cards these days want clear cashback, like up to 5%, instead of reward points that aren’t worth much. These cards also follow that formula.

Customers who have multiple cards use them for specific things like fuel, hotel or flight reservations, and online shopping (e-commerce cards) to get the most out of them. These cards have given banks a lot of power, but they aren’t very profitable for them at all. As a general rule, credit cards usually make about 22 percent to 25 percent, which drops to about 16 percent to 20 percent for popular platform cards.

“New-age tech platforms are betting that people will use their cards somewhere else, which will help them learn about people’s habits and get their spending data. That means that issuers can’t get to know their customers better, says Kumar.

Most credit cards now also offer no-cost EMIs, which lessens the impact of paying a lump sum on the due date. Slice and Uni cards are similar to challenger cards in that they target tech-savvy customers and have a higher value proposition. Slice and Uni cards’ main value proposition is often reduced to the one-third payment, which isn’t always the best case for a long-term play.

Customers like Savla have a hard time checking to see what deals are available and where before going out with friends. In the past, “I used to enjoy the process,” he says. “Now, I only use my Slice card once a month.”

It has to do with sub-prime loans and regulatory risks.

If you want to get credit, you need to be careful about the quality, say several payment executives. This is how it works: Banks have a lot of experience with what works and what doesn’t, but these fintech companies are pushing the envelope with newer models that make the business models hard to figure out. A significant change in fortune happened in 2007-08, and ICICI Bank had to slow down the amount of money it gave out for credit cards until about 2013-2014 because of the change in fortune.

Two or three bankers say that delinquencies at fintech are in the high single-digits, while they are only 2% to 3% at traditional banks. In this case, you are lending to people who are not well-off. That doesn’t mean you don’t make money.” It doesn’t work this way with current business models that give people a lot of cashback. In contrast to us, their cost of capital is high and, in many cases, double that of ours, says a banker who heads the cards division at a private-sector bank.

Zeta’s Nair says that failing to report non-performing assets (NPAs) on time is another thing fintech companies should be concerned about. For example, in the case of fintech companies, when a card issuer’s loan disbursement speeds up every month, even though the NPA might fall in that month, it doesn’t mean that the books are more robust than they were before. In a month or two, the loans that aren’t being paid back are being discussed.

As he says, the fintech hasn’t proven its worth when collecting money, which is a lot more complex than giving it out. Using strong-arm tactics to get money from people in China has recently led to the RBI banning those apps.

It turns out that the average Cibil score of Uni’s customers is around #775, which means that its customers aren’t very different from those of big private banks. More than half of its customers choose to pay one-third, which shows how appealing its deal is, indicating that it’s a good deal.

OneCard is trying to make itself look like a high-end metal card for people who already have a lot of credit cards and want to add OneCard to them. But Slice card has been around since 2019 and has been very good at attracting young people and people just starting. With very little information, it is too early to say if these cards will be profitable or if they will be an NPA risk.

As the buy-now-pay-later cards business has increased, many bankers think the RBI will step in this year to regulate loans from fintech companies. People who work for private-sector banks say the Reserve Bank of India isn’t sitting on this, and they say they’re waiting for models to come together before they get in.

Even though such a move might not hurt these companies, it could even give them a stamp of approval from the government by giving them more information about charges and penalties.

It’s mostly the credit card companies that risk getting a debt. The credit on the challenger card is usually based on the loans these companies take out. Thus, if they lose money, their lenders, which are non-banking financial companies, might have to pay them back (NBFCs).

“There are fears that this fintech lending sector is already huge, and if it isn’t regulated, it could become as big as microfinance institutions and cause a big problem for banks and NBFCs in a few years,” says the banker.

The startups are being careful to avoid this outcome. Banks start with low credit lines, like INR2,000, which can go up to INR10 lakh if customers use their cards more and pay their bills on time as they do with banks.

Because these cards have low credit limits, even if many people default on them, the losses will not be huge. Meanwhile, they know that venture capital can help them take risks and lose money, but they also understand that a market worth INR20,000 crore can be huge if they can get it. This is what Madhusudanan R, co-founder, and CEO of M2P, says.

The bottom line is:

There are very few employees at fintech companies because they have very few assets. This means that their customer service often doesn’t meet customer expectations. The customer reviews for Slice on Google Play show that many people aren’t happy with the company. There are many advantages to these platforms now, but one of the most important is how quickly they can issue cards because they use digital and mobile-first models.

“It’s a game of value for fintech companies right now,” says the speaker. Then, try to sell a lot of things on the app, and this is how all the companies in fintech have done it. The head of the private-sector bank’s cards business says that they haven’t been very good at making money from these models so far.

Banks don’t believe in catching them young because this group isn’t very likely to stick around. As long as their value proposition is strong, they know that people like Savla will come to them.

They are doing our work for us. Once they figure out who is a good customer, we can offer them a better deal to get them to come to us. We also run a small and tech-focused business with cards, he says.

edited and proofread by nikita sharma