India’s Gautam Adani Is Now The World’s Fourth Richest Following Bill Gates’ New Big Gift

India’s Gautam Adani Is Now The World’s Fourth Richest Following Bill Gates’ New Big Gift

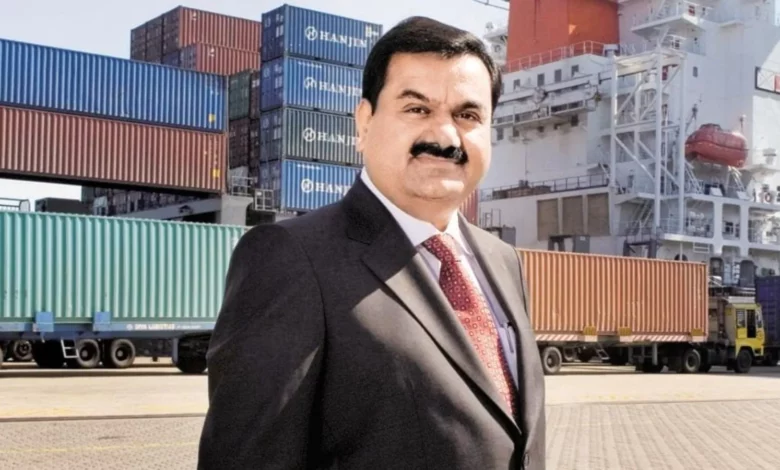

India’s Gautam Adani, who rose one spot in Forbes‘ Real-Time billionaire rankings after Bill Gates showed a major new gift this week, is now the No. 4 richest person in the world.

The math for billionaires is simple regarding sizable philanthropic contributions: Give money away, and your net value decreases. This is what happened to Bill Gates, who announced on Wednesday that he would be giving the Bill & Melinda Gates Foundation $20 billion this month as part of the foundation’s commitment to raising its yearly donation by 50% by 2026.

Adani surpassed Bill Gates to take over the No. 4 slot due to the change in funding. Since early 2021, the Indian tycoon’s wealth has more than doubled, reaching $112.9 billion today. The infrastructure billionaire Adani holds shares in six of his name-brand publicly traded businesses that produce power, green energy, gas, ports, and other things.

In February, Adani passed fellow Indian billionaire Mukesh Ambani to claim the title of the richest person in Asia. He was tenth in the world at the time and had a $90.1 billion net worth. Adani, 60, a college dropout (like Bill Gates, who left Harvard), founded a commodity-exporting business in 1988. With a $9.3 billion net worth, he first appeared on Forbes’ list of the World’s Billionaires in 2008. To honour his 60th birthday on Friday, Adani and his family promised to donate 600 billion rupees ($7.7 billion) to many social projects in June.

Following his large gift announcement, Bill Gates dropped one spot to No. 5 on Forbes’ Real-Time Ranking of the World’s Billionaires, with an estimated worth of $102 billion as of Thursday’s U.S. trading close.

According to Gates, who spoke to Forbes earlier this week, the Covid-19 pandemic, the economic slump, and the conflict in Ukraine are all contributing to the Gates Foundation increasing its charitable giving. Gates mentioned, “the political backdrop where, at least, it feels like there is at a relatively low point the willingness to think globally and execute complex things.”

Beginning in the mid-1990s, Microsoft co-founder Gates held the title of the richest person in the world for 13 years. With a $12.5 billion fortune, he first rose to the top spot on Forbes’ 1995 list of the World’s Billionaires. He maintained that position, seeing his wealth grow over time, until 2008, when Warren Buffett temporarily overtook him as the leader.

In 2009, Gates regained the top spot. From 2010 through 2013, Carlos Slim of Mexico took control. He regained the top spot in the world rankings in 2014 (with a value of $76 billion) and maintained it until 2018 when he slipped to No. 2, and Jeff Bezos passed him in terms of wealth. On the Forbes World’s Billionaires lists published in 2021 and 2022, Gates came in at number four.

Over the years, Gates has sold most of his Microsoft stock. He donated tens of billions of dollars worth of the stock to the Gates Foundation and its forerunners beginning in the late 1990s.

He diversified his holdings and sold a major chunk of Microsoft stock. Gates had 1.3 per cent of Microsoft stock as of March 2020 when he resigned from the company’s board of directors, a decrease from the approximately 45 per cent he held when the business went public in 1986. His Microsoft stock would be valued at roughly $26 billion if he had managed to hold onto that 1.3 per cent.

His multibillion-dollar investments now span a variety of industries, including Canadian National Railway, Deere & Co., Republic Services, and waste management.

Will Bill Gates ever donate his entire fortune? He now replies, “Yes”. Gates told Forbes’ Randall Lane this week that he fully wants to give his way off the Forbes billionaires list while he’s still living rather than waiting until he passes away.

Additionally, he predicted that the Gates Foundation would eventually wind down in twenty-five years. By that time, Gates, who is presently 66 years old, will be in his 90s and likely prepared to delegate that duty to someone else.

About Gautam Adani

Indian entrepreneur and philanthropist Gautam Adani established the Adani Group, a global corporation focusing on port operations and development in India. He is the Chairman of the Adani Group. He is a philanthropist who co-directs the Adani Foundation with his wife, Priti Adani. He serves as the president of his wife’s nonprofit foundation.

Forbes estimated the family’s net wealth to be around $25.2 billion in October 2020. According to India Today, he is the third most powerful man in India. As of 2019, he was India’s second-richest person.

Personal Life

Gautam was born into a Jain household in Ahmedabad, Gujarat. His father, Shantilal, had a textile business. He lived in the northern region of Gujarat with his mother, father, seven brothers, and seven sisters.

Karan Adani, the son of his and Priti Adani, serves as the CEO of Adani Ports & SEZ Limited. The managing trustee of the Adani Foundation is his wife, a dentist. In 1998, Gautam was previously nobbled and released early without receiving payment. He could escape harm by hiding in the kitchen and bathroom during the Taj Hotel Mumbai assaults in 2008.

Gautam Adani had been motivated and determined since a young age. He left school as a teenager since he had no interest in studies. After that, he transferred to Gujarat University but could not complete his degree. Despite his interest in the industry, he had no plans to join his father’s textile firm.

Education

Gautam Adani received a bachelor’s degree from the Sheth Chimanlal Nagindas Vidyalaya in Ahmedabad. He subsequently continued to Gujarat University to complete his undergraduate studies in business. He left college after finishing his second year.

Professional Life

Entrepreneurship intrigued Gautam, but not his father’s textile business. Gautam started working when he was very young. He moved to Mumbai when he was 18 because of his entrepreneurial spirit, leaving Ahmedabad behind. He had very little money but was determined to succeed.

In 1978, Gautam Adani worked as a diamond sorter at Mahendra Brothers. He worked there for two to three years before establishing his diamond brokerage firm in Mumbai’s Zaveri Bazaar.

By the age of 20, Gautam had amassed a million-dollar fortune thanks to the success of his business. In Ahmedabad, his older brother had just bought a plastics manufacturing facility and requested Gautam Adani to help run it. Adani returned to Ahmedabad and started a business with his brother. By importing polyvinyl chloride, he expanded his enterprise into international trade.

Gautam Adani began trading in commodities in 1985 by bringing in Polyvinyl Chloride (PVC), a crucial raw ingredient for the production of plastic, and then travelled to South Korea to close the deal.

Adani Group

Adani Group was created in 1988 by Gautam Adani, who serves as its chairman. Ahmedabad, Gujarat, India, is where the business is headquartered. It is a commodity trading company, with Adani Exports Limited as its centrepiece. Energy, resources, logistics, real estate, financial services, agribusiness, military, and aerospace are just a few of the Group’s many diverse businesses.

He has a 66 per cent stake in Adani Ports & SEZ Limited, 73 per cent stake in Adani Power, 75 per cent stake in Adani Enterprises, and a 75 per cent stake in Adani Transmission Limited. The Group, which operates in 50 countries and 70 locations, generates yearly revenues of around $13 billion.

Adani Enterprise Limited

In 1988, Gautam founded Adani Exports Limited, which later changed into Adani Enterprises Limited, the holding company for the Adani Group. The company initially engaged in agricultural and energy goods.

To grow his business, he started trading metals, textiles, and agricultural items in 1991. The change in commerce came from introducing measures for economic liberalisation, which was profitable for the group.

Adani Ports & SEZ Limited

The company began operations at the Mundra Port in October 1998. Through a Concession Agreement with the Gujarat Government and the Gujarat Maritime Board, the company was granted the right to run and develop the Mundra Port, which is situated on the Navinal Island in the Kutch region, for 30 years. In August 2020, Mundra Port surpassed JNPT to take the title of largest cargo port in India.

Currently, the business operates more private multi-ports than any other corporation in the world. India’s largest private sector port has a cargo capacity of 210 million tonnes annually.

The project is under the direction of Karan Adani, the Chief Executive Officer of APSEZ. The company’s activities include special economic zone management, logistics, and port management. The ports where the firm operates are Mundra, Dahej, and Hazira in Gujarat; Dhamra in Odisha; Kattupalli in Tamil Nadu; and Vizhinjam in Kerala.

Adani Power Limited

In 1996, Gautam founded Adani Power Limited, another outlet for the Adani Group. Adani Power is the nation’s largest private thermal power plant operator, with a 4620 Mega Watt capacity. Between 2009 and 2012, he acquired Abbot Point Port in Australia and Carmichael Coal in Queensland.

It is a 12,450-megawatt thermal power plant that is privately owned. In Naliya, Bitta, Kutch, Gujarat, it operates a 40-megawatt solar power facility. Adani Power, which is constructing a 1,600 MW plant, is based in Jharkhand. Adani Power Limited has long-term power purchase agreements with the governments of Gujarat, Maharashtra, Haryana, Rajasthan, Karnataka, and Punjab, totalling 9,153 MW.

The fourth quarter of 2019, which concluded on March 31, saw Adani Power earn a total profit of INR 634.64 Crore. The corporation reported a combined net loss of INR 653.25 billion in the last fiscal year.

The business has received several honours and accolades. It received the “Most Innovative Young Power Professional” award at IPPAI’s 18th Regulators & Policymakers Retreat in 2017. With the help of the British Chamber of Commerce and the Canadian High Commission, CSR Works International honoured the company in Singapore for having the best sustainability reporting in Asia.

Adani Transmission

Power transmission business Adani Transmission Limited has its headquarters in Ahmedabad, India. Currently, it ranks among the biggest power transmission businesses in India’s private sector. As of July 2020, the company operated a network with a total of 12,200 circuit kilometres, with more than 3,200 circuit kilometres still being built out at many locations.

After severing his transmission business’ ties to Adani Enterprises after eleven years, Gautam Adani founded Adani Transmission in December 2015. At the time of its founding, the business assumed responsibility for more than 3800 circuit kilometres of transmission lines connecting Mundra-Dehgam, Mundra-Mohindergarh, and Tirora-Warora.

Adani Green Energy

In accordance with the Companies Act 2013, Adani Green Energy Limited was established on January 23, 2015. In the early years of the business, AGEL and Inox Wind worked together to build a 20 MW wind power facility in Lahori, Madhya Pradesh.

Additionally, AGEL acquired the 50 MW wind energy project from Inox Wind near the Dayapar village of Kutch. After winning capacity bids for wind power projects connected to the National Grid from the Solar Energy Corporation of India, the latter came up with the idea for the project.

One of India’s largest renewable energy companies is Adani Green Energy Limited (AGEL), which has a portfolio of projects totalling 13,990 MW. The Adani Group has committed to ensuring that India has a secure and environmentally friendly future.

Utility-scale grid-connected solar and wind farm projects are developed, installed, owned, operated, and maintained by the company. All of these projects are guided by the group’s principle of “Growth with Goodness.” Government-backed enterprises and federal, state, and local government entities all receive the electricity generated.

Gautam Adani – Philanthropist

The Adani Foundation, which Gautam founded in 1996, is led by him. The organisation, which operates across Maharashtra, Himachal Pradesh, Chhattisgarh, Rajasthan, and Odisha, is funded by the Adani Group.

A lot of philanthropic activity is carried out by the Adani Foundation, which the Adani Group manages. Along with Gujarat, the foundation works in many other states, investing in rural development, sustainable economic resources, and education. The Adani Vidya Mandir in Ahmedabad is administered by Priti Adani and only enrols students whose parents make less than INR 1 lakh annually.

The organisation runs a unique programme to help fishermen, and it provides 500 fishermen from the coastal taluka with financial aid for purchasing fishing equipment. Fishermen’s children are given access to educational options.

Adani Foundation Group teamed up with IndiaSkills, a company for vocational education, and City & Guilds, one of the best names in work-related evaluation and qualifications, in 2012 to launch a skills training facility in Gujarat that would provide courses in engineering, construction, engineering, hospitality, and defence.

Gautam Adani – Help During Covid Crisis

Through the Adani Group’s webpage, Gautam Adani has contributed INR 100 crore to the Prime Minister CARES FUND to address the coronavirus outbreak. The Gujarat Chief Minister’s Relief Fund received a donation of INR 5 crore, and the Maharashtra Chief Minister’s Relief Fund received INR 1 crore.

The Adani group, a diverse corporation owned by Gautam Adani, transported four ISO cryogenic tanks from Dammam, Saudi Arabia, to Mundra, Gujarat, with 80 metric tonnes of liquid medical oxygen. Linde Saudi Arabia has promised to donate 5,000 oxygen cylinders of the highest quality to the neighbourhood. Adani mentioned on Twitter that his business delivers 1,500 medical oxygen cylinders daily to any location in Gujarat’s Kutch that needs them.

Conclusion

In all of his endeavours, Adani’s entrepreneurial talent is clear. He has expertise in just about every field you can think of, whether it’s logistics or real estate. Gautam Adani already had his mind made up to be an entrepreneur when he was truly a teenager, back when it wasn’t cool. And despite originating from a somewhat average family, he was able to create a life for himself that was quite extraordinary. He made some business decisions that could teach us a lot.

Edited by Prakriti Arora